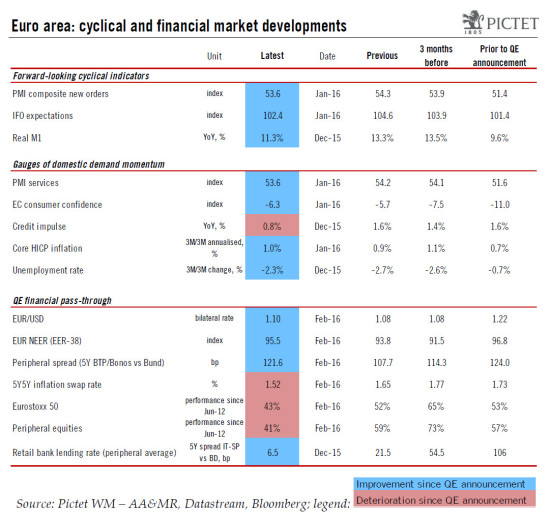

With downside risks to the euro area outlook intensifying in recent weeks, we expect the ECB to respond by easing monetary conditions further. We leave our 1.8% growth expectation for 2016, largely based on improving prospects for domestic demand. Although we have left our forecasts for euro area GDP unchanged – 1.8% growth expected in 2016, well above trend – downside risks have intensified in recent weeks. There are both good and bad reasons to worry about the recovery but, in short, the euro area can continue to do well despite sluggish global growth, financial volatility and political instability. One key feature of the macro outlook underpinning our forecasts is the improvement in domestic demand, both in terms of private consumption and investment, which we expect to continue in 2016 and beyond. Domestic momentum should be fuelled by loose(r) monetary conditions and rising credit flows to the real economy. Labour market conditions continue to improve. For the first time in years, the aggregate fiscal stance has turned supportive for growth. Last but not least, we expect the ECB to ease monetary policy further in a way that should increasingly benefit the real economy, especially the peripheral countries.

Topics:

Frederik Ducrozet considers the following as important: ECB, euro area, Eurozone, growth, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Eurozone Growth Surprises, Lifts Euro, while UK Budget is Awaited

With downside risks to the euro area outlook intensifying in recent weeks, we expect the ECB to respond by easing monetary conditions further. We leave our 1.8% growth expectation for 2016, largely based on improving prospects for domestic demand.

Although we have left our forecasts for euro area GDP unchanged – 1.8% growth expected in 2016, well above trend – downside risks have intensified in recent weeks. There are both good and bad reasons to worry about the recovery but, in short, the euro area can continue to do well despite sluggish global growth, financial volatility and political instability.

One key feature of the macro outlook underpinning our forecasts is the improvement in domestic demand, both in terms of private consumption and investment, which we expect to continue in 2016 and beyond. Domestic momentum should be fuelled by loose(r) monetary conditions and rising credit flows to the real economy. Labour market conditions continue to improve. For the first time in years, the aggregate fiscal stance has turned supportive for growth. Last but not least, we expect the ECB to ease monetary policy further in a way that should increasingly benefit the real economy, especially the peripheral countries.

Business confidence – medium risk

Confidence took a hit at the turn of the year as a combination of external and domestic worries weighed on business and consumer surveys. The January decline in forward-looking indicators such as the German IFO expectations component and the European Commission’s Economic and Sentiment Index was the largest since the summer of 2012, despite remarkable resilience in the periphery. The recovery remains uneven and evidence of re-convergence between member states still looks elusive. That said France and Italy, the two laggards in this business cycle, have been catching up and soft data point to further improvement, including in terms of investment and employment.

