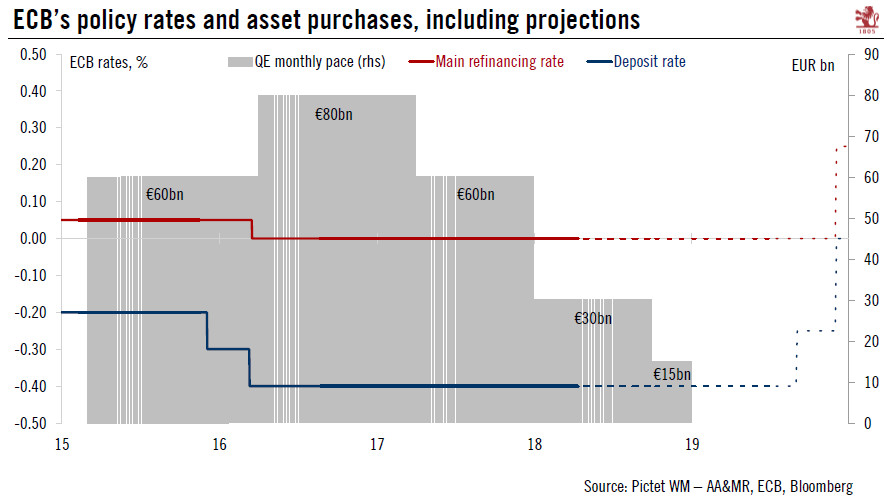

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled out, albeit at a slower pace, in order to postpone rate hike expectations.If those risks were to materialise, we would expect the ECB to announce a six-month QE extension at a EUR15bn pace, using the programme’s flexibility in order to reduce the share of central government purchases.The ECB’s QE exit and tightening cycle should see the 10-year

Topics:

Frederik Ducrozet and Laureline Chatelain considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.

Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.

Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled out, albeit at a slower pace, in order to postpone rate hike expectations.

If those risks were to materialise, we would expect the ECB to announce a six-month QE extension at a EUR15bn pace, using the programme’s flexibility in order to reduce the share of central government purchases.

The ECB’s QE exit and tightening cycle should see the 10-year German Bund yield rise to 0.90% by the end of 2018 in our central scenario. However, if the ECB were to extend QE for longer, we would revise our year-end target to 0.50%.