Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down in all the key places. Employment is usually a lagging indication, coincident at best, so continued weakness isn’t necessarily surprising given that we have no idea how much of a delay there might or will be to the economy’s relative improvement (stopped slowing). But the bottom of the 2015-16 “rising dollar” economy, or near-recession, was just about a year ago. That should have been enough time for labor conditions to at least hint at a small pickup. Payrolls Est Survey, Jan 2010 - 2017 - Click to enlarge Whether we examine full-time employment or the labor force, there is no acceleration; in that Household Survey segment, for example, the gain in the estimated number of employees reporting working full-time is still slowing and to a truly significant degree.

Topics:

Jeffrey P. Snider considers the following as important: BLS, currencies, depression, economy, employment, establishment survey, Featured, Federal Reserve/Monetary Policy, full-time jobs, hours worked, household survey, jobs, labor force, Markets, newsletter, payrolls, The United States, unemployment rate, wages, weekly earnings

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

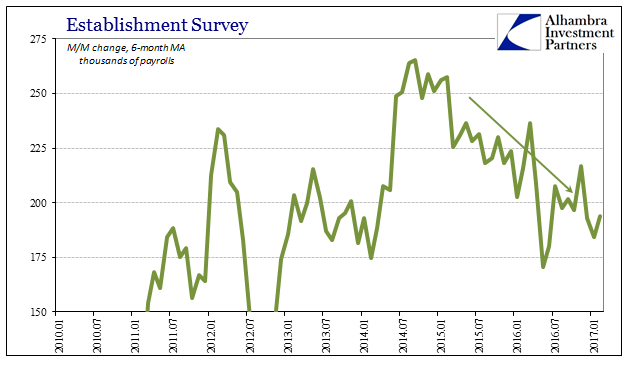

| Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down in all the key places.

Employment is usually a lagging indication, coincident at best, so continued weakness isn’t necessarily surprising given that we have no idea how much of a delay there might or will be to the economy’s relative improvement (stopped slowing). But the bottom of the 2015-16 “rising dollar” economy, or near-recession, was just about a year ago. That should have been enough time for labor conditions to at least hint at a small pickup. |

Payrolls Est Survey, Jan 2010 - 2017 |

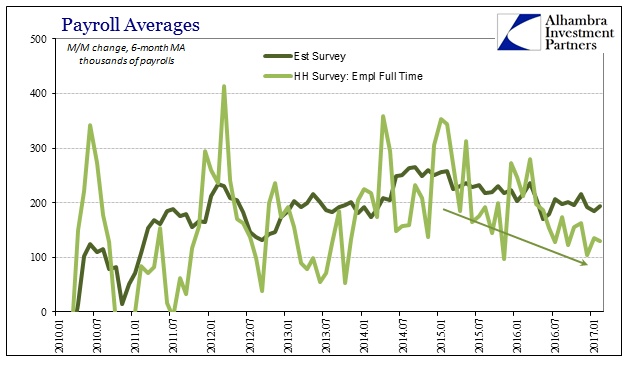

| Whether we examine full-time employment or the labor force, there is no acceleration; in that Household Survey segment, for example, the gain in the estimated number of employees reporting working full-time is still slowing and to a truly significant degree. The average monthly gain was about 350k to start 2015, but now just over two years later full-time employment is averaging just 129k. |

Payrolls Est Survey FT, Jan 2010 - 2017 |

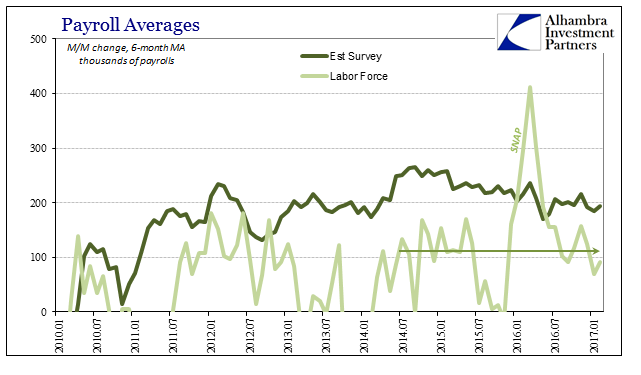

| Apart from the statistical variability with regard to the labor force, including both the late 2015 surge I have little doubt was due to renewed work requirements for food stamp benefits, as well as the population discontinuity sprung on the data last month, labor force growth really hasn’t changed all that much. Given how depressed it has been since the Great “Recession”, it really shouldn’t be this way. |