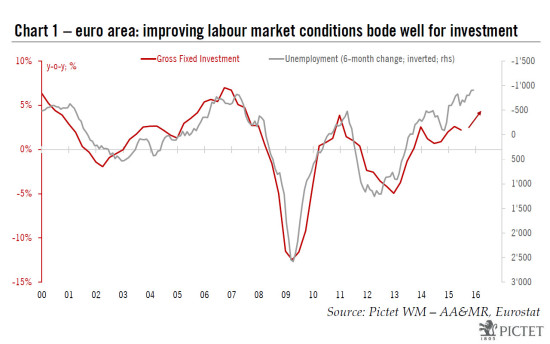

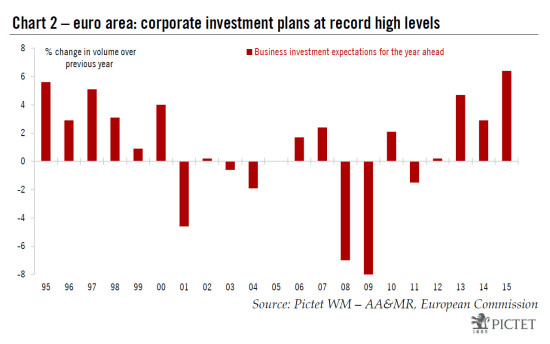

Domestic demand – low risk

Domestic demand has been the main driver of the recovery so far, with private consumption and investment contributing 55% and 30%, respectively, to the 3% cumulated expansion in euro area GDP since Q2 2013. For investment in particular, this contribution to growth exceeds its share in GDP (20%). Labour market conditions have been improving at a constant pace as hiring intentions reached a 5-year high, supporting real disposable income growth. We expect these trends to extend in 2016 and beyond as conditions are finally in place for corporate profits and investment plans to expand more significantly (see charts 1 and 2 below). Ultra-low investment rates in the past few years suggest there is considerable room for catch-up.

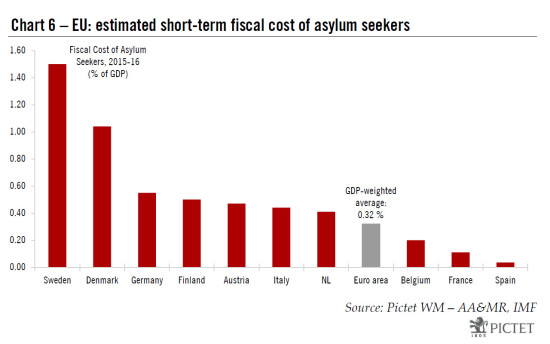

Last but not least, fiscal policy is turning (modestly) accommodative, as reflected in the European Commission’s winter forecasts, partly due to rising public expenditures as a response to the inflow of asylum seekers.

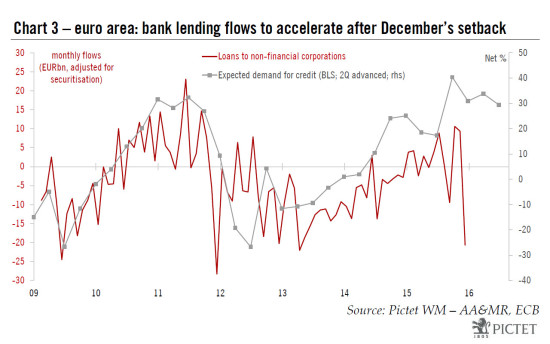

Bank lending – low risk

Bank lending suffered an unexpected setback in December 2015, with net flows to the euro area private sector falling by EUR21bn and the annual growth rate of bank loans easing to 0.3% y-o-y, from 0.7% in the previous months (adjusted for sales and securitisation). The correction was concentrated in short-term loans to non-financial corporations (a record EUR35bn drop on the month), with the Netherlands* once again proving a huge drag on the euro area aggregate (-EUR19bn).

We expect credit flows to accelerate in the next few months, and the credit impulse to remain supportive of even stronger domestic demand growth based on a number of forward-looking indicators such as the ECB’s Bank Lending survey (see chart 3).

China and EM – medium risk

Considering the slowdown in Chinese and Emerging Markets growth, the resilience in euro area trade data is all but remarkable. We estimate that euro area total exports rose by around 5% in 2015 (both in nominal and real terms), their best performance since 2011. The main destination countries where euro area exports are contracting, including Russia (-25% y-o-y), Brazil (-12% y-o-y) and China (-3% y-o-y), together account for less than 15% of the total. Meanwhile, exports to Developed Markets have been resilient, euro area companies have regained market shares, and forward-leading indicators suggest no clear reversal in the trend (e.g., German foreign orders).

To be sure, we forecast export growth to moderate in 2016 and net exports to contribute negatively to GDP growth this year, for the first time since 2009, as import growth picks up. But, barring a global recession, any weakness in euro area trade data should be more than offset by domestic strength.

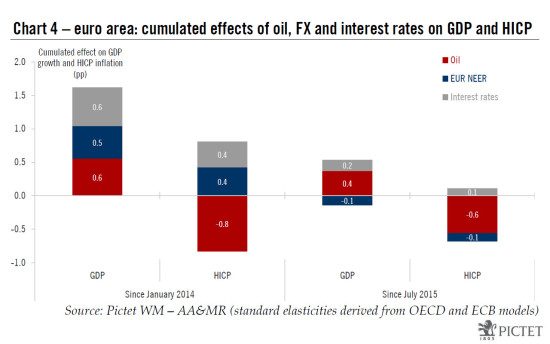

Oil – low risk

Assuming oil prices stabilise around current levels at the end of what we view as a protracted supply-side shock, the net boost to euro area activity (a net oil importer) should be significant in 2016. Using standard OECD elasticities, the 40%+ decline in oil prices in H2 2015 can be expected to boost GDP growth by an additional 0.4%, on top of the lagged positive impact of previous declines in prices (see chart 4). It is possible that the adverse effects of the oil crash have been underestimated in the euro area, just like in the US, but eventually both private consumption and corporate profits should benefit even if the savings rate rises somewhat in the process.

