Summary: MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance. This Great Graphic from Bloomberg is a weekly bar chart of MSCI Emerging Market equity index. In H2 15 and H1 16, it carved out a head and shoulders bottom that we identify on the chart. We also drew in the neckline...

Read More »Credit Suisse Offices Raided In Multiple Tax Probes: Gold Bars, Paintings, Jewelry Seized

Credit Suisse has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders. According to Bloomberg, Dutch investigators seized jewellery, paintings and even gold bars as part of a sweeping investigation into...

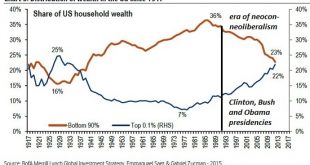

Read More »Do the Roots of Rising Inequality Go All the Way Back to the 1980s?

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse. I presented this chart of rising wealth inequality a number of times over the past year. Do you notice something peculiar about the inflection points in the 1980s? US...

Read More »LIBOR Pains

Wrong Focus If one searches for news on LIBOR (=London Interbank Offered Rate, i.e., the rate at which banks lend dollars to each other in the euro-dollar market), they are currently dominated by Deutsche Bank getting slapped with a total fine of $775 million for the part it played in manipulating the benchmark rate in collusion with other banks (fine for one count of wire fraud: US$150 m.; additional shakedown by US...

Read More »Five Keys to Understand Trump

(draft of monthly column for Caixin) The election of Donald Trump as the 45th President of the United States surprised many people, even seasoned political observers and astute investors. He failed to win the popular vote but did carry the electoral college, which is how the US elects its chief executive. His victory is a bit of a Rorshcach test, where people project the issues that allowed Trump to succeed, with...

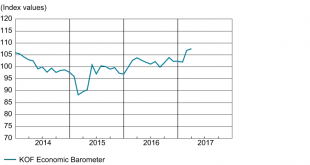

Read More »KOF Economic Barometer: Continues to Rise

In March 2017, the KOF Economic Barometer rose by 0.7 points to a new reading of 107.6. It thus reinforces its previous month’s climb to a level clearly above its long-term average. This indicates that the Swiss economy should grow at above average rates in the near future. In March 2017, the KOF Economic Barometer climbed from 106.9 in February (revised down from 107.2) by 0.7 points to a level of 107.6....

Read More »FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

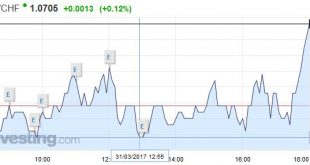

Swiss Franc EUR/CHF - Euro Swiss Franc, March 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March. The Fed did hike rates, but the...

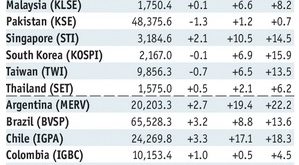

Read More »Emerging Markets: What has Changed

Summary Former Korean President Park was arrested. Hungary’s central bank was more dovish than expected. South African President Zuma finally fired Finance Minister Gordhan. Brazil’s meat industry may have seen the worst of the scandal. Banco de Mexico slowed the pace of tightening. Stock Markets In the EM equity space as measured by MSCI, Colombia (+2.0%), Brazil (+2.0%), and Singapore (+1.2%) have outperformed this...

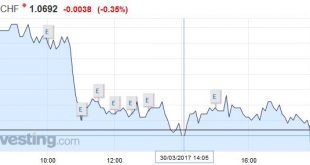

Read More »FX Daily, March 30: Euro breaks down against CHF and USD

EUR/CHF The SNB is intervening for 3 bn. CHF per week, this is far too much at these elevated Euro and Dollar levels. With two times positive economic data (here and here) about good news on internal demand, she might be finally be ready to let the euro fall. EUR/CHF - Euro Swiss Franc, March 30(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Pound to Swiss Franc exchange rate has opened up flat...

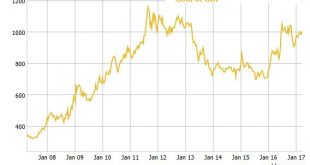

Read More »Brexit Gold Buying – UK Demand for Gold Bars Surges 39 percent

As the UK triggered its formal departure from the European Union yesterday, gold demand from UK investors remained ongoing and robust with increased numbers of British investors diversifying into physical gold in order to hedge the considerable uncertainty and volatility that the coming months and years will bring. The U.K. government yesterday triggered Article 50–the legal mechanism which will start negotiations on...

Read More » SNB & CHF

SNB & CHF