Overview: The dollar is beginning the week on a soft note, despite the modest backing up of yields over the last couple of sessions and better than expected data, including Black Friday sales and the preliminary November PMI. It is sporting minor losses against all the G10 currencies, but the Canadian dollar, which is the weakest of the major currencies this quarter and month. The greenback is also lower against most emerging market currencies, but the Turkish lira...

Read More »Corrective Forces Help the Dollar Stabilize

Overview: Corrective forces helped the dollar stabilize yesterday and it enjoys a firmer today. The euro has slipped below $1.09, and the dollar has resurfaced above JPY149.00. The FOMC minutes seem dated by the more than 30 bp decline in the US 10-year yield, the 7% rally in the S&P 500 and roughly 3% drop in the Dollar Index. The implied year-end 2024 Fed funds rate has fallen by 10 bp to 4.51% (5.33% currently). The Japanese government downgraded its economic...

Read More »Chinese Stocks Extend Rally Even Though Covid Infections Appear to be Spreading

Overview: The easing of vaccination, quarantine, and some travel protocols related to Covid in China (and Hong Kong) continues to draw funds back into Chinese stocks, wherever they trade. The Hang Seng rose 2.3% today to close the week with a nearly 6.6% advance. The index of mainland companies that trade there rose 2.5% on the day for a7.3% weekly gain. The CSI 300 of mainland shares rose 1% today and almost 3.3% for the week. Japan’s 1% gain today ensured a gain...

Read More »Coinbase Gets Greenlight to Operate Its Crypto Exchange in the Netherlands

Coinbase has secured regulatory approval from the Dutch central bank as a crypto service provider, allowing it to offer its full suite of retail, institutional, and ecosystem products to customers in the country. This makes Coinbase one of the first major global crypto exchanges to be approved by the De Nederlandsche Bank to operate in the country, alongside eToro and other platforms such as BitPay and Okcoin. Coinbase currently serves customers across almost 40...

Read More »FX Daily, January 15: The Greenback is Finishing the Week with a Firm Tone

Swiss Franc The Euro has fallen by 0.39% to 1.0753 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firm against most of the major and emerging market currencies today. Among the majors, the Japanese yen and Swiss franc are resilient. For the week, sterling and the yen appear poised to eke out small gains, while the Scandi’s are the weakest performers with around...

Read More »‘Paris’ Technocrats Face Another Drop

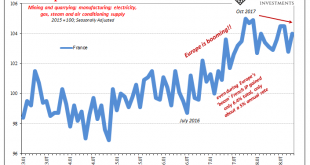

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts. Italy has found competition in the race to violate EU fiscal guidelines. Around the rest of Europe, the question is being asked....

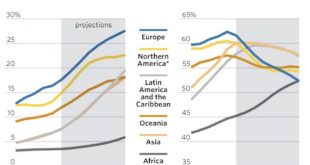

Read More »“This May Be The End Of Europe As We Know It”: The Pension Storm Is Coming

Authored by John Mauldin via MauldinEconomics.com, I’ve written a lot about US public pension funds lately. Many of them are underfunded and will never be able to pay workers the promised benefits – at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill. Readers outside the US might have felt safe reading those stories....

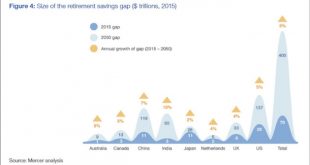

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

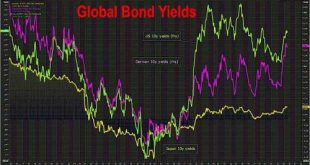

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org