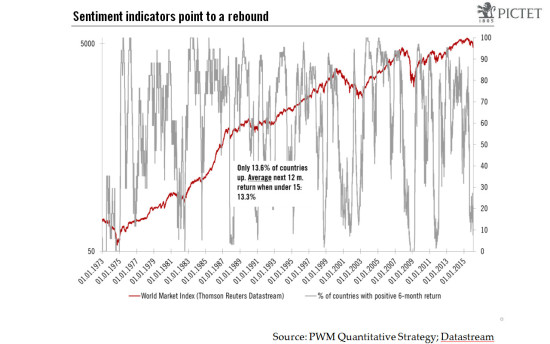

Macroview We see signs that the sell-off is bottoming out, and believe that the triggers for a rebound are coming into place. On 26 January, we explained that we expected the turmoil on global equity markets to abate in the near future. Several of the possible triggers for a rebound on equity markets that we identified are now materialising: Policy support from central banks. The Bank of Japan (BoJ) unexpectedly announced last week that it is cutting interest rates into negative territory. The European Central Bank (ECB) has indicated that it will further loosen monetary policy, probably at its March meeting. The People’s Bank of China (PBoC) is providing fresh liquidity injections to support growth. Although we do not expect the US Fed to change course on raising interest rates, it at least expressed concern in its statement this week about the implications of developments for risks to the outlook. Oil prices may have found a floor. The oil price has rebounded from a low of USD28/barrel on 20 January to USD30.5/b today, up by 9%, suggesting that a floor may have been reached. Sentiment indicators support a rebound. The extreme bearishness of statistical and survey-based contrarian market sentiment indicators also suggests that conditions are ripe for a rebound (as illustrated for example in the chart below).

Topics:

Christophe Donay considers the following as important: Equity Markets, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We see signs that the sell-off is bottoming out, and believe that the triggers for a rebound are coming into place.

On 26 January, we explained that we expected the turmoil on global equity markets to abate in the near future. Several of the possible triggers for a rebound on equity markets that we identified are now materialising:

- Policy support from central banks. The Bank of Japan (BoJ) unexpectedly announced last week that it is cutting interest rates into negative territory. The European Central Bank (ECB) has indicated that it will further loosen monetary policy, probably at its March meeting. The People’s Bank of China (PBoC) is providing fresh liquidity injections to support growth. Although we do not expect the US Fed to change course on raising interest rates, it at least expressed concern in its statement this week about the implications of developments for risks to the outlook.

- Oil prices may have found a floor. The oil price has rebounded from a low of USD28/barrel on 20 January to USD30.5/b today, up by 9%, suggesting that a floor may have been reached.

- Sentiment indicators support a rebound. The extreme bearishness of statistical and survey-based contrarian market sentiment indicators also suggests that conditions are ripe for a rebound (as illustrated for example in the chart below).

Our baseline scenario remains unchanged

Nevertheless, we continue to expect 2016 to be characterised by a lack of momentum in economic growth and in growth of corporate earnings, by uncertainty over central bank policies, and by concerns about emerging markets. The result will be continued elevated volatility in financial markets.