With Tamon Asonuma and Romain Ranciere. Journal of International Economics 140, 103689, January 2023. PDF. We document that creditor losses (”haircuts”) during sovereign debt restructurings vary across debt maturity. In our novel dataset on instrument-specific haircuts suffered by private creditors in 1999-‒2020 we find larger losses on short- than long-term debt, independently of the specific haircut measure we use. A standard asset pricing model rationalizes our findings under two...

Read More »“Sovereign Bond Prices, Haircuts and Maturity,” UniBe, 2022

With Tamon Asonuma and Romain Ranciere. UniBe Discussion Paper 22-13, November 2022. PDF. We document that creditor losses (”haircuts”) during sovereign debt restructurings vary across debt maturity. In our novel dataset on instrument-specific haircuts suffered by private creditors in 1999-‒2020 we find larger losses on short- than long-term debt, independently of the specific haircut measure we use. A standard asset pricing model rationalizes our findings under two assumptions, both...

Read More »Russia’s `Default’

Is it a default? Discussions in NZZ and FT.

Read More »Defaults Are Coming, Market Report, 22 June

We are reading now about possible regulations for air travel. In brief: passengers might be forced to spend hours at the airport. Authorities will perform medical checks, including possibly needles to draw blood, no lounges, no food or drink on board the plane, masks required at all times, and even denied the use of a bathroom except by special permission. We would wager an ounce of fine gold against a soggy dollar bill that people will hate this. The majority of...

Read More »The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot). The question on everyone’s mind is what will be the consequences? The standard...

Read More »“Moderne monetäre Theorie: Ein makroökonomisches Perpetuum mobile (The Macroeconomic Perpetuum Mobile),” NZZ, 2019

NZZ, April 25, 2019. PDF. Modern monetary theory (MMT) is neither a theory, nor modern, nor exclusively monetary. I discuss fallacies related to MMT. Dynamic inefficiency requires permanent, not transitory, r<g. For now, policy makers should rely on common sense rather than MMT.

Read More »“Moderne monetäre Theorie: Ein makroökonomisches Perpetuum mobile (The Macroeconomic Perpetuum Mobile),” NZZ, 2019

NZZ, April 25, 2019. PDF. Modern monetary theory (MMT) is neither a theory, nor modern, nor exclusively monetary. I discuss fallacies related to MMT. Dynamic inefficiency requires permanent, not transitory, r<g. For now, policy makers should rely on common sense rather than MMT.

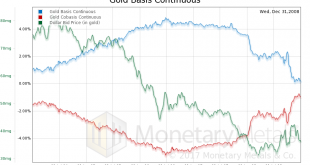

Read More »In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018

Last week, we discussed the tension between forces pushing the dollar up and down (measured in gold—you cannot measure the dollar in terms of its derivatives such as euro, pound, yen, and yuan). And we gave short shrift to the forces pushing the dollar down. We said only that to own a dollar is to be a creditor. And if the debtors seem in imminent danger of default, then creditors should want to escape this risk. The...

Read More »“Financial Policy,” CEPR, 2018

CEPR Discussion Paper 12755, February 2018. PDF. (Personal copy.) This paper reviews theoretical results on financial policy. We use basic accounting identities to illustrate relations between gross assets and liabilities, net debt positions and the appropriation of (primary) budget surplus funds. We then discuss Ramsey policies, answering the question how a committed government may use financial instruments to pursue its objectives. Finally, we discuss additional roles for financial...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org