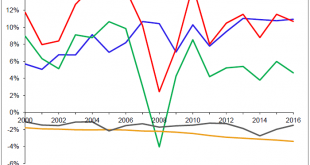

Introduction Being a small open economy Switzerland is highly exposed to the girations of the world economy, both through international trade and financial flows. The country’s trade surplus for instance accounted for nearly half the GDP growth between 2000 and 2007.2 While the growth contribution from trade has slowed during the global crisis, the linkages with the world economy remain important for Switzerland. This...

Read More »Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

Read More »This Is Why Shrinkflation Is Impacting Your Financial Wellbeing

– Shrinkflation has hit 2,500 products in five years– Not just chocolate bars that are shrinking– Toilet rolls, coffee, fruit juice and many other goods– Effects of shrinkflation been seen for “good number of years” – Consumer Association of Ireland– Shrinkflation is stealth inflation, form of financial fraud– Punishes vulnerable working and middle classes– Gold is hedge against inflation and shrinkflation Editor: Mark...

Read More »13 April 2017 Charles Hugh Smith sheds interesting light upon cause of the retail apocalyp

While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has been...

Read More »FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

Swiss Franc The Euro has fallen by 0.10% to 1.1496 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US...

Read More »Cool Video: Dollar Drivers on Bloomberg

I had the privilege to be at Bloomberg today and discussed with Vonnie Quin and Mark Barton. A clip to the Cool Video can be found here. There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh...

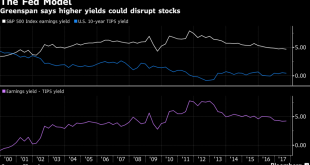

Read More »Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

Read More »Winning: U.S. Crushes All Other Countries In Latest Obesity Study

When President Trump promised last fall that under a Trump administration America would “would win so much you’ll get tired of winning,” we suspect this is not what he had in mind. According to the latest international obesity study from the Organization For Economic Co-operation and Development (OECD), America is by far the fattest nation in the world with just over 38% of the adult population considered ‘obese.’ Here...

Read More »Views From the Top of the Skyscraper Index

Views From the Top of the Skyscraper Index On a warm Friday Los Angeles morning in spring of 2016, we found ourselves standing at the busy corner of Wilshire Boulevard and South Figueroa Street. We were walking back to our office following a client wire brushing for events beyond our control. But we had other thoughts on our mind. Standing amid a mob of pedestrians, we gazed up at the skeleton frame of what would...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: - Click to enlarge Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding...

Read More » SNB & CHF

SNB & CHF