The main risk for the euro area comes with amplified disinflationary effects from the collapse in commodity prices, and more specifically from second-round effects on production costs, wages and consumer prices. We found that those indirect oil effects on inflation should remain limited, no more than -0.2 percentage point on core inflation this year. Still, focusing on the anchoring of inflation expectations, the ECB is expected to ease monetary policy at its upcoming 10 March meeting.

Inflation expectations – medium risk

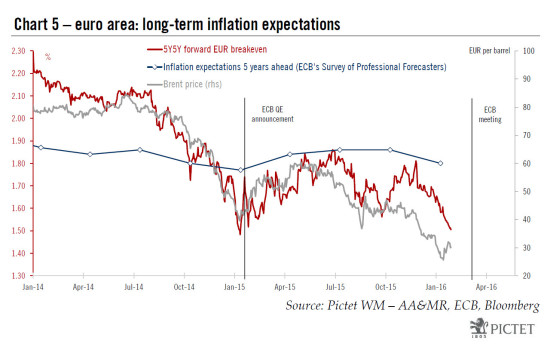

Despite oil prices showing signs of a tentative stabilisation, EUR 5y5y inflation swaps fell to 1.50% this week, close to their all-time lows. Arguably, such market-based indicators reflect the price for inflation compensation for very specific types of investors rather than pure inflation expectations. They have remained closely correlated to oil prices in recent months, and probably affected by poor liquidity conditions.

Several central banks including the Fed (see here and here) and the ECB have expressed their reservations about using inflation swaps for monetary policy purposes. Rather, the ECB should continue to monitor very closely a broader set of inflation expectations indicators, including from the Survey of Professional Forecasters and other surveys (see chart 5). The latter have declined as well in recent months, but even a modest rebound in oil prices along with modestly positive wage growth might be enough to prevent a dis-anchoring of inflation expectations.

Refugee crisis – medium risk

The economic cost of asylum seekers, as estimated by the IMF, is expected to be manageable, up to 0.3% of GDP for the euro area as a whole. By comparison, Sweden and Denmark would face costs three to five times larger (see chart 6). Over the longer-term, the potentially successful integration of immigrants could prove to be a historic opportunity for the EU facing weak demographics and long-term challenges to social welfare systems. For now, the refugee crisis only adds to political instability.

Political instability – medium risk

Political risks have risen in almost every single member state. Spain has yet to get a government and there is no guarantee that Pedro Sanchez, the leader of the centre-left PSOE, will be successful where Mariano Rajoy failed – even if he is, new elections would not be ruled out at a later stage. Greece, while no longer in a permanent state of existential crisis, is going through difficult negotiations with its creditors on pensions against the backdrop of renewed social tensions. In Portugal, the socialist government has entered intense negotiations with the European Commission about their 2016 budget plans, with decent chances of an agreement, in our view. In Italy, PM Matteo Renzi has recently escalated his complaints towards German and EU officials as regards various policies he deems unfair and inefficient, causing embarrassment in European capitals.

The political landscape is changing in Germany and France, too. Chancellor Angela Merkel has seen her ranking approval slip in recent polls as the result of her handling of the refugee crisis, mostly benefitting the far-right Alternative für Deutschland. The far-right remains very strong in France for different reasons, and so does the threat to mainstream, reform-oriented parties.

So far, there has been little impact on business confidence or growth data. True, downside risks could materialise with a delay in some countries where business (Spain) or consumer confidence (Italy) look toppish, but overall we still see limited systemic risks. However imperfect, the euro area now benefits from various financial safety nets, and our impression is that the lesson of previous confrontations has been learnt.

To some extent, financial and economic resilience has come at the price of long-term political fragility, in the form of reduced incentives for reforms at both the national and supra-national level. The risk of certain structural reforms being undone has increased (labour market, pensions). Integration initiatives at the EMU level have faltered. Brexit, while not part of our baseline scenario, would likely have very negative repercussions for the euro area over the medium-term. Some may argue that Jean-Claude Juncker’s “ever closer union” is undesirable anyway, but so is an incomplete union. There lie the long-term challenges, in our view, and there’s little the ECB can do for that matter.

* Loans granted by Dutch banks to non-financial corporations have fallen by EUR35bn since September 2015 (9% of the outstanding stock) with no obvious reason provided by the central bank. The on-going adjustment in real estate sectors only explains part of the loan contraction. Methodological changes introduced by the ECB in September 2015 to better account for off-balance sheet loans might have added some noise to the monthly data.