Quarterly wage data (ECI) for Q4 pointed to modest increases with no apparent pick-up in wage inflation. Although the January FOMC statement was not so dovish, we continue to believe the Fed will remain on hold in March. Besides GDP data, today saw some other key data being published: the quarterly Employment Cost Index (ECI), admittedly the most reliable measure of wages and salaries. Following Wednesday’s less-dovish-than-hoped FOMC statement, prolonged uncertainty over inflation prospects and seemingly some modest pick-up in average hourly earnings increases – the other main statistic on wages – publication of these Q4 ECI data was once again of particular significance. Wage growth remained muted in Q4 The Employment Cost Index rose by 0.6% q-o-q (2.3% annualised) in Q4, in line with consensus estimates. As a result, the y-o-y rise in the ECI inched back up from 1.9% in Q3 to 2.0% in Q4. This statistic can be quite volatile in the short run, and there were odd big swings in wages in H1. However, on a yearly average basis, the ECI advanced by ‘only’ 2.1% y-o-y last year, compared with a 2.1% again in 2014 and 1.9% in 2013. The current pace of increase in wages is certainly modest by past standards and most unlikely to generate any upward pressure on inflation. As for any potential upturn in the pace of wage increases, the analysis is by no means straightforward.

Topics:

Bernard Lambert considers the following as important: FED, Federal Reserve, Macroview, salaries, wages

This could be interesting, too:

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

investrends.ch writes Jerome Powell: «Es gibt keinen risikolosen Weg»

investrends.ch writes Fed senkt Leitzins wie erwartet

Quarterly wage data (ECI) for Q4 pointed to modest increases with no apparent pick-up in wage inflation. Although the January FOMC statement was not so dovish, we continue to believe the Fed will remain on hold in March.

Besides GDP data, today saw some other key data being published: the quarterly Employment Cost Index (ECI), admittedly the most reliable measure of wages and salaries.

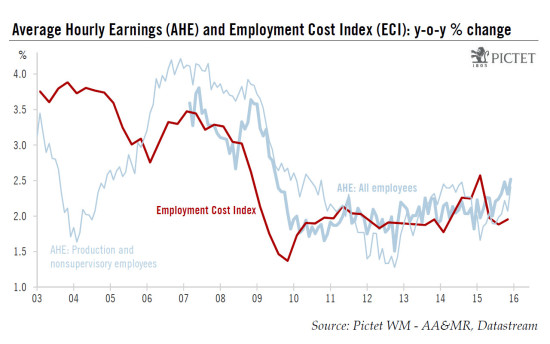

Following Wednesday’s less-dovish-than-hoped FOMC statement, prolonged uncertainty over inflation prospects and seemingly some modest pick-up in average hourly earnings increases – the other main statistic on wages – publication of these Q4 ECI data was once again of particular significance.

Wage growth remained muted in Q4

The Employment Cost Index rose by 0.6% q-o-q (2.3% annualised) in Q4, in line with consensus estimates. As a result, the y-o-y rise in the ECI inched back up from 1.9% in Q3 to 2.0% in Q4. This statistic can be quite volatile in the short run, and there were odd big swings in wages in H1. However, on a yearly average basis, the ECI advanced by ‘only’ 2.1% y-o-y last year, compared with a 2.1% again in 2014 and 1.9% in 2013. The current pace of increase in wages is certainly modest by past standards and most unlikely to generate any upward pressure on inflation.

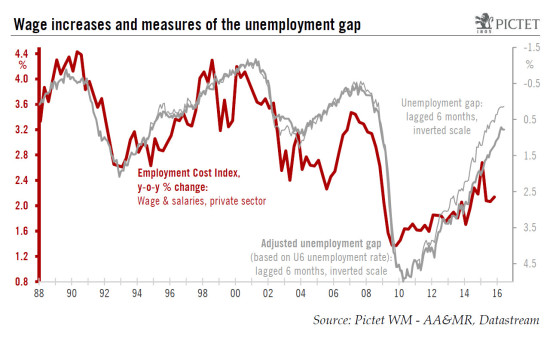

As for any potential upturn in the pace of wage increases, the analysis is by no means straightforward. The rate of recovery in GDP is relatively modest and, as we have just seen, most measures of wages are continuing to rise at a very modest tempo. At the same time, though, the unemployment rate has continued to fall rapidly, and most indicators of the situation in the labour market have improved quite markedly. Although there is much discussion about the extent of slack in the labour market, there is no denying this slack is diminishing rapidly and that the US economy is close to full employment. At some stage or another, the fall in unemployment can be expected to feed through and push wage inflation up (see chart below). We continue to expect wage increases to pick up gradually over the coming quarters.

We continue to expect the Fed to remain on hold in March

After its meeting earlier this week, the FOMC published a statement where, as widely expected, it acknowledged that “economic growth slowed late last year”. It was also pointed out in the statement that “the Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook”. This means that the Fed no longer considers that the risks to the outlook are ‘balanced’. However, overall the statement was not particularly dovish. The Fed stressed that “labor market conditions improved further”, and repeated that “with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen”. Unsurprisingly, it did not take a hike in March off the table.

Nevertheless, our expectation is still that the Fed will remain on hold in March and hike ‘only’ twice this year, once in June and once in December. In fact, with still subdued wage increases, ongoing turmoil in financial markets and the substantial additional tightening in monetary conditions recorded of late, we believe the probability that the FOMC will wait later than June before acting again has increased.