Macroview In 2016, we forecast global economic growth of 3.3%, slightly better than in 2015. This will be a ‘goldilocks’ environment (not too hot, not too cold), that allows continued supportive monetary policy. Macroeconomy US real GDP growth will be above potential at 2.5% (against potential growth of 1.8%), but with an absence of momentum. Growth will be driven by domestic demand. Euro area growth will accelerate modestly, to 1.8%, from an estimated 1.5% in 2015. Domestic demand is picking up — particularly in the periphery — supported by credit growth, which has turned positive and will reach about 2%. The euro area could deliver a positive surprise. In Japan, Abenomics is having only mixed success and a major take-off is not in prospect. Inflation and real economic growth will remain subdued. Emerging economies are in a delicate transition phase, as they need to switch their economic model from exports towards domestic demand, and a number of large economies are struggling: Brazil, for example, will remain in recession. However, there are some bright spots: India is picking up. Growth in China should stabilise at around 6.7%, supported by the authorities’ stop/go policies. In the ongoing debate about risks of inflation vs deflation, we are in the deflationist camp, in that we think economic trends point to deflation if left to their own devices.

Topics:

Christophe Donay considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

In 2016, we forecast global economic growth of 3.3%, slightly better than in 2015. This will be a ‘goldilocks’ environment (not too hot, not too cold), that allows continued supportive monetary policy.

Macroeconomy

- US real GDP growth will be above potential at 2.5% (against potential growth of 1.8%), but with an absence of momentum. Growth will be driven by domestic demand.

- Euro area growth will accelerate modestly, to 1.8%, from an estimated 1.5% in 2015. Domestic demand is picking up — particularly in the periphery — supported by credit growth, which has turned positive and will reach about 2%. The euro area could deliver a positive surprise.

- In Japan, Abenomics is having only mixed success and a major take-off is not in prospect. Inflation and real economic growth will remain subdued.

- Emerging economies are in a delicate transition phase, as they need to switch their economic model from exports towards domestic demand, and a number of large economies are struggling: Brazil, for example, will remain in recession. However, there are some bright spots: India is picking up.

- Growth in China should stabilise at around 6.7%, supported by the authorities’ stop/go policies.

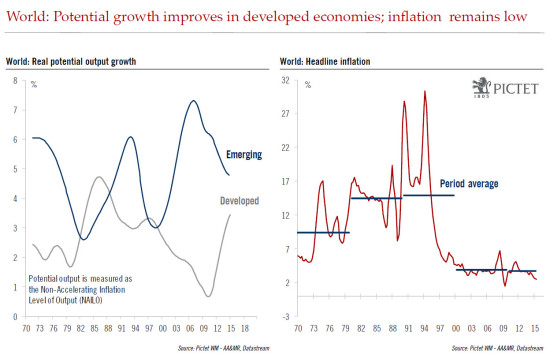

- In the ongoing debate about risks of inflation vs deflation, we are in the deflationist camp, in that we think economic trends point to deflation if left to their own devices. Inflationary pressures should remain very muted (raw materials prices, wage growth in developed economies).

- In a longer-term horizon, we think there is potential for a radical innovation shock to boost growth, contrary to concerns that developed economies may be facing secular stagnation.

Markets and asset classes

Developed markets (DM) equities:

- Profits have recovered, thanks to corporate restructuring and innovation improving enterprise efficiency.

- However, with momentum slightly negative, we expect earnings growth for the US and Europe blue chips of less than 7% in 2016.

- Only around 1/3 of continued downwards revisions to earnings projections is the result of the fall in the oil price — the rest is spread across sectors.

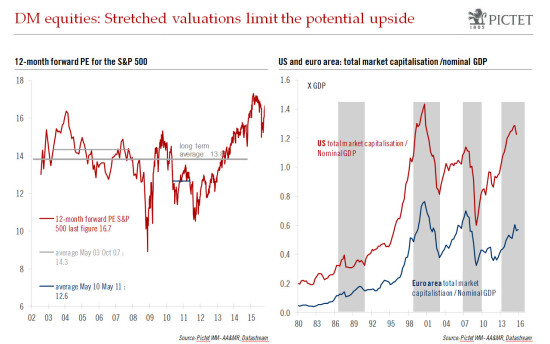

- Valuations are above historical averages and appear slightly excessive. Further expansion of valuations multiples will be difficult in the absence of economic momentum and a turnaround in earnings projections, and given tightening monetary policy in the US.

- Returns potential for DM equity markets in 2016 appears limited to around 7-10% (incl. dividends).

- European stocks are likely to outperform the US, given improving euro area growth and ECB QE.

- Volatility will be higher, with a standard volatility regime punctuated by spikes, owing to Fed tightening and the desynchronisation of central bank policies.

- Absence of momentum demands a tactical asset allocation, to play volatility peaks.

- Value stocks (mainly European cyclicals) could be considered as a tactical play. A stock-picking approach is required to play visible growth – stocks that benefit from revenue expansion, solid profitability and good visibility. Companies linked to innovation also are also likely to be appealing.

Emerging market (EM) equities:

- The transition phase in emerging markets will mean high volatility in EM equities. Moreover, the micro environment is lacklustre, with EM earnings growth in single digits. From a strategic perspective, the risk-reward balance for EM equities seems unfavourable.

- However, with valuations low, in the event that pressures in certain countries temporarily abate, a rebound cannot be ruled out.

- Yields on core long-term sovereign bonds are likely to rise slightly as US monetary policy tightens, but well anchored inflation anticipations will limit the rise in long-term interest rates to 0.8% for German Bunds and 2.7% for 10-year US Treasuries. Shorter-term rates will also rise as the yield curve flattens.

- ECB QE will help long-term interest rates in the euro area periphery converge towards those of the core.

- EM bonds should offer attractive yields, but downside risks to EM currencies exist. As a result, EM debt in hard currency rather than local currencies could be considered as safer.

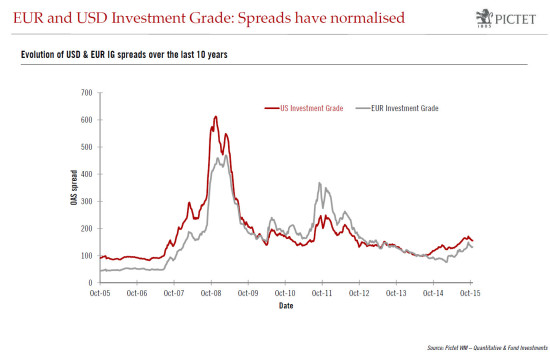

- Widening spreads on US high-yield corporate bonds may present an opportunity, but there are liquidity and default risks. The asset class could look attractive, with returns of around 7.5%.

- Investment-grade corporate bonds are less risky than high-yield, but the yield is much less rewarding.

Key summary for asset allocation and investment strategy

Expected returns for 2016 are roughly in line with expected returns for the long-term, or around a nominal total of around 4% for a balanced portfolio. The absence of momentum and elevated volatility means a key role for an active tactical asset allocation and stock-picking.