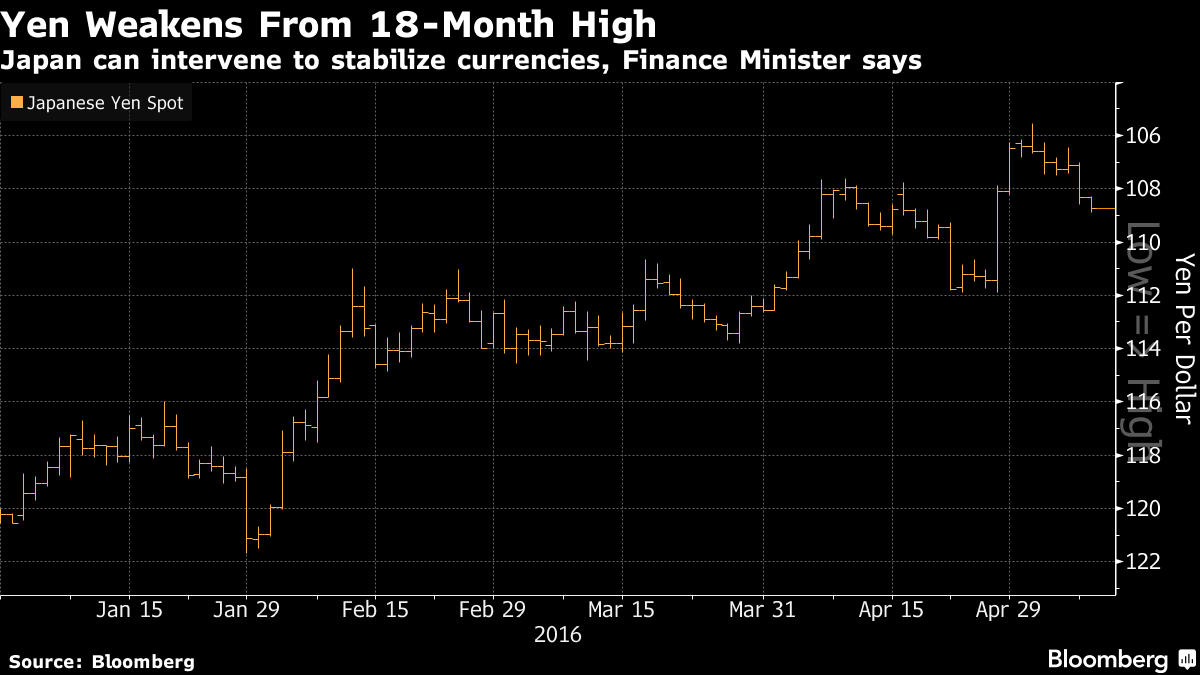

In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50 consecutive months however showed a modest rebound from the prior month on the back of China's recent, and now burst, speculative commodity bubble. The weaker yen was the main driver of overnight action: "The weakening yen is acting as a boost to stocks,” Yoshihiro Okumura, general manager at Chiba-Gin Asset Management told Bloomberg. “We’re seeing some risk-on moves overall. The key going forward is whether we’ll get a sense that all the negative earnings are over with now." The yen weakened for a second day after Japan’s Finance Minister said the government can intervene to stabilize foreign-exchange markets if necessary. Japan’s currency fell against all its Group-of-10 peers after Taro Aso, speaking in parliament in Tokyo Tuesday, reiterated that the U.S. doesn’t object to the Asian nation’s policy.

Topics:

Tyler Durden considers the following as important: Auto Sales, B+, Bond, Brazil, China, Copper, CPI, Credit Suisse, Crude, Crude Oil, default, Equity Markets, European Union, fixed, France, Germany, Gold Spot, Greece, headlines, Italy, Japan, Jim Reid, Market Conditions, Monetary Policy, NASDAQ, Netherlands, NFIB, Nikkei, None, Precious Metals, RANSquawk, Real estate, recovery, Speculative Trading, Wholesale Inventories, Yen, Zurich

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50 consecutive months however showed a modest rebound from the prior month on the back of China's recent, and now burst, speculative commodity bubble.

