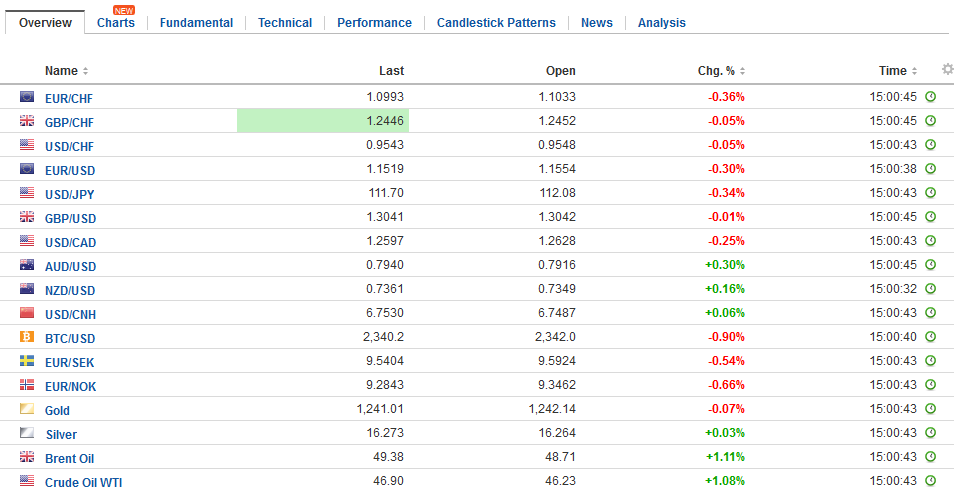

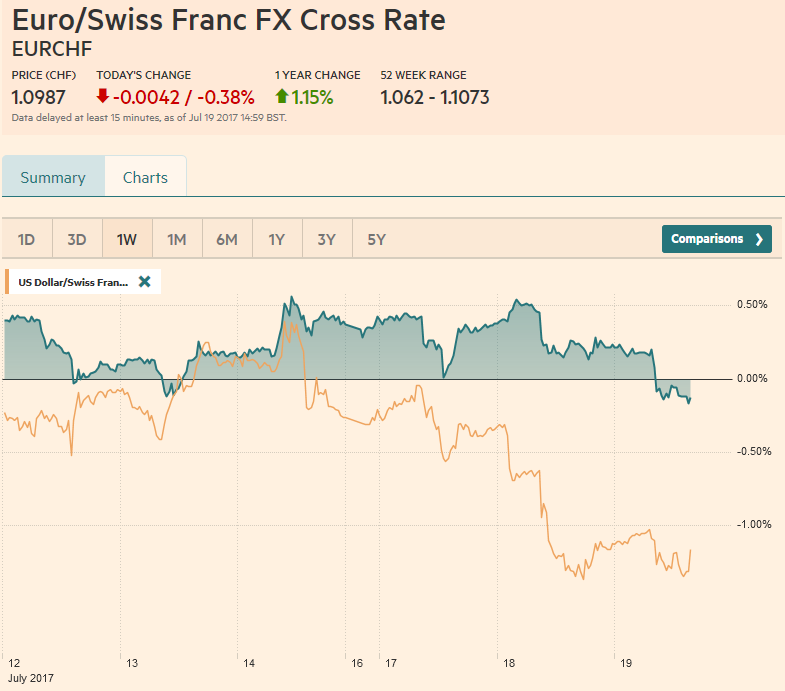

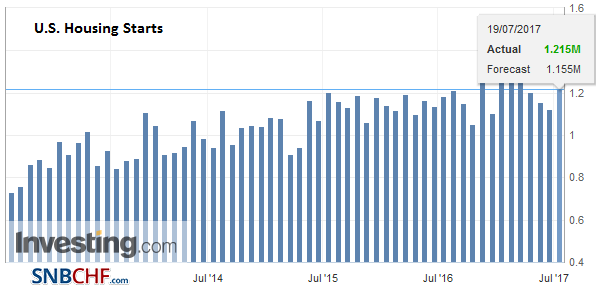

Swiss Franc The Euro has fallen by 0.38% to 1.0987 CHF. EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow’s BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide. The euro reached a 14-month high yesterday just shy of .1585 as it approaches the 2016 high near .1615 and has pulled back today, though remains well within yesterday’s range. There is a 525 mln euro option struck at .16 that expires today. Caution ahead of tomorrow’s ECB meeting, in

Topics:

Marc Chandler considers the following as important: $CNY, AUD, EUR, FX Trends, GBP, JPY, newslettersent, U.S. Housing Starts, USD

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Swiss FrancThe Euro has fallen by 0.38% to 1.0987 CHF. |

EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

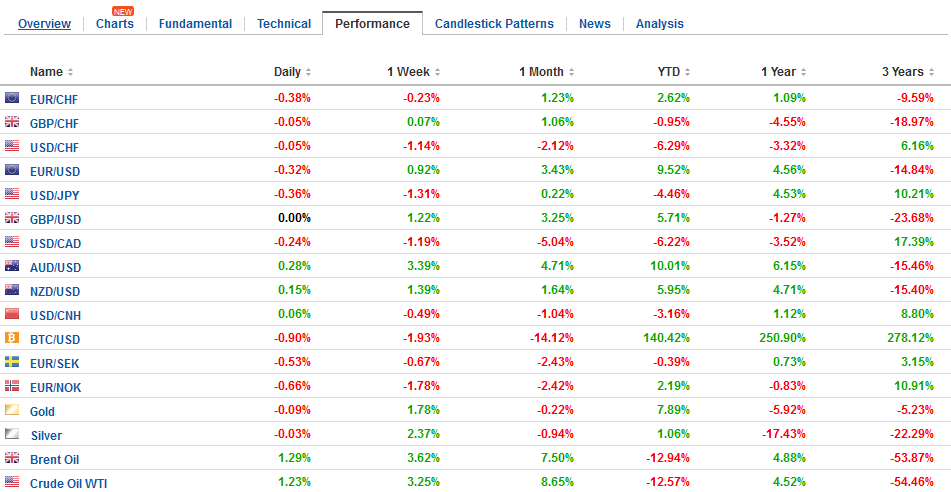

FX RatesAfter being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow’s BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide. The euro reached a 14-month high yesterday just shy of $1.1585 as it approaches the 2016 high near $1.1615 and has pulled back today, though remains well within yesterday’s range. There is a 525 mln euro option struck at $1.16 that expires today. Caution ahead of tomorrow’s ECB meeting, in a light news day, seems to be behind the consolidative tone. A Reuters report quoted an unnamed official suggesting that the ECB wants to keep the asset purchase commitment open-ended. Many, including ourselves, saw the dropping of the commitment to buy more bonds if necessary as part of the housekeeping that would continue to prepare the market for a September announcement indicating an extension of the balance sheet expansion operation, but at a slower pace. If the report weighed on the euro, there was not much of a reaction in the European bond market, where 10-year yields are narrowly mixed (~+/- 0.5 bp). Two-year yields are little changed but mostly slightly firmer. |

FX Daily Rates, July 19 |

| Initial support for the euro is seen near $1.1510 and then $1.1465-$1.1485. Sentiment seems evenly divided between euro bulls, on continued equity flows (valuation) and anticipation that a gradual exit from the unorthodox monetary stance is underway, and dollar bears on a softer policy mix (less Fed tightening and less fiscal accommodation). Our concern is that the market may be exaggerating both sides The ECB’s normalization will be a protracted process, and besides the tweaking of its forward guidance, its balance sheet is still around a year away from peaking, if as we suspect the asset purchases will continue through H1 18. On the US side of the equation, we continue to expect the Fed to allow its balance sheet to begin shrinking in Q4, and we would not rule out a December rate hike.

Doubts over the viability of Trump Administration’s legislative agenda, which includes tax reform, given the mess made of health care reform, is palpable. A backup strategy, reportedly being considered by Republican leadership, that would repeal the Affordable Care Act with a two-year grace period in which time an replacement can be found, does not appear to have majority support. The Senate version of health care reform was largely developed in secret, with no real overtures to the opposition party. This same strategy, it would seem, is being played out with the tax reform, where six men (two from each legislative chamber and two from the White House) are framing it largely in secret. |

FX Performance, July 19 |

United StatesLate yesterday, the US TIC data showed that China increased its Treasury holdings for a fourth consecutive month in May. Essentially, as China’s reserves increase, so does its demand for US Treasuries. We know that China’s reserves rose in June as well and it would not be surprising to see that its Treasury purchases increased as well. China’s Treasury holdings stand at $1.10 trillion, according to US figures. Japan’s holdings edged higher too, and it held on to its top billing with $1.11 trillion of Treasuries. Overall foreign ownership of US Treasuries rose by nearly $50 bln to $6.12 trillion, meaning that Japanese and Chinese investors account for a full third. Central banks account for nearly 3/4 of the foreign ownership of Treasuries. |

U.S. Housing Starts, June 2017U.S. Housing Starts, June 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

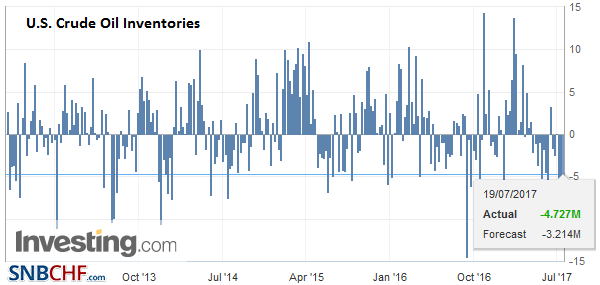

| Oil prices are flat despite the API reporting that US oil inventories unexpectedly rose. The DoE’s estimate is seen to be more robust, and its measure is expected to show a 3.5 mln barrel draw. Meanwhile, iron ore prices continued to rally. In China, it tacked on another 3.5% after rallying 7% over the past two sessions. |

