Swiss Franc EUR/CHF - Euro Swiss Franc, April 05(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc may come under pressure tomorrow after Consumer Price Index inflation numbers are released. Inflation is expected to fall from 0.6% to 0.5% for the month of March and any weakening in the numbers could see the Swiss Franc weaken. Fridays unemployment data from Switzerland could also give a...

Read More »Systemic Depression Is A Clear Choice

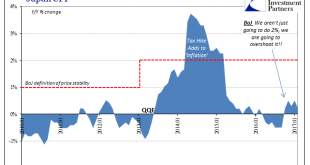

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures...

Read More »Incomes Always Deviate Negative

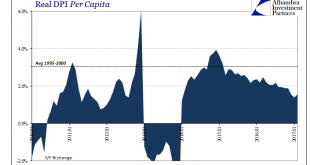

Personal Income growth in February 2017 was more mixed than it had been of recent months. Nominal Disposable Per Capita Income increased 3.73% year-over-year, while in real terms Per Capita Income was up 1.57%. For the former, that was among the better monthly results over the past year, while the latter was near the worst. The difference is still calculated inflation, where the rising oil component of every deflator...

Read More »The American Empire and Economic Collapse

Dashed Hopes Despite widespread optimism among libertarians, classical liberals, non-interventionists, progressive peaceniks and everybody else opposed to the US Empire that some of its murderous reins may finally be pulled in with the election of Donald Trump, it appears that these hopes have now been dashed. Liberty… some of it is still above water, but definitely not as much as there could or should be.* - Click...

Read More »German and Swiss Precious Metals Refiners join forces as Heraeus acquires Argor-Heraeus

German precious metals group Heraeus Precious Metals (HPM), part of the Heraeus industrial group, has just announced the full acquisition of Swiss precious metals refining group Argor-Heraeus. Heraeus is headquartered in Hanau, just outside Frankfurt. Argor-Heraeus is headquartered in Mendrisio in the Swiss Canton of Ticino, beside the Italian border. The Heraeus takeover announcement, on 3 April 2017, continues a...

Read More »Inclusion in SDR Does Not Spur Official Demand for the Yuan

Summary: China’s share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves – valuation, portfolio decisions, and China’s gradual inclusion in allocated reserves. The Swiss franc’s as a reserve asset diminished, but the “other” category appeared robust. The inclusion of the Chinese yuan in the SDR basket at the start of Q4 16 did not...

Read More »The Balance of Gold and Silver – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Orders of Preference Last week, we discussed the growing stress in the credit markets. We noted this is a reason to buy gold, and likely the reason why gold buying has ticked up since just before Christmas. Many people live in countries where another paper scrip is declared to be money — to picture the absurdity, just...

Read More »Consensus Inflation (Again)

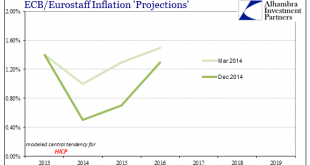

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January...

Read More »When the “Solutions” Become the Problems

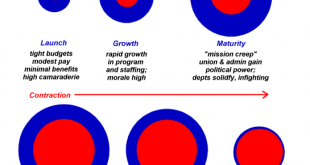

Those benefiting from these destructive “solutions” may think the system can go on forever, but it cannot go on when every “solution” becomes a self-reinforcing problem that amplifies all the other systemic problems. We are living in an interesting but by no means unique dynamic in which the solutions to problems such as slow growth and inequality have become the problems. This is a dynamic I have often discussed in...

Read More »Swiss Retail Sales, February: +0.5 percent Nominal and +0.6 percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More » SNB & CHF

SNB & CHF