This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday,...

Read More »Where There’s Smoke…

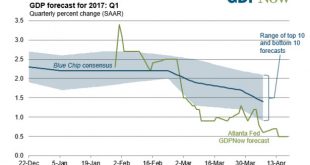

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

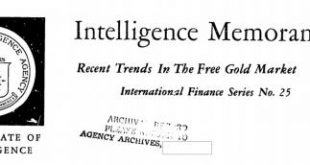

Read More »Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

By Smaul gld The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system. The classification of the documents is significant because “secret” is the CIA’s second-highest...

Read More »Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

By Smaul gld The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system. The classification of the documents is significant because "secret" is the CIA’s second-highest classification. The CIA notes unauthorized disclosure of secret...

Read More »Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

Submitted by Koos Jansen from BullionStar.com After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes? After the Germans had activated a program to...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

“At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?” Those are the shocking words of St.Louis Fed Director of Research Christopher Waller whose brief note today will be required reading for everyone at The Bank of Japan, The ECB and every other central banker on the verge of NIRP… If you pick up any principles of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org