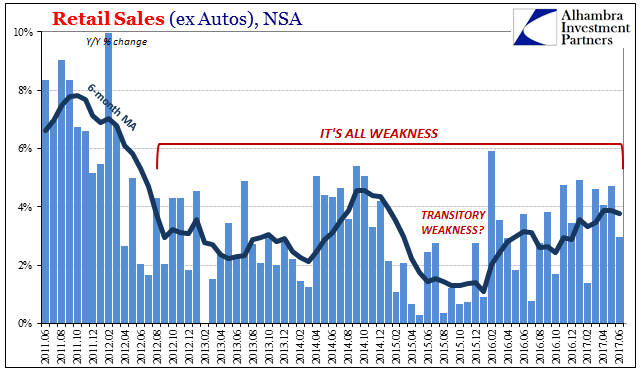

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January. The economy in 2017 is not following up on even the meek promise of late 2016. Unadjusted, retail sales in June 2017 were only 3.24% above retail sales in June 2016. Well more than a year after the (supposed) end of the “rising dollar” downturn, retail sales still display this tendency of being way down too close to the 3%

Topics:

Jeffrey P. Snider considers the following as important: Auto Sales, bond market, bonds, Business cycle, conundrum, currencies, economy, Featured, Federal Reserve/Monetary Policy, gasoline, Janet Yellen, Markets, newsletter, Oil, online sales, Reflation, Retail sales, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

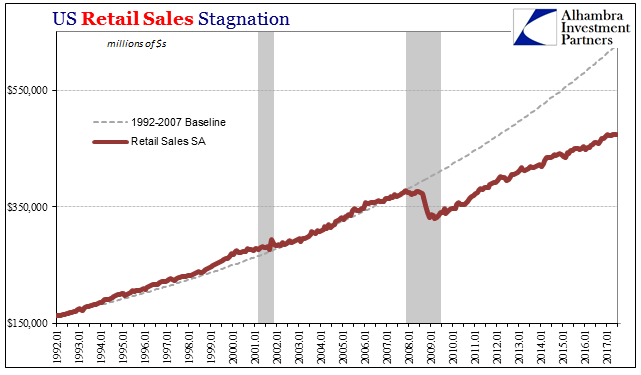

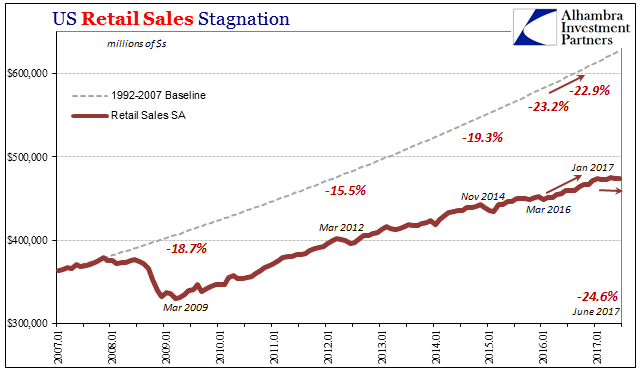

| Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January. The economy in 2017 is not following up on even the meek promise of late 2016.

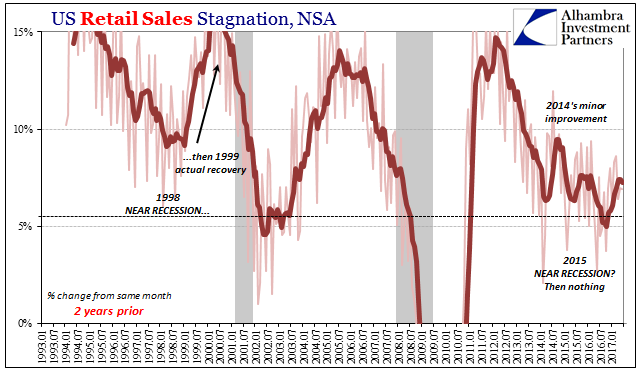

Unadjusted, retail sales in June 2017 were only 3.24% above retail sales in June 2016. Well more than a year after the (supposed) end of the “rising dollar” downturn, retail sales still display this tendency of being way down too close to the 3% recession level. In an actually strong economy, such monthly variation would still be in order but it would go to the high side, an occasional month in double digits. Retail sales can’t even manage to reach 6% once, going back now five years, which used to be a minimum standard for expansion. |