The weaker yen was the main driver of overnight action: "The weakening yen is acting as a boost to stocks,” Yoshihiro Okumura, general manager at Chiba-Gin Asset Management told Bloomberg. “We’re seeing some risk-on moves overall. The key going forward is whether we’ll get a sense that all the negative earnings are over with now." The yen weakened for a second day after Japan’s Finance Minister said the government can intervene to stabilize foreign-exchange markets if necessary. Japan’s currency fell against all its Group-of-10 peers after Taro Aso, speaking in parliament in Tokyo Tuesday, reiterated that the U.S. doesn’t object to the Asian nation’s policy. His comments came a day after he said “it’s natural that Japan has means to intervene” in the foreign-exchange markets.

“The increase in Japan’s talk about intervention is drawing market attention,” said Sean Callow, a senior foreign-exchange strategist at Westpac Banking Corp. in Sydney. “Japanese officials run the risk being ‘the boy who cried wolf’ if they keep talking without acting." Considering they have been crying wolf all of 2016 after the disastrous NIRP experiment, one would assume the market has had enough, and yet here we are with a 300 pip squeeze in two days.

The MSCI All Country World Index’s 0.4 percent gain was its biggest in three weeks as Credit Suisse Group AG boosted European banks and Japanese shares rose. Nickel led a rebound in a Bloomberg measure of raw-materials prices as Japan’s largest supplier forecast a widening shortage. Philippine’s peso jumped the most in six weeks after Rodrigo Duterte called for “healing” after claiming victory in a presidential election and trading Europe signaled Brazilian markets would rebound as the move to oust President Dilma Rousseff appeared back on track. Optimism was dented by the latest industrial output print in Germany which declined more than expected in March while France’s unexpectedly fell highlighted the uneven nature of the recovery.

Cited by Bloomberg, Michael Hewson, a London-based market analyst at CMC Markets said that"people are slightly less risk averse now than they were end of April. Credit Suisse earnings weren’t great, but they were better than the worst of expectations. Still, the optimism is a little premature. Economic data hasn’t been very convincing." So not great, but better than the worst expectations, and the result is a 1.5% jump in Europe and a 0.6% bounce in US futures. As a reminder, on Monday morning Goldman cuts its Stoxx 600 and Eurostoxx 50 forecast. Now we know why.

Some more details: the Stoxx Europe 600 Index advanced 1.3 percent as of 10:31 a.m. London time, with all of its industry groups rising. Lenders led the gains. Greece’s ASE Index rose 2.7 percent for the biggest rally among western-European markets. S&P 500 futures added 0.6 percent after the gauge closed little changed on Monday. Credit Suisse rallied 4.8 percent after posting a smaller loss than analysts estimated. Pandora A/S jumped 9.8 percent after the maker of charm bracelets reported better-than-projected results and raised its full-year forecast.

Market Wrap

- S&P 500 futures up 0.6% to 2066.5

- Stoxx 600 up 1.3% to 337.5

- Eurostoxx 50 +1.5%

- FTSE 100 +0.8%

- CAC 40 +1%

- DAX +1.1%

- IBEX +1.9%

- FTSEMIB +2%

- MSCI Asia Pacific up 0.7% to 127.4

- Nikkei 225 up 2.2%

- Hang Seng up 0.4%

- Kospi up 0.7%

- Shanghai Composite up 0%

- ASX up 0.4%

- Sensex up 0.3%

- Euro up 0.01% to $1.1384

- Italian 10Yr yield down 4bps to 1.42%

- Spanish 10Yr yield down 3bps to 1.56%

- US 10Yr yield up 2bps to 1.77%

- German 10Yr yield up 0bps to 0.13%

- Gold spot up 0.2% to $1265.9/oz

Global Top News

- Republican Senators Nowhere Near Uniting Over Trump as Nominee: some hope to meet with party nominee and urge new approach

- Duterte Claims Big Philippine Win Amid Doubts on Economic Smarts: vice presidential vote count remains too close to call

- Credit Suisse Posts Loss as Thiam Signals Cost-Cutting Progress: says ‘subdued’ market conditions may persist for a while

