huobipro注册地址: https://www.huobi.pro/en-us/topic/m_register/?inviter_id=11265570

Read More »Europe chart of the week – Italy’s fiscal buffers

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis.The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction targets, although at this stage we still expect negotiations to result in...

Read More »Eurosceptic Italian government faces a reality check

With the putative M5S-League government publishing its final common programme, we take a look at the road ahead for the Italian economy and for Italian government debt.We expect negative noise surrounding the Italian budget to intensify initially, but believe that negotiations with Brussels will result in compromises eventually, including dilution of the incoming Italian government’s fiscal easing measures. The biggest risks lie with the proposed rolling-back of the pension reforms, in our...

Read More »Italian bonds and politics take centre stage

The CIO office’s view of the week ahead.Dear readers,A public holiday in Geneva on Monday means we are sending the Weekly View today instead.This week has seen some unsettling events, including a rise in oil prices and Italian political developments. Brent crude rose above USD 80 / bbl, a four-year peak, largely on fears about a fall in Iranian oil exports following the US’s withdrawal from the nuclear deal and sharp disruption to Venezuelan oil supply. US production has been increasing, but...

Read More »NAFTA update – Talks stalled

NAFTA talks look likely to drag on, taking a backseat to US trade talks with China. At the end of the day, any re-negotiated treaty might include only relatively small changes.It is looking like House Speaker Paul Ryan’s deadline to have a final North American Free Trade Agreement (NAFTA) deal on his table, set for 17 May 2018 will not be met. This deadline was to meant to ensure that a new NAFTA deal could be approved during Congress’s ‘lame duck’ session -between the midterm elections in...

Read More »Contraction in Japanese economy will likely be temporary

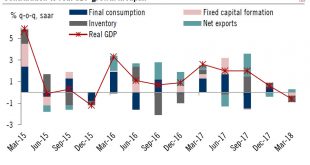

Weather factors may largely explain the negative GDP number in Q1. But we expect growth to pick up for the rest of the year.The preliminary report of Japanese GDP for Q1 2018 came in below expectations, showing contraction of 0.2% from the previous quarter (0.6% annualised).The slowdown in growth was broad based across most subindices of the GDP report, but was especially noticeable in internal demand (both consumption and investment). External demand also showed some softness, with net...

Read More »US chart of the week—Capex conundrum

While we still believe an increase in capex will contribute significantly to US growth this year, hard data remains uneven.Our 2018 US growth scenario of 3.0% GDP growth in the US is premised on solid non-residential investment growth of 7.0% – itself based on: (1) the positive business environement post tax cuts; (2) strong global growth; and (3) tighter domestic resource and capacity utilisation.In Q1, US investment was up 6.1% y-o-y, down from 6.3% in full-year 2017. So we need US capital...

Read More »Inflation print saves a difficult week

The CIO office’s view of the week ahead.Weaker-than-expected core US inflation in April helped equities last week. When one remembers that fears of rising inflation, especially wage inflation, were behind the spike in bond yields and then in equity market volatility earlier this year, one understands why the latest data were greeted positively by markets. Successful auctions for 10-year and 30-year Treasuries last week helped too. Overall, subdued inflation in the US and a relaxation of bond...

Read More »Building a smart and equitable city

When Bill de Blasio was elected New York’s mayor in 2013, he launched the Mayor’s Office of Technology and Innovation to raise the quality of the city’s infrastructure, education system and workforce for the digital era.The Office’s mission statement was to deploy digital technologies to improve the city’s services, but also to use them to develop its economy and create more opportunities for all New Yorkers. One of its first tasks was introducing free-of-charge kindergartens for all...

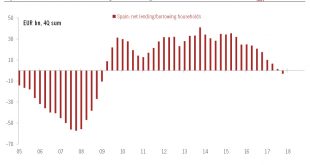

Read More »Spaniards back in the mood to borrow

After years of frugality, Spanish households are re-leveraging again.Before the financial crisis, the real estate bubble and the parallel growth in borrowing meant that the indebtedness of Spanish households spiralled ever higher, reaching a peak of 84.7% of GDP in Q2 2010. Since then, Spanish’s households have tightened their belt, with indebtedness falling to 61.3% of GDP in Q4 2017.However, recent data suggest that the situation might be changing again. Indeed, in 2017, households...

Read More » Perspectives Pictet

Perspectives Pictet