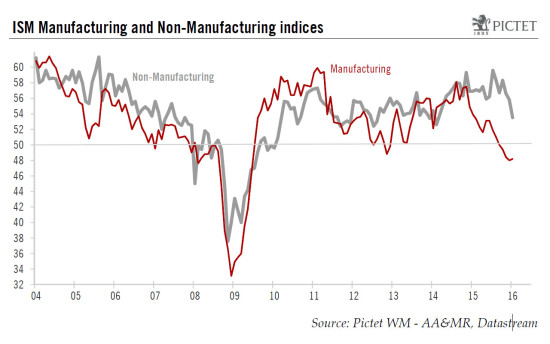

The US ISM Manufacturing index remained stuck at quite low levels and the Non-Manufacturing index declined further heavily. However, it remained pitched at a still relatively healthy level. The ISM Manufacturing index stabilised at a low level in January. But its Non-Manufacturing counterpart fell further heavily, although it remained pitched at a still relatively healthy level. Nevertheless, together with most other economic data published recently, these surveys unfortunately confirm that growth entered 2016 with a soft momentum. ISM Manufacturing index stabilised at a low level in January The ISM Manufacturing survey for January 2016 was published on Monday. The headline reading inched back up marginally from 48.0 in December to 48.2 in January, slightly below consensus expectations (48.4). Nevertheless, this yardstick remained pitched at a quite a low level (see chart above). The number recorded in December was the lowest since the recession ended in June 2009. As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart, although it dropped m-o-m, from 52.7 in December to 52.4 in January. The details of the Manufacturing ISM report showed that the Employment sub-index fell further m-o-m to 45.9, its lowest level since June 2009.

Topics:

Bernard Lambert considers the following as important: growth, ISM, Macroview, United States

This could be interesting, too:

Dirk Niepelt writes “Governments are bigger than ever. They are also more useless”

Dirk Niepelt writes Urban Roadway in America: Land Value

Dirk Niepelt writes Banks and Privacy, U.S. vs Canada

Dirk Niepelt writes Most-Regretted College Majors

The US ISM Manufacturing index remained stuck at quite low levels and the Non-Manufacturing index declined further heavily. However, it remained pitched at a still relatively healthy level.

The ISM Manufacturing index stabilised at a low level in January. But its Non-Manufacturing counterpart fell further heavily, although it remained pitched at a still relatively healthy level. Nevertheless, together with most other economic data published recently, these surveys unfortunately confirm that growth entered 2016 with a soft momentum.

ISM Manufacturing index stabilised at a low level in January

The ISM Manufacturing survey for January 2016 was published on Monday. The headline reading inched back up marginally from 48.0 in December to 48.2 in January, slightly below consensus expectations (48.4). Nevertheless, this yardstick remained pitched at a quite a low level (see chart above). The number recorded in December was the lowest since the recession ended in June 2009. As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart, although it dropped m-o-m, from 52.7 in December to 52.4 in January.

The details of the Manufacturing ISM report showed that the Employment sub-index fell further m-o-m to 45.9, its lowest level since June 2009. However, more encouragingly, the Production sub-index bounced back slightly from 49.9 in December to 50.2 in January, whilst the New Orders sub-index – which is supposed to be the most forward-looking component of the survey – rebounded from 48.8 in December to 51.5 in January.

After recording its fourth month in a row below the 50-point threshold, the ISM manufacturing index is increasingly pointing to a recession in the US industrial sector. As we have noticed repeatedly, the combined effect of lower oil prices, soft foreign demand and a higher dollar was – and will over the coming months continue to be – a clear, sharp negative factor for the manufacturing sector, which is much more dependent on exports and the oil-extraction sector than the whole services-oriented economy. Moreover, the downward correction in inventories has probably amplified the downturn in manufacturing activity over the past few months. Fortunately, the manufacturing sector represents only some 12% of the overall US economy.

ISM Non-Manufacturing index dropped further heavily

The ISM Non-Manufacturing survey was published today. The headline index dropped further, slipping from 55.8 in December to 53.5 in January, well below consensus expectations (55.1). However, although a sizeable fall was recorded over the past three months, January’s reading remains pitched at still relatively healthy levels by historical standards.