- Brexit Backers Close Gap on ‘Remain’ in BCC Poll of Businesses: support for Leaving EU up to 37% from 30%

- Osborne Says Pent-Up Investment to Boom If U.K. Stays in EU: says delayed decisions will go ahead if Brexit rejected

- Several People Injured in Knife Attack in Grafing Near Munich: 4 to 5 people were injured, one of them seriously

- EnCap Said to Seek $1.5 Billion for ‘Stack’ Oil Explorer PayRock: according to people with knowledge of the matter

- Emirates Profit Rises 50% on Fuel Windfall, Long-Haul Routes: hedging policy reaps full benefit of declining oil price

- Pop. Emilia Weighs Bid for All 4 of Italy’s Rescued Banks: MF: MF report doesn’t cite anyone

- LendingClub Founder Goes From Wall Street Darling to Unemployed: Renaud Laplanche resigns after allegations tied to loan sales

Looking at regional markets, Asian stocks traded mostly higher after encouraging Chinese inflation figures supported a turnaround in sentiment. Nikkei 225 (+2.2%) outperformed as JPY weakness bolstered exporter sentiment, while ASX 200 (+0.4%) rebounded off its worst levels as strength in financials offset commodity weakness in which WTI crude futures declined below USD 44/bbl and iron ore dropped around 6%. Shanghai Comp (flat) recovered from opening losses after the latest China data release inspired an improvement in sentiment. Finally, 10yr JGBs were mildly lower as firm gains in Japanese stocks dampened demand for safe-haven assets while today's 10yr auction also saw a decline in the b/c from prior.

Top Asian News

- China Said to Consider Curbs on Backdoor Listing Valuations: CSRC weighs deal quota for overseas-listed Chinese cos.

- Hedge Funds Bullish on the Philippines as Duterte Wins Election: Civetta, F&H say they are encouraged by nation’s fundamentals

- China April Retail Auto Sales Rise 6.4% on Year, PCA Says: China’s retail auto sales in April rose to 1.72m units

- Mitsubishi Motors Pain Spreads With $3 Billion Exposure Risk: Trading co. Mitsubishi discloses potential impact of fraud

- SoftBank Profit Misses Estimates on Continued Losses at Sprint: Reports net income of 474.2b yen for fiscal year ended March 2016 vs 576.5b yen est.

- Japan’s Top Trading Houses Post First Net Losses as Prices Slump: Mitsubishi, Mitsui post combined losses of 232.8b yen

- 1MDB Default Deters Funds as Malaysia Can’t Put Scandal to Bed: Political situation still one of “biggest hurdles,” PineBridge says

European equities trade higher this morning, benefiting from the upside seen in Asia, combined with some notable positive earnings pre-market. The most notable earnings release pre-market came from Credit Suisse, with the Swiss Bank leading the way this morning, trading higher by over 5% after announcing a smaller than expected loss. The strength in equities has contributed to some of the downside in fixed income markets, with Bunds trading lower today and slipping back below the 164.00 level. Bunds have also been impacted this morning by the auction calendar, with a number of countries coming to market today including the Netherlands, Austria, UK and Germany. Elsewhere, as mentioned yesterday EUR denominated corporate bond sales have picked up this week as companies look to take advantage of low interest rates after publishing their quarterly earnings.

Top European News

- Thyssenkrupp Cuts FY Forecast on Steel Price; Beats 2Q Estimates: now sees FY adj. Ebit of at least EU1.4b, compared w/ previous guidance of EU1.6b-EU1.9b

- Abertis Reaches Accord to Buy 51.4% of A4 Holding for EU594M: A4 Holding main assets are A4 Brescia-Padova, A31 highways in Italy

- ING Profit Falls on Regulatory Costs, Loss at Markets Unit: regulatory losses jumped on levies, deposit insurance

- Adecco CEO Says U.K. Finance Hiring Sputters on Brexit Vote: Dehaze tells Bloomberg TV France is slowly recovering

- Munich Re Revises Annual Profit Target on Ergo, Investments: sets new profit target of EU2.3b vs previous target of EU2.3b-EU2.8b

- Nokia Revenue Misses Estimates Amid Waning Carrier Spending: CEO Suri seeking growth after Alcatel-Lucent acquisition

