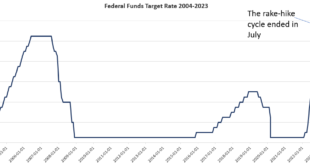

The Fed's Federal Open Market Committee released the minutes to its December meeting yesterday, and the minutes further strengthen the view held by many Wall Street investors and observers that the Fed plans to implement rate cuts by the middle of 2024. Specifically, the most recent Fed survey of market participants "suggested that the first reduction in the policy rate would occur in June." This contrasts only slightly with the FOMC members themselves, who, in...

Read More »What the Fed Accomplished: Distorted the Economy, Enriched the Rich and Crushed the Middle Class

The mainstream holds the Fed is busy planning a return to the glory days of zero interest rates, but ZIRP is on the downside of the S-Curve; it’s done, gone, history. Let’s summarize what the Federal Reserve accomplished since embarking on its massive interventions to control volatility, risk, bond yields, interest rates, the mortgage market, bank subsidies and liquidity, all of which can be summed up as the cost of credit-capital, that is, capital that is borrowed...

Read More »Exposing the Price Level Myth

Price inflation statistics were a hot topic in 2023. Official measures, like the Personal Consumption Expenditures Price Index (PCE) and the Consumer Price Index (CPI), rose to levels not seen in over four decades. These measures were under commentators’ microscopes as recently as last week. The FRED Blog (run by the St. Louis Fed) briefly discussed how these two measures are constructed and how they differ. Paul Krugman compared the change in the “core” versions of...

Read More »Zoning Laws: Wolves in Sheep’s Clothing

While zoning laws do not explain all homelessness in this country, they help make housing less affordable, putting more people on the streets who no longer can pay for a place to live. Original Article: Zoning Laws: Wolves in Sheep's Clothing [embedded content] Tags: Featured,newsletter

Read More »The Bill of Rights: The Only Good Part of the Constitution

The Bill of Rights turns 232 years old today. Adopted in 1791 as a consolation prize for the Anti-Federalists, it has been the most important part of American legal history since the 18th century. Original Article: The Bill of Rights: The Only Good Part of the Constitution [embedded content] Tags: Featured,newsletter...

Read More »Truth Is the Biggest Threat to Democracy in DC

It seems U.S. government officials are entitled to blindfold and deceive the American people to avoid “intruding” on foreign leaders planning a military attack? This theory of democracy gets curiouser and curiouser. Original Article: Truth Is the Biggest Threat to Democracy in DC [embedded content] Tags:...

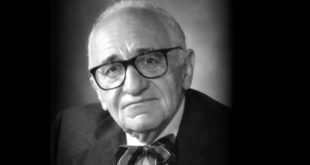

Read More »Experiencing the Rothbard Graduate Seminar: Who Should Apply

Why did you want to attend RGS? I attended the Rothbard Graduate Seminar (RGS) in 2023 for several reasons. For one, it fulfilled a requirement as one of the final classes to complete the Mises graduate program. Additionally, RGS was part of the Mises summer fellowship program, which I was also a part of this year. That said, I wanted to attend RGS because of the unique format it provides for graduate-level reading, lectures, and discussions with the professors and...

Read More »Consolidative Tone Emerges Ahead of Tomorrow’s US Jobs and EMU CPI

Overview: After gaining for the past couple of sessions to open the New Year, the dollar is mostly softer today. The yen is the main exception. The greenback was bid above the JPY144 area where chunky options expire today. Most emerging market currencies are also firmer though there are a few exceptions in Asia, like the South Korean won and Thai baht. Still, the general tone is consolidative ahead of tomorrow US jobs data and the eurozone's CPI. Equities, which...

Read More »Why More Secession Means Lower Taxes and More Trade

[This article is Chapter 9 of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities.] When we hear of political movements in favor of decentralization and secession, the word “nationalist” is often used to describe them. We have seen the word used in both the Scottish and Catalonian secession movements, and in the case of Brexit. Often the term is intended to be pejorative. When used pejoratively—as by the critics of Brexit—the...

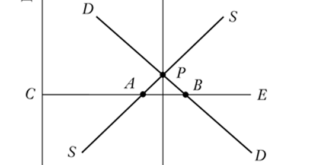

Read More »Resurrecting the Failed Policy of Rent Control

It certainly isn’t common to find much agreement between the various authors here at the Mises Institute and our favorite metaphorical punching bag: Paul Krugman. But when it comes to the recently resurrected policy corpse of rent control, we have found a common cause. As Krugman noted back in 2000, The analysis of rent control is among the best-understood issues in all of economics, and—among economists, anyway—one of the least controversial. In 1992 a poll of the...

Read More » SNB & CHF

SNB & CHF