Payrolls Est Survey LF, Jan 2010 - 2017 |

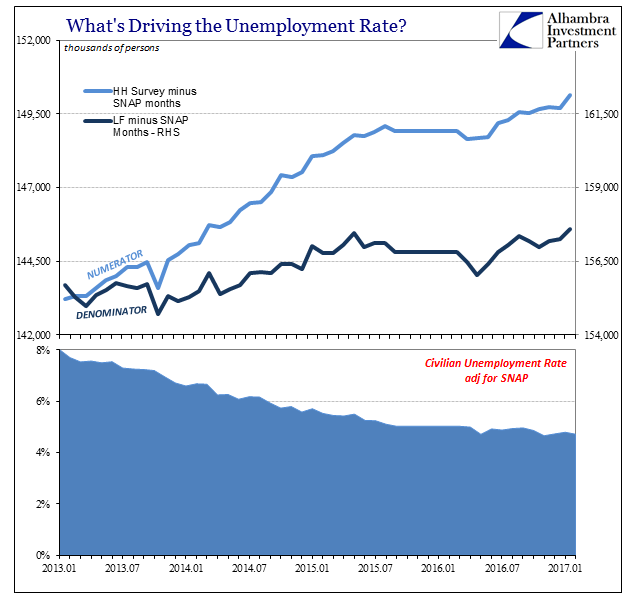

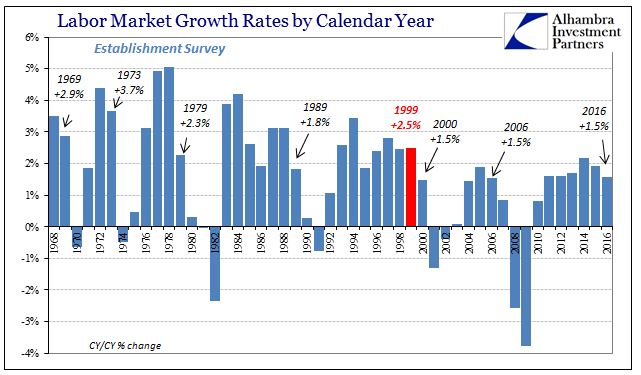

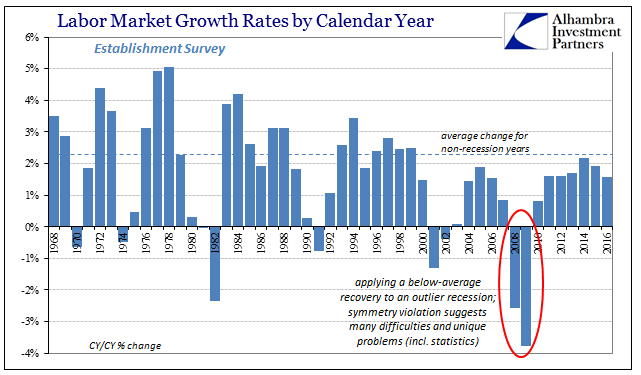

| A good part of the reason the labor market has been so overstated in the narrative (in the statistics is another matter) is that the figures are almost never given context. The headline number is the headline number even though statistically speaking it is the most suspect. Even the six-month average gain fails to properly illustrate the overall weakness in labor beyond just the deceleration of the past few years. In other words, we have to keep in mind from what point that deceleration has occurred. |

Payrolls HH Survey UE Rate, Jan 2013 - 2017 |

| It became fashionable a few years ago to state that the US economy was strong and getting stronger (“overheating” risk) due to the “best jobs market in decades.” While that may have been technically true given the statistics, it was hugely misleading in interpretation because even in 2014 the payroll gains were considerably less than what was achieved in the latter years of the dot-com bubble. |