- Nordea CEO Says Headcount Must Fall to Meet Cost-Cut Goals: CEO says “low 40s” should be cost-to-income goal for Nordea

- EasyJet Posts Loss as Terror Clips Demand, Weighs on Fares: over-capacity hurting European carriers on short-haul routes

- Ditecsa Prepares Offer for Abengoa Unit, Expansion Reports: unit has 1,500 staff, revenue of ~EU400m

In FX, The yen slid 0.9 percent to 109.25 per dollar, adding to Monday’s loss of 1.1 percent. It declined versus all of its 16 major counterparts, except the South African rand. Bloomberg Dollar Spot Index fell 0.1 percent, after a five-day winning streak that marked its strongest run of gains in almost a year. The Philippine peso strengthened 0.8 percent as Duterte, the tough-talking mayor of Davao City, sought to calm markets and win over Filipinos and investors watching closely how he will manage the economy. there has been plenty of data releases overnight but none which majorly influenced FX, or indeed any of the key markets. Malaysia’s ringgit slumped to a seven-week low and Russia’s ruble weakened as trading resumed following a slide in oil on Monday. South Korea’s won fell to the lowest in almost eight weeks.

German trade data showing an improvement in the surplus, while the equivalent UK stats revealed a tighter, but still wide deficit. French industrial and manufacturing production was notably weak, but for the EUR, it was another tight trading session against the USD. However, we did see the greenback giving back some of its recent gains vs the CAD, more modestly so against GBP, but vs the JPY, the positive sentiment in equities saw the lead spot rate tipping 109.00 , with the prospect for a move on towards 110.00 now very much on the cards. Some moderation also seen in AUD/USD, with dealers reporting strong bidding interest at .7300. The recovery has been slow, but in line with the risk on tide. Little on the US data slate, so focus on Wall Street on the JPY pairings, with CAD/JPY in focus given the underlying spot moves seen this morning — up over 1.5 JPY from yesterday's lows.

In commodities, WTI and Brent have been pushing higher this morning with WTI heading toward the USD 44.00/bbl level. Gold has seen a slight reprieve from yesterday's sell off up marginally 0.15% as the dollar index slows down. Silver is also trading in positive territory up 0.44%.Meanwhile in base metals copper and iron ore were mixed with the red metal edging a mild recovery while Singapore iron ore futures declined below USD 50/mt for the first time since March.

On today's US calendar the main release of note is the March wholesale inventories and trade sales report. As well as that, we’ll get the NFIB small business optimism survey reading and March JOLTS job openings data. Fedspeak wise it is the turn of Dudley who is due to speak this morning in Zurich (at 8.15pm BST) on the international monetary system.

Bulletin Headline Summary from RanSquawk and Bloomberg

- European equities trade higher across the board as a pick-up in risk sentiment continues to guide price action

- This sentiment has filtered through to FX markets with USD/JPY reclaiming 109.00 to the upside

- Looking ahead, highlights include US JOLTS and API Crude Oil Inventories

- Treasuries lower in overnight trading amid rally in global equities and commodities while oil rises back toward $44 a barrel; week’s auctions begin with $24b 3Y notes, WI 0.895%; sold at 0.89% in April.

- German industrial production declined 1.3% m/m in March, more than expected, its second consecutive drop that could signal slackening demand in Europe’s largest economy

- Germany posted a record current-account surplus just days after being placed on a U.S. watchlist for countries that may have an unfair foreign-exchange advantage

- With record-low costs for mortgages and savings accounts earning almost nothing, Germany is warming to real estate. In the past five years, housing costs in Berlin, Hamburg and Munich have jumped by more than 30%

- China’s commodities boom started as a logical bet-- that China’s economic stimulus and industrial reforms would lead to shortages of construction materials -- quickly morphed into a full-blown commodities frenzy with little bearing on reality

- Saudi Arabia, the world’s biggest oil exporter, plans “significant growth” in output in 2016 and further international expansion, the head of the country’s state-run producer said

- Credit Suisse Group AG reported a second straight pretax loss at the securities business it’s overhauling as CEO Tidjane Thiam offloaded much of the high-risk assets that have triggered more than $700 million in losses since last year

