Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

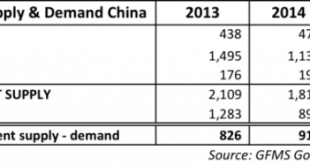

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org