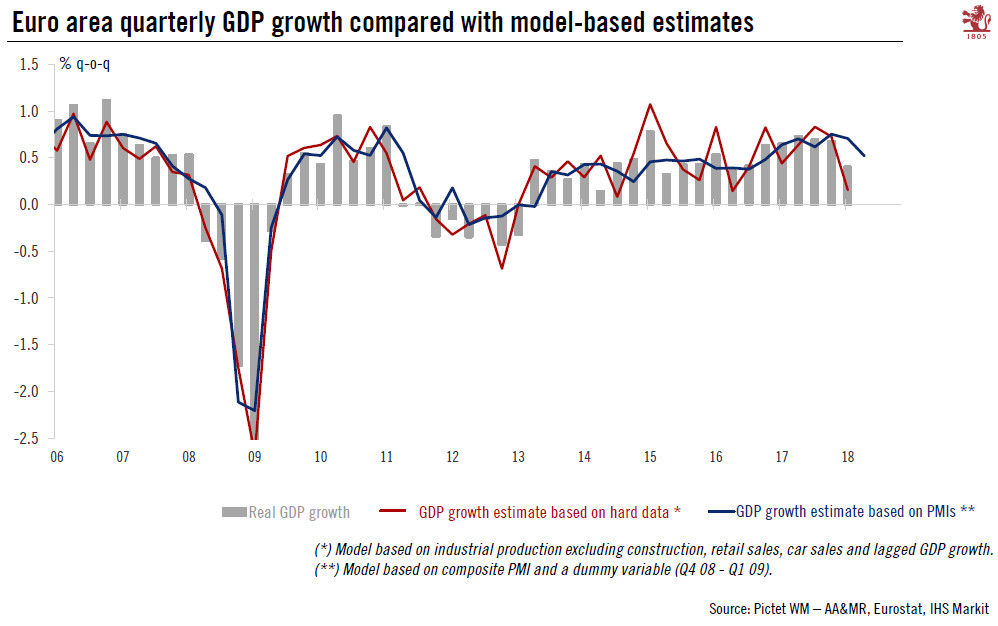

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.The deterioration in business sentiment in France and Germany was likely amplified by transitory factors once again. Outside the two largest euro area countries, activity rebounded to a three-month high.The euro area composite PMI remains consistent with 0.4-0.5% q-o-q

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB quantitative easing, euro area growth, Euro area PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.

The deterioration in business sentiment in France and Germany was likely amplified by transitory factors once again. Outside the two largest euro area countries, activity rebounded to a three-month high.

The euro area composite PMI remains consistent with 0.4-0.5% q-o-q growth in Q2, only marginally lower than ECB staff projections. However, downside risks are rising and the ECB is likely to wait until July before it makes a decision on QE.

The timing of the next ECB announcement is no longer the main question, in our view: we expect a decision on QE to be postponed to the 26 July meeting as the ECB waits for additional data to reassess the situation. In the meantime, weaker growth will likely fuel speculation over the ECB’s contingency plans, including the possibility of a longer QE extension aimed at influencing rate hike expectations. We are not there yet, but the risks are rising.