The US Supreme Court released its ruling on Trump v. Anderson this week and unanimously slapped down the Colorado Supreme Court which had tried to disqualify candidate Donald Trump from the Colorado ballot using section 3 of the Fourteenth Amendment to the US constitution.The US Supreme Court's ruling was so baseless in law that even the most Left and partisan members of SCOTUS joined the majority in declaring the Colorado ruling null and void. The case had been...

Read More »Juvenal’s Greatest Poser: “Who Will Guard the Federal Reserve?”

[This article was first published in the New York Sun.]“Who will guard these guardians?” That poser of Juvenal, satirist of Rome, is an immortal question — nowhere more pertinent, though, than in deciding who should oversee the Federal Reserve. In the Fed, we have supposed guardians of stable prices who have decided by themselves to create perpetual inflation.Just to mark the point: Guardians of the currency have decided by themselves to depreciate it forever....

Read More »Smedley Butler Explains the Latest Excuse for American Intervention in Ukraine

Senior Fellow Alex Pollock drew my attention to an important quotation by Smedley Butler: 1935 speech and later a book by Major General Smedley D. Butler (USMC), includes “… A racket is best described, I believe, something that is not what it seems to the majority of people. Only a small “inside” group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make large fortunes. … If we put...

Read More »US Dollar enters fourth day of consecutive losses ahead of Powell testimony

Share: The US Dollar trades softer across the board on Wednesday. US Federal Reserve Chairman Jerome Powell is heading to Capitol Hill for his semi-annual testimony. The US Dollar Index snaps an important support, looking bleak ahead of the ECB decision and NFP data. The US Dollar (USD) is facing some firm selling pressure on Wednesday...

Read More »Swiss Franc extends losses on Swiss interest rate outlook

The Swiss Franc edges lower against the US Dollar on the back of relatively low inflation in Switzerland, which indicates interest rates remaining low. SNB’s Jordan says Swiss Franc rising in real terms is hurting Swiss exporters, SNB unlikely to pursue CHF-strengthening policies. USD/CHF hits resistance at falling trendline, 50-week SMA. The Swiss Franc (CHF) edges lower against the US Dollar (USD) on Wednesday as traders continue to bet on a less-inflationary...

Read More »Apartment Bridge Loans Are Collapsing

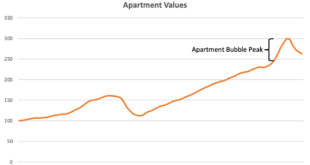

Stoked by ultra-loose monetary policy from the Federal Reserve, capital markets have been in a persistent bubble for several years. Printing trillions of new dollars and maintaining a zero-interest rate policy (“ZIRP”) was marketed by politicians and bureaucrats as supportive of the “main street economy,” but those trillions were directed primarily towards speculation in capital markets. Nowhere was this malinvestment more apparent than in apartment investing. After...

Read More »Be on the Lookout for These Lies in Biden’s State of the Union Address

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest...

Read More »Dissecting Lincoln

Thomas DiLorenzo, the president of the Mises Institute, has already reviewed Paul C. Graham’s Nonsense on Stilts: The Gettysburg Address and Lincoln’s Imaginary Nation (Shotwell Publishing, 2024) in characteristically excellent fashion, but the book is so insightful that some further comments are warranted. It is clear that Graham has a philosophical turn of mind and is a master of linguistic analysis.His skill is amply on display in his dissection of Abraham...

Read More »Reimagining Public Safety – The Case for Privatizing Security

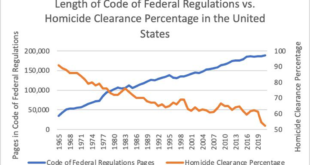

Since the conclusion of World War II, each biennial session of Congress has ushered in a staggering 4-6 million words of additional legislation. However, amidst this flood of legal text, the State's focus on expanding regulations and enforcing compliance has overshadowed its fundamental obligation: provision of security—the cornerstone of what progressives call the social contract.This neglect is starkly evident in the steady decline of the national homicide...

Read More »States Rights and Anti-Interventionism is Rising

Super Tuesday saw Donald Trump sweep all possible state delegates except for the state of Vermont. However, hovering just below the surface were a series of propositions that were voted on by the Texas Republican Party. Various propositions touched on topics of gold as legal tender, border security, and school choice, but the most interesting was Proposition 6. Proposition 6 reads as follows: “The Texas Legislature should prohibit the deployment of the Texas National...

Read More » SNB & CHF

SNB & CHF

-638453232816314704-310x165.png)