Trading, forecasting, aggregating, and innovating—referred to from here on out as the Four—are activities that people have engaged in since the beginning of humanity. They are part of the human fabric because they stem from mankind’s peculiarities—heterogeneity, inclination to forecast, sociality, and inventiveness. The Four are key social interactions in human life at both the individual and aggregate levels. In 2022, the value of worldwide global exports amounted to approximately trillion at the current price. Most humans live together in urban areas, while an even larger share belongs to social groups such as families and firms. Virtually everyone must deal with forecasts and innovations (in the role of consumer, saver, voter, taxpayer, worker, and tenant).

Topics:

Maurizio Bovi considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Trading, forecasting, aggregating, and innovating—referred to from here on out as the Four—are activities that people have engaged in since the beginning of humanity. They are part of the human fabric because they stem from mankind’s peculiarities—heterogeneity, inclination to forecast, sociality, and inventiveness. The Four are key social interactions in human life at both the individual and aggregate levels.

In 2022, the value of worldwide global exports amounted to approximately $25 trillion at the current price. Most humans live together in urban areas, while an even larger share belongs to social groups such as families and firms. Virtually everyone must deal with forecasts and innovations (in the role of consumer, saver, voter, taxpayer, worker, and tenant). In a nutshell, the Four are ancestral, vital social interactions that each of us face not only in special moments but, rather, every day.

Why do humans perform the Four? The short answer is because each person has some peculiar gain. While it is easy to recognize the paramount role of innovating activities for both the individual well-being and system-wide performances, some words on the other three affairs seem necessary.

The division of labor allows for specialization, hence higher productivity. However, the division of labor also needs the exchange of what each produces. To the extent that trading is a free choice between partners with the same bargaining power and knowledge, it improves the condition of all participants (otherwise, why choose to trade?). Robinson Crusoe’s story puts forward the idea of the gains from trade. Centuries ago, Venice (a small city, after all) became an economic superpower, exploiting its commercial connections as part of the Silk Road network. Another way to appreciate the advantages of the exchange is to consider that sanctions banning trading activities are aimed at inflicting damages to sanctioned countries. Iran and North Korea are case history.

One way to see the gain from forecasting is considering when expectations are wrong. At the individual level, if someone believes that she has no chance of finding a job (becoming a “discouraged worker”), then she will not adequately prepare herself for the job market or will be apathetic in her job search. This forecast-induced behavior may magnify the likelihood that grim expectations—and real losses—will materialize.

Alongside discouraged workers, poor people may well get trapped in a permanent state of poverty because their own gloomy predictions of improvement steer them to be insufficiently proactive. Ex post guarantees may then reduce ex ante efforts. Finally, if employees/lenders earn fixed wages/interests, underestimating price developments in high-inflation environments would lead them to lose significant purchasing power. Clearly, these individual situations may be so widespread as to affect the economy as a whole. Looking more explicitly at the aggregate level, the gain from correctly forecasting emerges in maintaining stability in the system. Expectations should not diverge too much or for too long from fundamentals.

For instance, in financial markets, the price of a stock must reflect—at least in the long term—the fundamental value of the firm. Bubbles such as the dotcom and the 2008 subprime mortgage crises are points in case. As well known, financial crises often distress the real part of the system determining huge socioeconomic costs. One may then think about intertemporal decisions. These must be such that aggregate demand is not systematically larger than the system-wide fundamental, or natural, capacity of production. Otherwise, again, the system dangerously overdrives.

Since the outset of our species, humans have understood that unity is strength and that there are gains from aggregating. We form several clusters—families, clans, villages, cities, up to the United Nations. For the present aim, cities and firms are particularly critical social aggregations. Aggregating in a city enhances labor division and specialization and, accordingly, productivity and wages, as the so-called urban wage gap indicates.

Cities then have the advantage of a critical mass. The quality and quantity of goods and services available in a big city is much larger than what one can find in a village. Only large cities can afford to sustain the demand for niche products and the high fixed costs of cultural activities such as theaters, museums, and the like. Typically, neither congestion nor high housing prices convinces people to abandon their urban location.

Humans concocted the firm once family and trading became insufficient for their insatiability. The firm is an efficient way to produce. Ronald Coase argued that humans aggregate in firms because of transaction costs—such as the costs and time of creating and maintaining property rights, opening a firm, and finding suppliers and customers. Within a firm, all these costly activities can be easily managed with virtually no negotiations or costs.