U.S. Retail Sales All Weakness, Jun 2011 - 2017(see more posts on U.S. Retail Sales, ) |

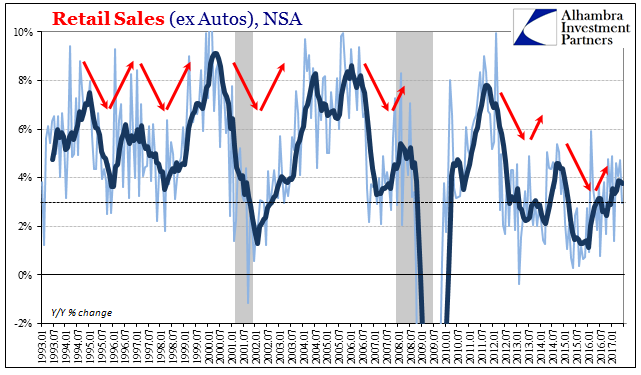

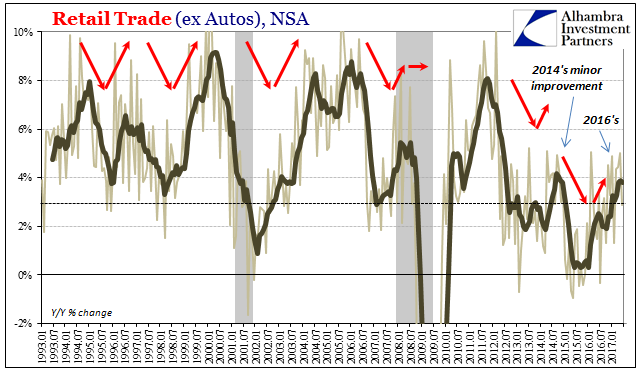

| The lack of acceleration and momentum suggests, as with other economic accounts, this “reflation” or mini-cycle could already be topping out. That it may be doing so right around 2014 levels is the least surprising development; “dollar”, downturn, partial rebound. Rinse. Repeat. |

U.S. Retail Sales ex Autos, Jan 1993 - Jul 2017(see more posts on U.S. Retail Sales, ) |

U.S. Retail Sales Trade ex Autos, Jan 1993 - Jul 2017(see more posts on U.S. Retail Sales, ) |

|

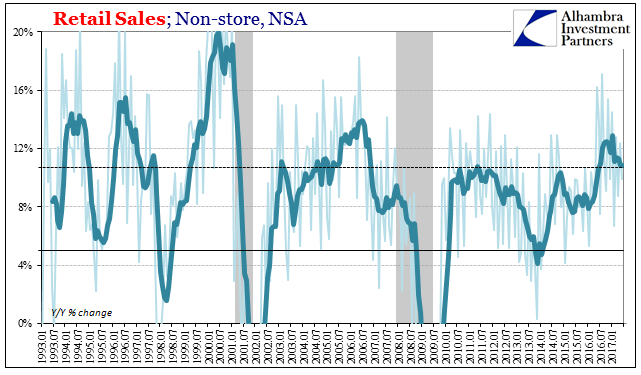

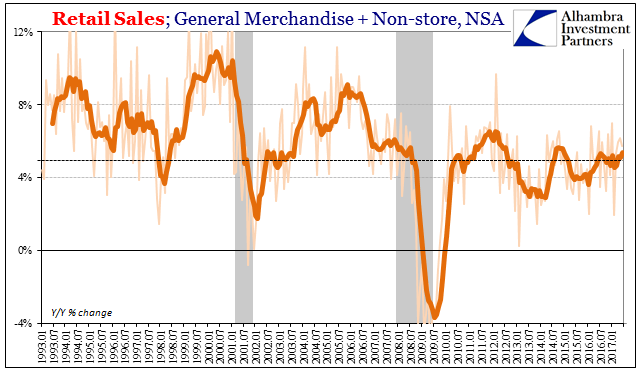

| In what were before genuine areas of strength, there are more and more only questions. The blistering pace of Non-store retail sales has not disappeared entirely, for one, but it has noticeably cooled this year. While still rising at a faster rate than in recent years, mostly online sales aren’t as robust as they were in the second half of 2016. Since those sales were not transferred to another segment, back to “brick and mortar” stores, for example, it has for whatever reason taken back some of the marginal improvement. |

