Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months.Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.The services PMI declined to 54.4, but this followed a 1.4 points jump...

Read More »Weekly View – why isn’t Trump happy?

The CIO office’s view of the week ahead.After recent criticism of the Fed from Donald Trump’s top economic advisor, Larry Kudlow, last week the US president himself said that he was “not happy” about the Fed’s rate-hiking campaign. Traditionally, US presidents have refrained from commenting on Fed decisions as a way of affirming the central bank’s independence, but these apparently casual remarks increase the suspicion that the political heat on the US central bank is being cranked up.And...

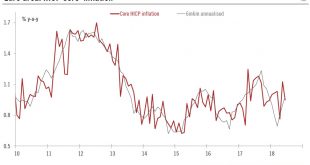

Read More »Services dent euro area core inflation in June, but no reason to panic

We expect core inflation to rise gradually later this year.The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The...

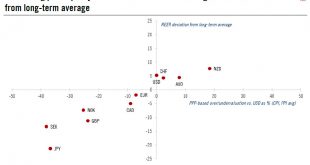

Read More »Swiss franc’s defensive features likely to come back into fashion

Trade tensions and heavy short positioning should pave the way for appreciation against the US dollar.The Swiss franc has been relatively weak since the end of June (depreciating 1.3% vs USD) despite increasing trade tensions. Yet the defensive feature of the Swiss currency, stemming from a structurally large current account surplus and elevated stock of foreign assets (i.e. its net international investment position), favour some appreciation of the franc.For the moment, as highlighted by...

Read More »China dominates many US supply chains

The US consumer may end up being subject to a de facto ‘tax’ as the scope for finding alternative suppliers is limited.Last week, the Trump administration said it would add USD200 billion of Chinese imports to its tariff net, possibly taking effect as soon as September. These tariffs come on top of the tariffs on USD50 billion of Chinese goods already announced (of which USD34 billion already kicked in early July). By way of comparison, the US imported USD506 billion worth of merchandise...

Read More »Chinese growth moderates as expected

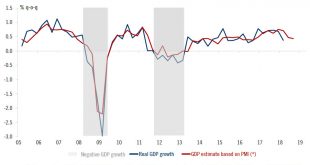

We expect the authorities to adapt fiscal and monetary policies to deal with downward risks to growth prospects.Chinese GDP for Q2 came in at Rmb22.0 trillion (about USD3.4 trillion), rising 6.7% year-over-year (y-o-y) in real terms. This represents a moderate deceleration from Q1 (6.8% y-o-y), largely in line with our expectations (see chart). For the first two quarters of the year as a whole, the economy expanded by 6.8% compared to the same period last year.The data show that China’s...

Read More »Powell provides some clues to Fed thinking

Alongside clear signals that policy rates will continue to rise in the near term were some dovish hints about policy further down the road.Chairman Jerome Powell’s congressional testimony on 17 July contained limited new information about the Federal Reserve’s monetary policy intentions. Conveying the impression that he maintained a steady hand on the tiller, Powell seemed unfazed by the recent escalation in trade. Instead, Powell remained positive about the global economy. He also...

Read More »What will the rest of the year bring?

Download issue:English /Français /Deutsch /Español /ItalianoRisk assets have disappointed this year and global equities were trendless, but as long as fundamentals can re-assert themselves, there could still be some life in risk markets.Global equities were trendless and the overall performance of risk assets lacklustre in the first half of 2018. But while trade tensions have been causing jitters and could continue to do so in the short term, as long as fundamentals are able to re-assert...

Read More »Weekly View – opposing forces

The CIO office’s view of the week ahead.A new list of US tariffs was unveiled last week. These tariffs, which could be implemented in September, will undoubtedly trigger countermeasures by the Chinese. But markets chose to look past these tensions to a US economy that still appears robust. Consumer and corporate confidence remain high and Q2 GDP growth is likely to be in the vicinity of 4%. In spite of an increasingly tight labour market, underlying inflation remains tame, while the US...

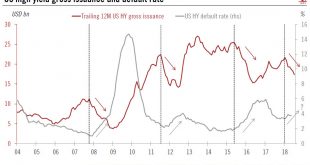

Read More »US high yield is looking suspect

Unlike its euro counterpart, spreads on US high yield have held in well this year so far. However, with the default rate stalling and trade tensions rising, we think this could change.US high yield (HY) is one of the few segments in the fixed income space that has posted a positive total return since the beginning of the year. Thanks to lower duration, US HY has so far suffered less from the surge in US Treasury yields than its investment-grade counterpart. Moreover, some index-heavy sectors...

Read More » Perspectives Pictet

Perspectives Pictet