Macroview Tactical trading hedge funds are known for their long term decorrelation with traditional assets. After a news-heavy year so far, markets are gearing up for further volatility. Increased uncertainty and volatility offers opportunities for tactical traders, providing a differentiated source of returns. It has been a bumpy start to 2016. Amid sharp sell-offs on financial markets, it may seem that there is no place to hide. However, certain hedge fund managers think otherwise. For...

Read More »Equities: A change of regime

[unable to retrieve full-text content]Equities: A change of regime Equities markets had an unusually turbulent start to the year. What should investors expect next, on both tactical and strategic horizons?

Read More »Equities: A change of regime

Equities markets had an unusually turbulent start to the year. Christophe Donay, Chief Strategist at Pictet Wealth Management, explains what investors should expect next, on both tactical and strategic horizons.

Read More »United States: not such a weak job report

January’s employment report showed soft job gains. However, this was above all a statistical payback. Unemployment dropped, wage increases were higher than expected and the average workweek inched up. The overall situation remains healthy in the US labour market. Non-farm payroll employment rose by a soft 151,000 m-o-m in January, below consensus expectations (190,000). December’s figure was revised down (from 292,000 to 262,000), but November’s number was revised up (from 252,000 to...

Read More »Euro area: good and bad reasons to worry about the euro area outlook

With downside risks to the euro area outlook intensifying in recent weeks, we expect the ECB to respond by easing monetary conditions further. We leave our 1.8% growth expectation for 2016, largely based on improving prospects for domestic demand. Although we have left our forecasts for euro area GDP unchanged – 1.8% growth expected in 2016, well above trend – downside risks have intensified in recent weeks. There are both good and bad reasons to worry about the recovery but, in short,...

Read More »United States: the ISM Non-Manufacturing index fell further markedly in January

The US ISM Manufacturing index remained stuck at quite low levels and the Non-Manufacturing index declined further heavily. However, it remained pitched at a still relatively healthy level. The ISM Manufacturing index stabilised at a low level in January. But its Non-Manufacturing counterpart fell further heavily, although it remained pitched at a still relatively healthy level. Nevertheless, together with most other economic data published recently, these surveys unfortunately confirm...

Read More »Conditions are ripe for rebound on equity markets

Macroview We see signs that the sell-off is bottoming out, and believe that the triggers for a rebound are coming into place. On 26 January, we explained that we expected the turmoil on global equity markets to abate in the near future. Several of the possible triggers for a rebound on equity markets that we identified are now materialising: Policy support from central banks. The Bank of Japan (BoJ) unexpectedly announced last week that it is cutting interest rates into negative...

Read More »US wages & monetary policy: not-so-dovish FOMC statement in January

Quarterly wage data (ECI) for Q4 pointed to modest increases with no apparent pick-up in wage inflation. Although the January FOMC statement was not so dovish, we continue to believe the Fed will remain on hold in March. Besides GDP data, today saw some other key data being published: the quarterly Employment Cost Index (ECI), admittedly the most reliable measure of wages and salaries. Following Wednesday’s less-dovish-than-hoped FOMC statement, prolonged uncertainty over inflation...

Read More »United States: soft growth in Q4, but a serious downturn remains unlikely

The economy ended last year with soft momentum, and the sharp tightening in US financial and monetary conditions will undoubtedly weigh on US economic growth over the coming months. However, we remain upbeat about consumption and the housing sector. US real GDP, curbed by lower stockbuilding and a slowdown in consumption growth, grew by a soft 0.7% in Q4. We have cut our forecast for 2016. However, we still expect reasonably healthy growth (2.0%). In Q4 2015, US real GDP grew by a weak...

Read More »Japan: Kuroda surprises by introducing a negative interest rate

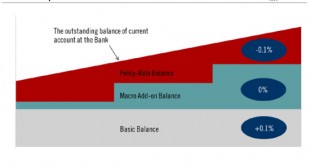

Under a three-tier system, the Bank of Japan (BoJ) introduces a negative interest rate (-0.1%). Haruhiko Kuroda did it again. After having continuously denied the idea of using a negative interest rate, the governor of the Bank of Japan (BoJ) has now decided to introduce one. More specifically, the BoJ will adopt a three-tier system in which the outstanding balance of each financial institution’s current account at the Bank will be divided into three tiers, to each of which a positive...

Read More » Perspectives Pictet

Perspectives Pictet