Payrolls Est Survey Annual, 1968 - 2016 |

| Year-over-year changes in the Establishment Survey show that though 2014 was better than any of the previous fourteen years in terms of the rate of change, it was still appreciably smaller than 1999. The proper way to describe the labor market in 2014 was that it was the best bad year of a decade and a half of only bad years. It didn’t even measure up to average: |

Payrolls Est Survey Annual, 1968 - 2016 |

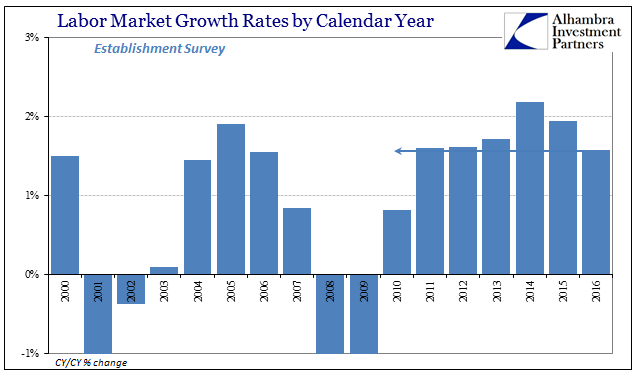

| The deceleration thereafter from such a low “peak” rate leaves the rate of employment growth in 2016 as the lowest since 2010; less than even 2011 and 2012. |

Payrolls Est Survey Annual REcent, 2000 - 2016 |

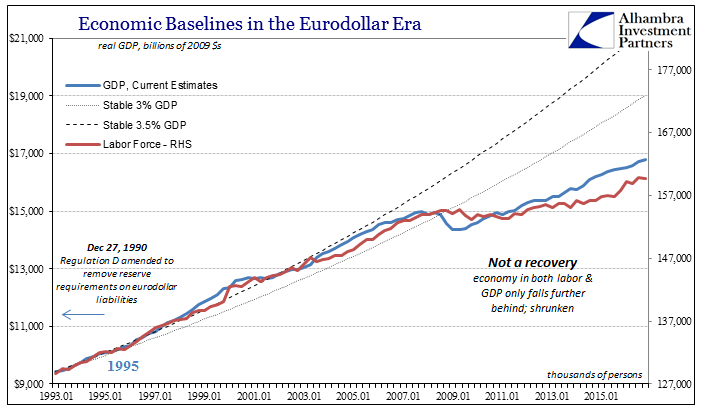

| Since the Establishment Survey results have been some of the most charitable views of the economy, this is a rather different perspective that doesn’t suggest anywhere near “robust” or “strong.” The labor market even in the best light is stuck in varying gradations of insufficient. This is, to put it succinctly, the whole economy of the past decade. |