U.S. Crude Oil Inventories, July 19(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

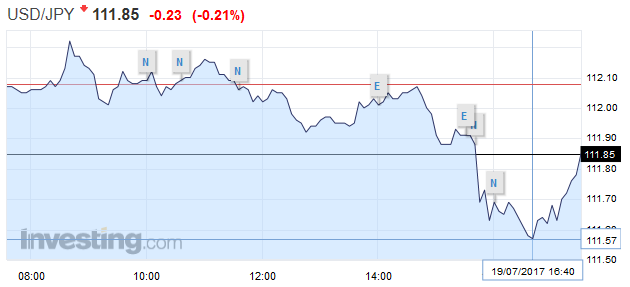

USD/JPYIn May, foreign investors bought $91.9 bln of long-term US assets after buying only $9.7 bln in April. Foreign investors bought $57.3 bln of short-term instruments (e.g., T-bills, swaps, etc.), after buying $74.4 bln in April. The dollar is in narrow ranges against the Japanese yen and continues to straddle the JPY112.00 level. The high in late Asia was just shy of JPY112.25, where there is a $460 mln option struck that expires today. There is another $436 mln struck at JPY112.50. Yesterday’s push to nearly JPY111.65 met the 50% retracement objective of the dollar’s advance since the mid-June FOMC meeting. A break of that area, which seems technically likely, would spur a test on JPY111.00, the 61.8% retracement objective. |

USD/JPY - US Dollar Japanese Yen, July 19(see more posts on USD/JPY, ) |

Japan

The Bank of Japan meeting concludes tomorrow as well. Policy is on hold. It is the last meeting for two board members who have pushed back against elements of Governor Kuroda’s unorthodox course. Kiuchi and Sato will be replaced with Kataoka and Suzuki, who are thought to be supportive of Kuroda, whose term ends next April. Several points are worth making.

First, the power of appointment in Japan, as well as the United States, is how the respective central banks, rather than encroachment on the nominal independence is how Abe and Trump respectively have influence monetary policy. Second, the idea that dissents at the central bank are desirable as a product a robust debate and should lead to better policy that numerous reports of the change in the composition of the BOJ emphasize seems to stand in stark contrast with traditional investor distaste for dissents of central bank decisions. Recall that when some important BOJ decision like the starting of QQE was decided by a 5-4 vote, many were aghast. Third, there may be a difficult balance to strike between group think on the one hand, and the need for strong, decisive signals and actions.

While the BOJ is not likely to change policy, some expect it to trim this year’s inflation forecast from 1.4%, ostensibly due to the drop in oil prices. We suspect the BOJ will not cut it sufficiently to be convincing. Headline and core (excluding fresh food) CPI rose 0.4% in the year through May. While CPI is more likely to be under 1% this year (and under 0.7%), officials may be reluctant to slash forecast so much in fear of undermining the credibility of its forecasts that inflation will gradually pick up and approach the target in FY19.

Separately, we note that Kiuchi and Sato objected to the 2% inflation target, arguing that it was too high for Japan’s circumstances. Similarly, in the US, there was a debate over adopting a formal inflation target. The hawks in 2012 wanted to 1.5% inflation target, but the Fed’s leadership at the time (Bernanke and Yellen) pressed and ultimately got a 2% target. The 2% target has been more or less adopted by many major central banks, but it seems rather arbitrary and takes on a life of its own, not because it is necessarily the best definition of price stability, but because of inertia, credibility and face. The US traditional eschewed a formal inflation target. Greenspan captured the spirit of that earlier approach by defining price stability not as a numerical target but as the level in which various economic actors do not have to take it into account.

Among the other major currencies, sterling and the Canadian dollar are also trading inside yesterday’s ranges, while the Antipodeans have marginally extended their recent gains. Reports suggest that the new capital requirements introduced for Australian banks do not appear particularly onerous and banks led the Australian equity market with a 2.4% gain Meanwhile, Asian equities were happy to follow suit after the US advance, with new record closing highs for the S&P 500 and NASDAQ. The MSCI Asia Pacific Index rose 0.35% and extending its advance for the eighth consecutive session. All regional equity markets rallied except Indonesia.

European bourses are narrowly mixed. The Dow Jones Stoxx 600 is up by about 0.25% near midday in Europe. Information technology and utilities are the strongest sectors, while financials and industrials are laggards. Greek stocks are posting minor gains as is the bond market despite reports suggesting that it is pulling back from its reported bond offering as it awaits clarification from the IMF on its assessment of the sustainability of Greece’s debt.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CNY,$EUR,$JPY,newslettersent,U.S. Housing Starts