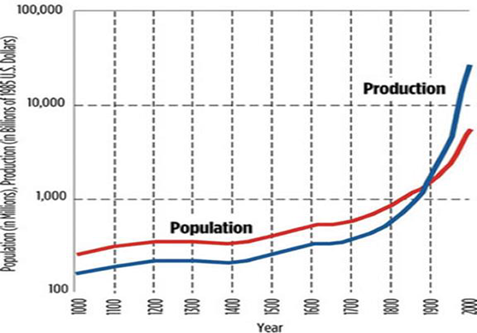

Although the Four have a dark side, they can reinforce each other, and their gains sum up, boosting mankind toward big achievements. A prominent instance is the Industrial Revolution, which began in the 1800s. During this period, all the Four were sustained, pushing economic systems to be increasingly innovative, urbanized, and exchange-oriented in a globalized way (forecasting has clear connections with the other three activities). These economic activities allowed humans to escape from the Malthusian trap.

Figure 1: World economic and demographic growth

Source: Robert E. Lucas, “The Industrial Revolution: Past and Future,” Federal Reserve Bank of Minneapolis, May 1, 2004.

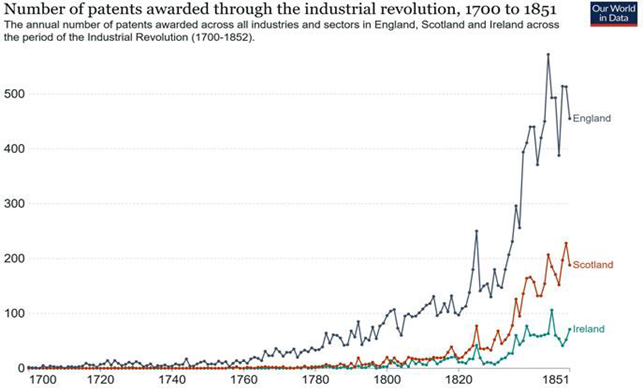

In the 1800s, there was a strong acceleration of patents and patentable inventions per person. A set of innovative businesses were quickly emerging and diffusing across firms.

Figure 2: The number of patents awarded through the Industrial Revolution, 1700–1851

Source: “Research and Development,” Our World in Data, OurWorldInData.org/research-and-development. Data from Sean Bottomley, “Patenting in England, Scotland and Ireland during the Industrial Revolution, 1700–1852,” Explorations in Economic History, October 2014.

Cities and productive firms ushered in groundbreaking efforts. Geographical aggregation materialized because most of the innovations required that machinery be centrally located where sources of power were available. Innovation allowed production to become massive, and production was increasingly located in factories. Firms increasingly featured in the economic landscape, and the mechanization of production made urbanization necessary.

Until 1800, more than 90 percent of the population of all nations lived in rural areas. By 1900, however, almost half of the inhabitants were urbanized in Western countries. Innovating and trading were tightly intertwined too. Most of the innovations of the period popped up because of the presence of large trading markets. Industries such as cotton and pottery would not have grown to a large scale without the existing system of intercontinental seaborne trade relations.

The advanced products of the British Industrial Revolution quickly invaded foreign markets, reshaping international trade. At the national level, the period witnessed innovations in the way of trading. Marketing and advertising are points in case. Until 1800, there was a long period characterized by persistently low international trade, with the ratio of total trade—exports plus imports—to global gross domestic product never exceeding 10 percent. However, this ratio quickly tripled, reaching 30 percent just before World War I.

It should be clear that, as mentioned, forecasting has tight connections with the other three activities. In a sense, the Industrial Revolution may have also induced different forecasting attitudes. As shown in figure 1, when things tend to move slowly for long periods, one is tempted to give great weight to the past when imagining the future (Malthus docet). However, when dynamics are bubbling—when the present is so different from the past—then inertia and experience contribute less to forecasting.

The Industrial Revolution may have made humans more forward-looking than ever. The contribution of forecasting may also be somewhat inferred from the fact that, as observed, sustained system-wide growth cannot coexist with systematic system-wide prediction errors.

This article is based on my 2022 book Why and How Humans Trade, Predict, Aggregate, and Innovate, published by Springer.

This article is based on my 2022 book “Why and How Humans Trade, Predict, Aggregate, and Innovate,” Springer.

Tags: Featured,newsletter