- Faced with weak banks and an anemic economy the European Union has opened up the entire financial rule book for review, including contentious issues such as the cap on bankers’ bonuses

- The drive to oust President Dilma Rousseff is back on track after the head of the lower house Waldir Maranhao released a statement in the dead of night revoking his own call to annul impeachment sessions in the lower house

- Sovereign 10Y yields little changed except Greece, which rallies 71bp; European and Asian equity markets higher; U.S. equity- index futures rise. WTI crude oil and precious metals rally

US Economic Calendar

- 6am: NFIB Small Business Optimism Apr 93.6, est. 93.0 (prior 92.6)

- 8:55am: Redbook weekly sales

- 10am: Wholesale Inventories, m/m, Mar, est. 0.1% (prior -0.5%)

- 4:30pm: API weekly oil inventories

DB's Jim Reid concludes the overnight wrap

In terms of markets yesterday, caution was the name of the game as a steep selloff across the commodity complex kept investors sidelined. The S&P 500 did manage to close out with a modest +0.08% gain with performance for European markets slightly better (Stoxx 600 +0.47%). Credit markets were a smidgen tighter on both sides of the pond meanwhile. It was the moves for commodity markets which caught the eye though. Oil gets most of the attention and yesterday we saw WTI close back down below $44/bbl after falling -2.73%. However it was moves for metal markets which caught our eye though. Aluminium (-2.32%), Copper (-2.58%), Zinc (-2.81%), Nickel (-5.07%) and Iron Ore (-5.66%) were hammered and even Gold tumbled nearly 2% during yesterday’s session. We’ll touch on the moves in more detail below, along with what were some interesting developments in Greece and Brazil.

Before we do though, it’s straight to China where we’ve got some important inflation numbers to digest. China has reported CPI of +2.3% yoy in April which is both in line with March and relative to expectations. Food prices are again driving the number and were up +7.4% yoy with non-food prices currently +1.1% yoy. Meanwhile, PPI increased by nine-tenths last month and more than expected to -3.4% yoy (vs. -3.7%). That is actually the highest reading since December 2014 and further evidence prices at the factory gate may have bottomed out.

Bourses in China have been fairly muted in their reaction with the Shanghai Comp and CSI 300 +0.35% and +0.19% respectively. Elsewhere it’s been a broadly better day for Asian markets however. The Nikkei is +2.07% and benefiting from further weakening in the Yen, while the ASX (+0.26%) and Kospi (+0.47%) are also up. The Hang Seng (-0.05%) is the notable underperformer.

Staying with China, shortly after we went to print yesterday, an article from China’s People’s Daily was released which provided some important signals that China’s macroeconomic policy stance may turn from aggressive easing to a more neutral position soon in the eyes of our China economists. They note that the article indicates that the government is generally satisfied with the economic performance so far this year. It recognizes that structural challenges facing the economy will take time to resolve, and economic growth in the coming years will likely take an L-shaped path, rather than a V- or U-shaped one. The article also goes onto to say that the policy maker points out that adding leverage will not be effective in stimulating the economy at the current stage, and higher leverage could heighten systematic risks. With some focus also on the danger of indecisiveness when facing policy dilemmas, the context of the statement is a clear signal to our colleagues that the focus of the government will likely shift from promoting and stabilizing growth to control and the reduction of systematic risks in coming months. This leads them to believe that the aggressive policy easing seen in the past few months may come to an end soon.