U.S. Retail Sales Nonstore, Jan 1993 - Jul 2017(see more posts on U.S. Retail Sales, ) |

U.S. Retail Sales General Merchandise plus Non-store, Jan 1993 - Jul 2017(see more posts on U.S. Retail Sales, ) |

|

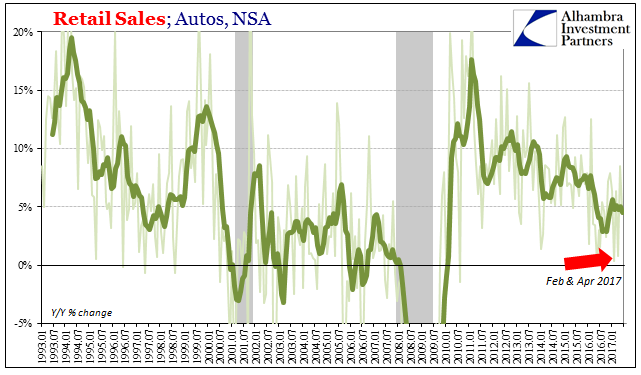

| One clear area of remaining weakness is sales of the big ticket auto. In the format of retail sales, autos sales continue to be depressed in a clear difference with consumer behavior in 2014. Though sales were revised substantially higher for May, in June the growth rate was just 4.8%, leaving the 6-month average at 4.5%. Given the state of inventories, that’s not close to enough to stave off greater production adjustments. |

U.S. Retail Sales Autos, Jan 1993 - Jul 2017(see more posts on U.S. Retail Sales, ) |

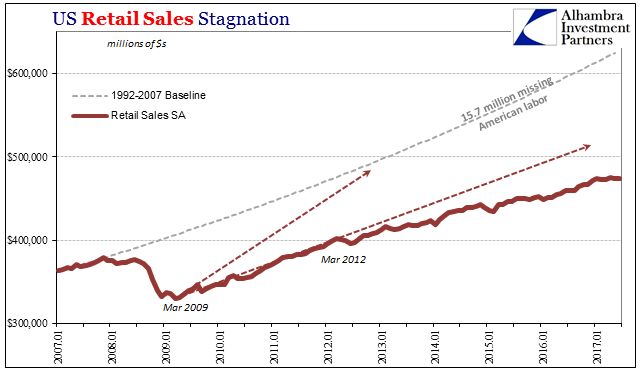

| The overall result of this ongoing, persistent weakness is for consumer spending to remain in non-linear contraction. A global economy that really requires at minimum 6% growth from US consumers is going to be in trouble where best in these mini-cycles it can get up to an average of maybe 4%. It’s not nearly enough expansion on its own, let alone to make up for lost time at regularly lower levels. |

U.S. Retail Sales Stagnation, Jan 1993 - Jul 2017(see more posts on U.S. Retail Sales, ) |

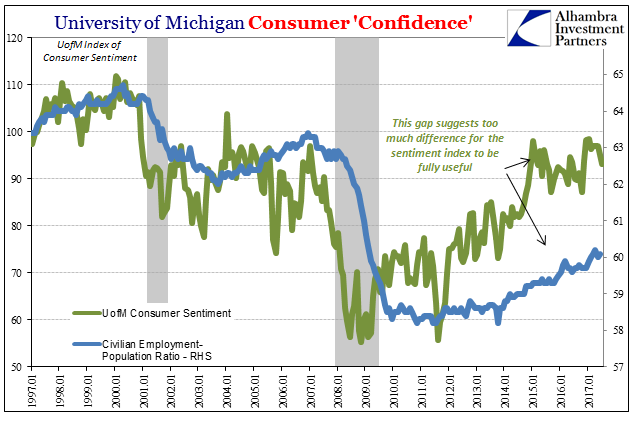

| It betrays, of course, mainstream theory about sentiment and psychology. Economists believe that happy consumers are spendy consumers. While that may be the case at times, it is clearly not always so and unfortunately we appear to be living out a contrary example. Consumer sentiment, as business sentiment, remains quite high but unjustified by levels of economic activity; especially here of consumers in retail sales. |

