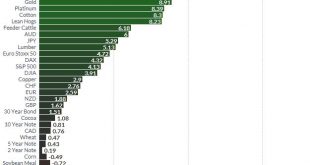

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world’s largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump. Yesterday. in the latest expression of his building anti-Trumpian sentiment, Bridgewater released a...

Read More »Putting Pennies in the Fuse Box – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Careening from Crisis to Crisis Back in the old days, homes had fuse boxes. Today, of course, any new house is built with a circuit breaker panel and many older homes have been upgraded at one time or another. However, the fuse is a much more interesting analogy for the monetary system. When a fuse burned out, it was...

Read More »Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates. At least not without making a commitment like the...

Read More »Don’t Confuse Immigration With Naturalization

Authored by Ryan McMaken via The Mises Institute, As the immigration debate goes on, many commentators continue to sloppily ignore the difference between the concept of naturalization and the phenomenon of immigration. While the two are certainly related, they are also certainly not the same thing. Recognizing this distinction can help us to see the very real differences between naturalization, which is a matter...

Read More »Weekly Speculative Position:

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »A century of attracting holidaymakers

The exhibition "Take a Holiday!" looks back at the innovative and colourful ways in which Switzerland has been advertised as a tourism destination. The Museum für Gestaltung in Zurich commemorates the centenary of the Swiss tourism office. (SRF, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit...

Read More »Naturalisation

What does it take to become a fully-fledged Swiss citizen? --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe:...

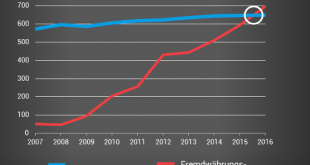

Read More »Riskante SNB-Politik: up! fordert Währungswettbewerb

(ll) – Die Schweizerische Nationalbank (SNB) hat am Donnerstag ihren Geschäftsbericht publiziert und musste erneut heftige Kritik vor der Schweizer Unabhängigkeitspartei up! einstecken. up! kritisiert insbesondere die expansive Geldpolitik, die zu Fremdwährungsreserven von 692 Milliarden Franken geführt hat. Zudem fordert up! einen Übergang von der staatlichen Währung zu einem System von Marktwährungen. Die SNB hat in...

Read More »Safe Haven Gold Rises 2.5 percent As Stocks Fall and ‘Trump Trade’ Fades

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening. The precious metals had their second consecutive week of gains last week. Gold rose 1.5% and silver 2% while platinum rose 0.5% and palladium...

Read More » SNB & CHF

SNB & CHF