Your cares and troubles are gone There’ll be no more from now on! Happy days are here again! The skies above are clear again Let us sing a song of cheer again Happy days are here again! Lyrics: Jack Yellen, Music: Milton Ager That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P 500. Bonds have been...

Read More »Spending Here, Production There, and What Autos Have To Do With It

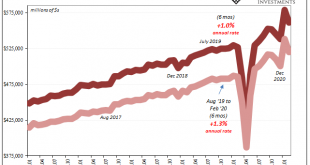

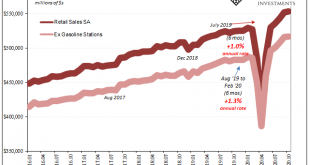

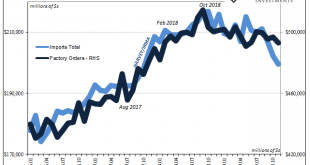

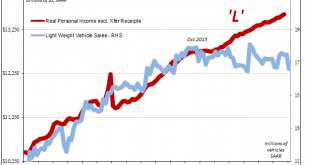

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise. Consumers are spending, prices should be heading upward at a noticeable rate. To begin with, consumer spending – as pictured by the Census Bureau – was obviously boosted during January by the previous...

Read More »Consumers, Producers, and the Unsettled End of 2020

The months of November and December aren’t always easily comparable year to year when it comes to American shopping habits. For a retailer, these are the big ones. The Christmas shopping season and the amount of spending which takes place during it makes or breaks the typical year (though last year, there was that whole thing in March and April which has had a say in each’s final annual condition). The calendar being what it is – we’ve never been forced to use the...

Read More »Extending the Summer Slowdown

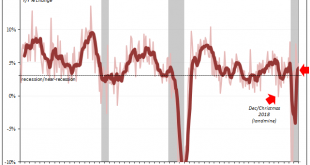

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer. If it succumbs to the slowdown every other economic account is displaying, that could only mean it really has been...

Read More »More Trends That Ended 2019 The Wrong Way

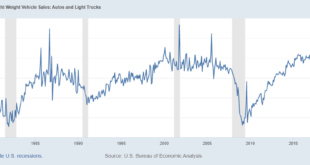

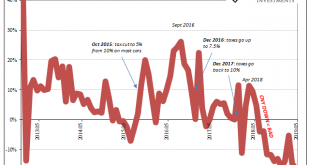

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019. That’s the version that is being described, Jay Powell’s underlying...

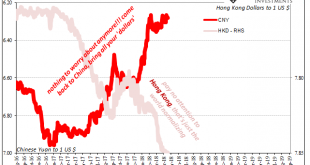

Read More »China Data: Something New, or Just The Latest Scheduled Acceleration?

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day. A new set of relatively strict pollution controls was added in the second half of this year. As is...

Read More »Dollar (In) Demand

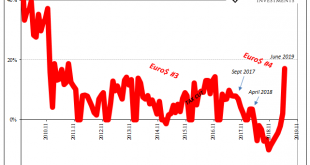

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness. That’s why in early 2016 authorities...

Read More »Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each. The US labor market is a foundation of non-inflationary sand, and China’s “stimulus” is...

Read More »Something Different About This One

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes. That would be powerful stuff. Instead, in June last year the narrative...

Read More »Getting Back Up To Speed On Loss Of Speed in US Economy

For much of 2018, the idea of “overseas turmoil” lived up to its name. At least in economic terms. Market-wise, there was a lot domestically to draw anyone’s honest attention. Warnings were everywhere by the end of the year. And that was what has been at issue. Some said Europe and China are on their own, the US is cocooned in a tax cut-fueled boom. Decoupling, only now the other way around. The Bureau of Economic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org