U.S. Retail Sales UofM Consumer Confidence, Jan 1997 - Jul 2017(see more posts on U.S. Consumer Confidence, U.S. Retail Sales, ) |

| I truly shudder to think what this disparity could potentially mean – that Americans are, at least in the narrow context of UofM’s survey, becoming comfortable, even happy, with a world without actual growth. If confidence has legitimately achieved levels consistent with the middle 2000’s, but actual spending and economic growth remain far, far less, there aren’t too many other conclusions to draw.

One is, however, somewhat predicated on dissonance. It is a mutation of what used to be called “recession fatigue.” In other words, this unacceptable economic state has dragged on for so long that people have come to believe it just has to end in the near future, because there is no way for it to go on and on and on. There is in our experience nothing that would prepare people for a permanent alteration in the economic trajectory, especially given the input from economists and policymakers who both claim such a thing impossible as well as for so many years now that the economy was already in, or very close to, full recovery. |

U.S. Retail Sales SA Long, Jan 1992 - Jul 2017(see more posts on U.S. Retail Sales, ) |

U.S. Retail Sales SA Gap, Jan 2007 - Jul 2017(see more posts on U.S. Retail Sales, ) |

|

U.S. Retail Sales SA Missing, Jan 2007 - Jul 2017(see more posts on U.S. Retail Sales, ) |

|

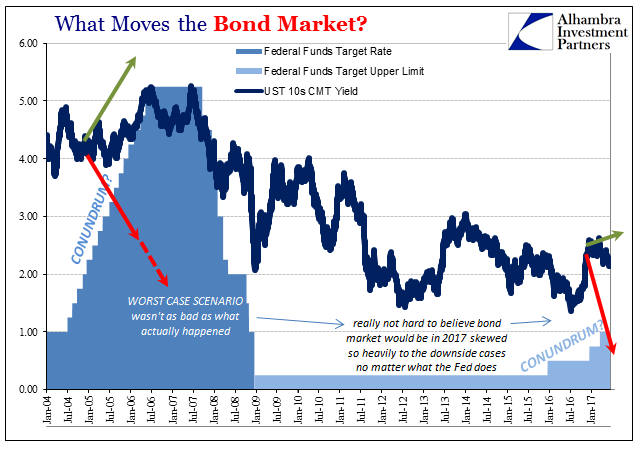

| You can’t blame the average American for thinking this way, even though they know they go to the mall more infrequently and don’t spend as freely as they once did (in what seems like a lifetime ago). Yet, that is the situation which we are all confronted with – the depressing permanence of no-growth, because that is what this is. The economy shrunk in 2008-09 in what was not a recession, and due to further, occasional (monetary) interference it continues to shrink (non-linear).

If monetary policy in QE or anything else can score a victory, it may be in confidence alone. Obviously, it is at best a hollow one, and at worst quite dangerous. What happens when Americans who still think there is going to be recovery find out there isn’t, and more than that policymakers changed their minds on that very idea more than a year ago? The fact that Janet Yellen and the FOMC are, while they are “raising rates”, quite reluctant to state as much openly and explicitly suggests already an answer. There is no conundrum. Risks are rising again, not rates. |

U.S. Conundrum Spectrum, Jan 2004 - Jul 2017 |

Tags: Auto Sales,bond market,Bonds,Business Cycle,conundrum,currencies,economy,Featured,Federal Reserve/Monetary Policy,gasoline,Janet Yellen,Markets,newsletter,OIL,online sales,Reflation,Retail sales