Around 180 poultry companies in the Netherlands have been temporarily closed, and some firms have culled their flock, after traces of insecticide fipronil were found in eggs in Belgium and the Netherlands last month (Keystone) The discount supermarket chain Aldi Switzerland is withdrawing all imported eggs from sale at its 190 stores as a precaution, it said on Friday, as a scare over possible insecticide contamination...

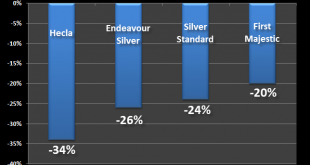

Read More »Silver Mining Production Plummets 27 percent At Top Four Silver Miners

Silver Mining Production Plummets 27% At Top Four Silver Miners by SRSRocco Report In an interesting change of events, production at four of the top primary silver miners plummeted during the second quarter of 2017. This goes well beyond normal fluctuations in mining companies production figures during different quarterly reporting periods. The company with the least percentage decline in silver production still...

Read More »China Exports, China Imports: Textbook

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand. According to China’s National Bureau of Statistics, however, exports in June rose by...

Read More »Number of ‘near miss’ plane incidents double

Switzerland’s transport safety authority reports an increase in serious violations of air safety regulations that could have potentially led to collisions. Small planes with incompatible warning systems were one of the reasons behind the increase in incidents (Keystone) According the 2016 annual report of the Swiss Transportation Safety Investigation Board released end of July, the number of aviation incidents...

Read More »Is Another Oil Head-Fake Brewing?

The dramatic declines in the costs of oil production will be boosting supply at the very moment that demand is falling. Over the past decade I’ve addressed what I call Head-Fakes in the cost of oil/fossil fuel: even though we know the cost of extracting and processing oil will rise over time as the easy-to-get oil is depleted, oil occasionally plummets to such low prices that we’re fooled into thinking it will remain...

Read More »Can Switzerland Survive Today’s Assault On Cash And Sound Money?

Authored by Marcia Christoff-Kurapovna via The Mises Institute, “Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world...

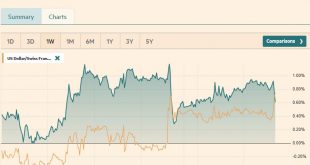

Read More »FX Daily, August 08: Trade Featured as Dollar Drifts Lower

Swiss Franc The euro has depreciated by 0.17 to 1.1451 CHF. EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended...

Read More »Bitcoin Forked – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Fork in the Cryptographic Road So bitcoin forked. You did not know this. Well, if you’re saving in gold perhaps not. If you’re betting in the crypto-coin casino, you knew it, bet on it, and now we assume are happily diving into your greater quantity of dollars after the fork. You don’t have a greater quantity of...

Read More »CEO of Monetary Metals-Keith Weiner talks about bitcoin and why the current monetary system is…

Is bitcoin money? Keith Weiner discusses why gold is crucial in an economy and that bitcoin isn’t money. Keith also discusses why the system if failing today. His view of why the system is failing is much different than the mainstream view. You don’t want to miss this insightful interview with Keith Weiner!

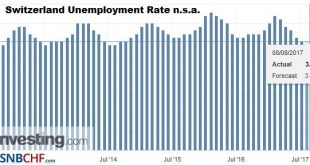

Read More »Switzerland Unemployment in July 2017: Remained unchanged at 3.2 percent seasonally adjusted

Unemployment Rate (not seasonally adjusted) Registered unemployment in July 2017 – According to the SECO, at the end of July 2017, 133,926 unemployed persons were registered with the regional employment services centers (RAVs), 323 more than in the previous month. The unemployment rate remained at 3.0% in the reporting month. Compared to the previous month, unemployment fell by 5’384 persons (-3.9%). Switzerland...

Read More » SNB & CHF

SNB & CHF