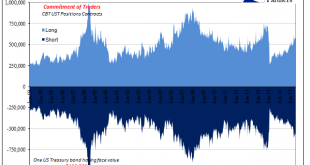

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

Read More »Survey on the use of payment methods in Switzerland

SNB to launch survey on payment methods in 2017 The Swiss National Bank (SNB) is this year conducting a survey on payment methods for the first time. Over the coming months, 2,000 people resident in Switzerland will be asked about their habits regarding the use of payment methods. The aim of the survey is to obtain representative information on the Swiss population’s use of various payment methods and to identify any...

Read More »Swiss banks defy Brexit to recruit in London

Financial service firms in London are preparing for the impact of Brexit. (Keystone) At the same time as big global banks are considering alternatives to London in the wake of the Brexit vote, Swiss newspaper Le Matin Dimanche reports, financial institutions are also recruiting new staff in the City. Rather than in commercial banking, however, these employees specialise in private wealth management. Here “the...

Read More »Bank of England Crushes Sterling

Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day’s low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week’s low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low...

Read More »Popularity of diesel becoming exhausted

Last June in Munich, Greenpeace symbolically showcased a diesel engine in a coffin. (Keystone) After decades of rapid growth, the popularity of diesel vehicles in Switzerland is on the wane following scandals and concerns about environmental impact. The rise of diesel in Switzerland was big and it was fast: accounting for 17.8% of all cars on the road in 2002, last year diesel had more than doubled, to 36.8%, an...

Read More »Emerging Markets: What has Changed

Summary The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates. Brazil President...

Read More »Why We’re So Risk-Averse: “We Can’t Take That Chance”

If our faith in the future and our resilience is near-zero, then we can’t take any chances. You’ve probably noticed how risk-averse Hollywood has become: the big summer movies are all extensions of existing franchises–mixing up the superheroes in new combinations, or remaking hit films from the past–all safe bets. The trend to “playing it safe” is not limited to Hollywood:–we see risk aversion in every sphere of the...

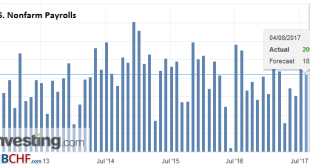

Read More »Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. United States Nonfarm payrolls The 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a...

Read More »Worin die populäre Geldschöpfungskritik irrt – Teil 2

Wie der erste Teil darzulegen versuchte, muss einer Ausweitung der Geldmenge durch Geschäftsbanken zwangsläufig eine Vermehrung der Basisgeldmenge vorausgegangen sein. Ohne eine Entscheidung der Zentralbank, den Geschäftsbanken –vorgängig oder nachträglich – Basisgeld zur Verfügung zu stellen, ist eine jede Geschäftsbank aufgrund der gegenseitigen Konkurrenz untereinander in deren Möglichkeit, Geld zu schöpfen,...

Read More »FX Daily, August 04: Does the Employment Report Matter?

Swiss Franc The Euro has fallen by 0.15% to 1.1475 CHF. EUR/CHF and USD/CHF, August 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are some chunky option strikes that could come into play today. There are 920 mln euros struck at $1.1850 that expire today. There are A$523 mln struck at $0.7950 expiring today. There are $680 mln struck at CAD1.2550 that will be...

Read More » SNB & CHF

SNB & CHF