Last month’s decline was widespread. Following its sharp fall in December, the supplier Deliveries sub-index did bounce back. This notwithstanding, most other sub-indices fell heavily m-o-m. This was notably the case for the business activity index, the employment sub-index and the New Orders sub-index. The latter dropped from 58.9 in December to 56.5 in January.

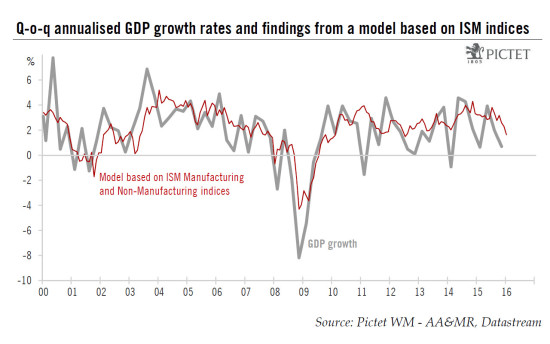

Taken together, the two ISM indices suggest that overall economic growth has slowed significantly over the past few months. However, if we use historical correspondence to try to calibrate what the ISM indices are pointing towards in terms of GDP growth (see chart above), we arrive at 1.6% in January, not such a low reading in itself, but nevertheless a much lower number than was registered on average in Q4 (2.7%) and Q3 (3.3%). Nevertheless, although ISM surveys are timely and useful indicators of the strength in the economy, they are not very reliable at forecasting GDP growth in the short run. Indeed, as we have just seen, ISM indices had been pointing to 2.7% GDP growth in Q4 whereas the advance estimate published last week for this was a meagre 0.7%.

Data published recently have continued to disappoint

Overall, January’s ISM surveys were disappointing. Some other economic data have been published so far this week, but they were not more reassuring, to say the least. Consumer spending grew by ‘only’ a modest 0.1% m-o-m in December. However, this followed an upwardly revised solid +0.4% in November. Although January’s car sales – published yesterday – surprised slightly on the upside (+1.4% m-o-m to 17.6 millions), they nevertheless remained 1.9% (non-annualised) below the average level recorded in Q4, auguring relatively badly for consumption in Q1. However, the snowstorm in the East of the US did probably dampen sales temporarily. Meanwhile, construction spending numbers for December, published on Monday, were surprisingly weak. Construction spending rose by a modest 0.1% m-o-m, whereas consensus estimates suggested a 0.6% increase. And figures for the previous two months were revised down.

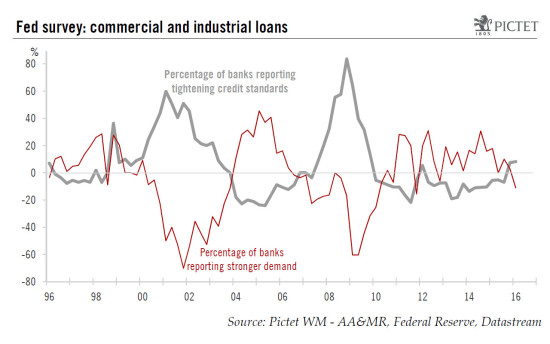

The Fed’s quarterly Senior Loan Officer Survey on bank lending, measuring changes over the three months ending in January this year, was also rather disappointing. Credit standards on business loans and on commercial mortgages tightened, whilst demand for business loans declined and demand for commercial mortgages increased less robustly. However, banks continued to loosen standards for home mortgages and consumer loans. And willingness to make consumer loans improved. Moreover, it is important to note that according to weekly Fed data, effective bank lending was in fact quite robust over the past few months.

Altogether, the economic data published recently unfortunately confirm that US growth entered 2016 with a relatively soft momentum. Nevertheless, for the time being, our forecasts – revised down at the end of last week – that GDP growth will reach 2.0% q-o-q annualised in Q1 and 2.0% as well on average in 2016 remain unchanged.