Our baseline scenario remains for the ECB to announce a comprehensive policy package including a 10bp deposit rate cut (along with a tiered deposit system), a EUR20bn increase in the pace of asset purchases to EUR80bn per month (along with changes to QE modalities), as well as more attractive TLTRO operations. This time is different – it’s no longer about oil At first glance it feels as though market participants have gone all the way back to three months ago, when they were expecting a...

Read More »Spain: new elections increasingly likely

If Pedro Sanchez loses tomorrow's confidence vote, and if political parties fail to form a new government over the next two months, new general elections would be called. Risks to the recovery may surface if political uncertainties remain entrenched. Yesterday, Pedro Sanchez, the PSOE leader, lost the first investiture vote. A second vote will take place on Friday, 4 March. The threshold will be less demanding as only a simple majority is needed. Even so, Sanchez’s chances of winning the...

Read More »Equities: Renewing the bull market?

Legal notice Please consult the legal notice (1) for detailed local legal restrictions applicable to your country and (2) weblinks to specific entities of the Pictet Group designed in function to those restrictions. U.S. Nationals and Residents please, click here

Read More »Equities: Renewing the bull market?

Equity markets have picked up since early February. Christophe Donay, Chief Strategist at Pictet Wealth Management, discusses whether this is a new bull market or just a tactical rebound.

Read More »Switzerland: Fourth quarter GDP surprises on the upside

According to SECO’s estimate, Swiss real GDP expanded by 0.4% q-o-q (1.7% q-o-q annualised, 0.3% y-o-y) in Q4, much better than consensus expectations (0.1%). Swiss GDP surprised on the upside in Q4, driven by robust consumption. Looking ahead, our scenario for the Swiss economy remains unchanged. For 2016, we expect Swiss GDP to expand by 1.1% and headline inflation to average -0.6%. The 0.4% q-o-q rise in the Q4 figure came after a downwardly revised Q3 figure of -0.1% q-o-q. For 2015...

Read More »United States: core PCE inflation picked up markedly in January

As widely expected, core PCE inflation picked up further in January, but the increase was surprisingly pronounced. However, we do not expect much more upside over the rest of the year. In Friday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. Following higher-than-expected CPI numbers the week before, a relatively marked monthly increase was also expected last Friday. However, the...

Read More »Euro area: large drop in core inflation delivers the final blow to the ECB

Today’s inflation report raises the likelihood of an even bigger easing package to be delivered at the 10 March meeting. Not only were today’s preliminary inflation figures for the euro area very weak, but the breakdown raised new concerns over the underlying trend in consumer prices – a potential headache for the ECB, independently of recent developments in the real economy and financial markets. According to Eurostat’s estimates, euro area HICP inflation fell to -0.19% y-o-y in...

Read More »Euro area: Credit rebounds sharply

After a large and unexpected fall in December, largely due to a collapse in lending to non-financial corporations in the Netherlands, euro area bank credit flows rebounded sharply in January, in line with other indicators such as the ECB’s Bank Lending Survey We continue to believe that the credit cycle has legs and we therefore maintain our forecast for the euro area GDP growth unchanged at 1.8% for 2016. Nevertheless, we also remain cautious. January bank credit flows came before the...

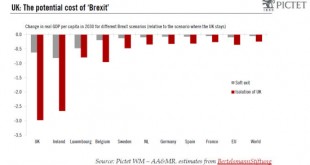

Read More »UK: To Brexit, or not to Brexit?

We expect the UK to remain in the EU, but the risks are high. Opinion polls suggest a close result, and unless the gap widens markedly between the “Ins” and “Outs”, a prolonged period of uncertainty beckons. Moreover, in the event of Brexit, negotiations could go on for years. Having secured a deal at the European Council meeting on 19 February, PM David Cameron announced that the referendum on UK EU membership will be held on 23 June. Based on the reactions on both sides, it looks like...

Read More »Euro area: Revisiting the ECB’s Lower Bound

Financial stress is threatening the fragile euro area recovery, especially the credit cycle. More negative rates are likely to be part of the ECB’s response We expect the ECB to cut the deposit rate to -0.50% by June, probably in two steps (by 10bp in March and by another 10bp in June), as part of its response to weaker inflation prospects and tighter financial conditions. That said, the adverse consequences of negative rates are becoming increasingly visible as foreign central banks are...

Read More » Perspectives Pictet

Perspectives Pictet