GDP Baseline Labor Force, Jan 1993 - 2015 |

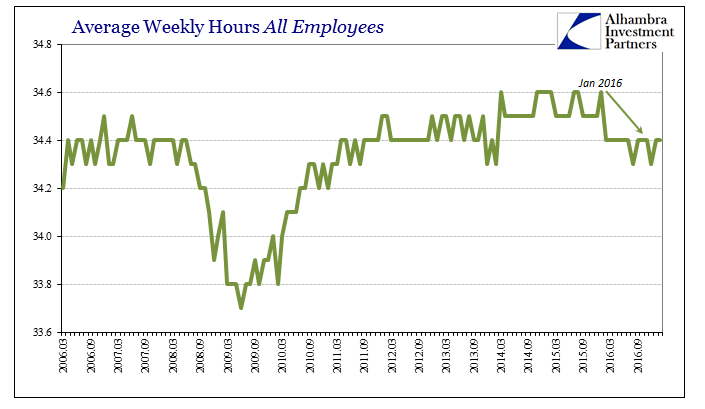

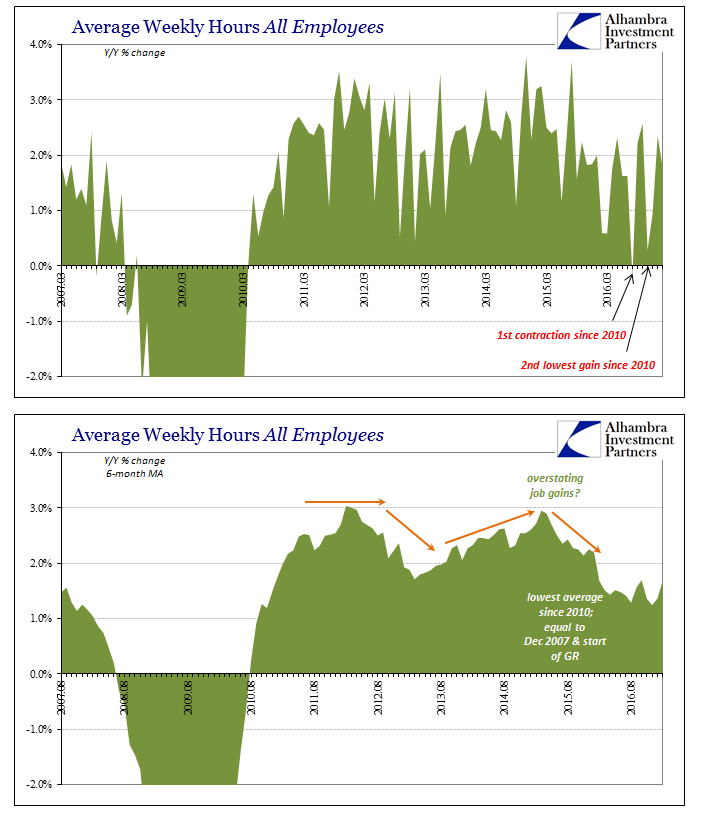

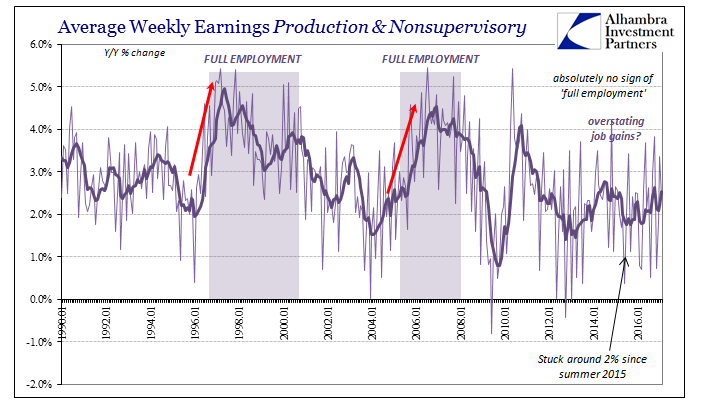

| The rest of the details inside the payroll reports support that contention almost uniformly. From hours to wages, the deceleration as well as the unusually low point from which it started appears in the subsidiary data. |

Payrolls Weekly Hours, March 2006 - September 2016 |

| Since the economy was never great to begin with, that may propose why a break out from still slowing has been so far absent even a year past the recent worst. It would be perfectly normal if businesses in reality, as opposed to how they are described, have been highly cautious after being subjected to these “unexpected” economic conditions. |

Payrolls Weekly Hours Index, March 2007 - 2017 |

| This does not in any way dismiss the possibility of labor market improvement in the coming months, in fact I would be surprised if that didn’t occur at some point (absent further negative pressure). But what it does suggest is that any such upgrade will be the same relative shift (positive numbers, more or less) rather than wholly of another condition. Like “reflation”, at some point jobs are going to need so much more than talk, “rate hikes”, or talk about rate hikes. |

Payrolls Weekly Earings Prod Nonsuper, Jan 1990 - 2016 |

Tags: bls,currencies,depression,economy,employment,establishment survey,Featured,Federal Reserve/Monetary Policy,full-time jobs,hours worked,household survey,jobs,labor force,Markets,newsletter,payrolls,unemployment rate,wages,weekly earnings