This to some extent then helps explain that broadly poor day for commodity markets yesterday. The move for Oil was more reflective of some changing weather patterns in and around the Alberta region which is fuelling hopes that the wildfires may be starting to come under control. However the China story probably had a bigger impact for metals yesterday and it now means that Aluminium, Copper and Nickel are down anywhere from 7-9% in May already. Iron ore is amazingly down 17% this month and has plummeted over $15/tn from the April highs too. Steel rebar futures were also limit down yesterday and there’s still a lot of concern in the market about the speculative trading on Chinese commodity exchanges. A Bloomberg article caught our eye yesterday noting some of the eye-watering numbers concerning this. The daily average market turnover on bourses in Dalian, Zhengzhou and Shanghai is said to have increased from about $78bn in February to a peak of $261bn on April 22nd which in contrast compares to peak turnover on the Nasdaq in early 2000 of $150bn. The same article also suggests that over 40% of volume in rebar futures in April came in the night session and once people returned from their day jobs, while the average holding period for a contract is said to be less than 3 hours. Recent measures by bourses to curb speculative trading is helping to keep a lid on turnover in the last couple of weeks and has resulted in metals prices declining from recent highs, but what started with trading in Chinese equity markets some 12 months ago and has now spread to commodity markets is a strong illustration of how quickly bubbles can form when there’s large amounts of leverage and huge amounts of credit in an economy.

Another one of the BRIC economies namely Brazil was also the focus of some attention yesterday too. It was a confusing day for the country however as mid-way through yesterday afternoon the acting head of the Lower House of Congress announced that he was to call for a new vote on the impeachment of President Rousseff. This was supposedly on the back of the vote on April 17th containing procedural irregularities. However later on in the evening, Brazil’s Senate confirmed that the impeachment proceedings would still move ahead despite the call from the Lower House, and that voting by the Senate on whether to put Rousseff on trial could begin as soon as Wednesday. All the headlines sent Brazilian assets into a tailspin however. The Real had weakened by as much as nearly 4.6% at one stage (the most since September 2011) before paring the vast bulk of that move to close just 0.41% weaker on the day. Meanwhile the Ibovespa plummeted nearly -3.5% post the early headline, before also retracing much of that to finish the day with a -1.41% loss.

Closer to home, there were some positive developments in Greece to highlight. After talks had effectively been in a standstill over the last few months, yesterday the IMF, European finance ministers and the Greek government came to an agreement on a path forward which should be workable and so as a result allow Greece to receive the funding its needs for bond payments due in July. DB’s resident expert George Saravelos noted that it was a substantial back down from the IMF which allowed for the important step forward. The fund has accepted a softer version of the initial contingency package of fiscal measures, with the Greek side now agreeing to vote on a vague ‘spending break’ that only imposes temporary across the board spending cuts the year a fiscal target is missed. A similar softer package on debt measures has also been agreed upon including short, medium and long term debt measures. A number of underlying issues still remain unresolved but it’s a positive step forward nonetheless in resolving near term risks of another Greek crisis.

Moving on, there was a bit of Fedspeak for us to take note of yesterday. The Chicago Fed President Evans came across as slightly dovish in his tone, saying that he is in favour of the Fed being in a ‘wait and see mode’ for now and that while the fundamentals for US growth continue to be good, ‘uncertainty and risks remain’. Meanwhile, Minneapolis Fed President Kashkari sounded a similar tone in comments yesterday. The Fed official said that in his view that Fed’s current stance on monetary policy is ‘about right’ and that ‘to me, just looking at the raw data, it says we should be accommodative’. Elsewhere, the ECB’s Constancio reiterated that patience is needed to judge the effects of the recent ECB measures, while also reiterating that the Bank will continue to do what is necessary to achieve its inflation goal.

Just wrapping up yesterday, it was a particularly quiet day for data with the only release in the US being the April labour market conditions index reading which revealed a third consecutive monthly worsening in conditions. The index printed at -0.9pts for last month following a -2.1pts reading in March. Meanwhile in Europe there was good news to be had in the latest German factory orders data. Orders printed at +1.9% mom for March (vs. +0.6% expected) to be up +1.7% yoy now. Elsewhere the Sentix investor confidence reading printed at 6.2pts for May which is half a point higher relative to April.

Looking at today’s calendar, the main focus this morning in Europe will be the various industrial reports out of Germany, France and Italy for March. German trade data is also due to be released while later this morning we’ll receive the March trade data for the UK. Over in the US this afternoon the main release of note is the March wholesale inventories and trade sales report. As well as that, we’ll get the NFIB small business optimism survey reading and March JOLTS job openings data. Fedspeak wise it is the turn of Dudley who is due to speak this morning in Zurich (at 8.15pm BST) on the international monetary system.