After a large and unexpected fall in December, largely due to a collapse in lending to non-financial corporations in the Netherlands, euro area bank credit flows rebounded sharply in January, in line with other indicators such as the ECB’s Bank Lending Survey We continue to believe that the credit cycle has legs and we therefore maintain our forecast for the euro area GDP growth unchanged at 1.8% for 2016. Nevertheless, we also remain cautious. January bank credit flows came before the most severe episode of financial market stress, which could have an impact on banks' balance sheets with a few months' delay. As a result, while today's M3 and credit data will certainly reassure the ECB in terms of the positive credit dynamics, the case for additional easing at its 10 March meeting remains very strong. The detail of the January M3 report revealed that the annual rate of expansion in the euro area money supply (M3) quickened from 4.7% y-o-y in December to 5.0% y-o-y in January, beating consensus expectations (4.7%) and averaging 4.9% in the three months up to January. Meanwhile, the narrow aggregate M1, which includes currency in circulation and overnight deposits, decelerated from 10.8% y-o-y to 10.5% y-o-y. On the M3 counterpart side, the pace of credit expansion to private sector remains still subdued by historical standards.

Topics:

Nadia Gharbi considers the following as important: credit cycle, ECB, euro area, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

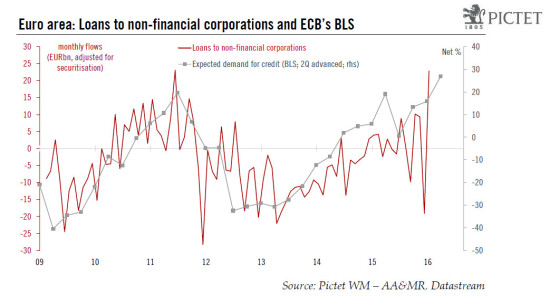

After a large and unexpected fall in December, largely due to a collapse in lending to non-financial corporations in the Netherlands, euro area bank credit flows rebounded sharply in January, in line with other indicators such as the ECB’s Bank Lending Survey

We continue to believe that the credit cycle has legs and we therefore maintain our forecast for the euro area GDP growth unchanged at 1.8% for 2016. Nevertheless, we also remain cautious. January bank credit flows came before the most severe episode of financial market stress, which could have an impact on banks' balance sheets with a few months' delay. As a result, while today's M3 and credit data will certainly reassure the ECB in terms of the positive credit dynamics, the case for additional easing at its 10 March meeting remains very strong.

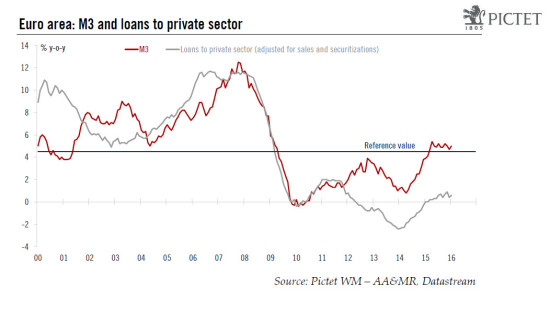

The detail of the January M3 report revealed that the annual rate of expansion in the euro area money supply (M3) quickened from 4.7% y-o-y in December to 5.0% y-o-y in January, beating consensus expectations (4.7%) and averaging 4.9% in the three months up to January. Meanwhile, the narrow aggregate M1, which includes currency in circulation and overnight deposits, decelerated from 10.8% y-o-y to 10.5% y-o-y.

On the M3 counterpart side, the pace of credit expansion to private sector remains still subdued by historical standards. The annual growth rate of loans to private sector (adjusted for sales and securitisations) increased from 0.4% y-o-y in December to 0.6% y-o-y in January (see the chart below). Broken down by sectors, the annual growth rate of loans to households stood at 1.4% y-o-y in January, while loans to non-financial corporations increased to 0.6% y-o-y in January from 0.1% y-o-y in December.

Broad-based rebound in flows across sectors

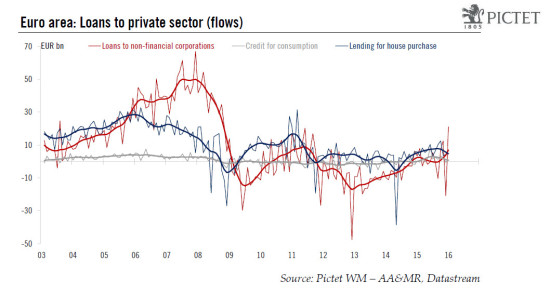

Looking at flows, the rebound in bank credit to non-financial private sector was broad-based across sectors. Loans to households (adjusted for sales and securitisations) rose by EUR 6 bn in January, slightly stronger than in recent months. Meanwhile, loans to non-financial corporations (adjusted for sales and securitisations) were up by EUR 23 bn, more than offsetting December’s collapse (-EUR 19 bn). This rebound was in line with forward-looking indicators such as the ECB’s Bank Lending Survey and also marked a cycle high since the adjusted series began in January 2009, equalling the previous record high posted in June 2011.

In terms of countries, the gap between core and periphery widened somewhat. The strongest figures in credit flows to non-financial corporations (NFC) were recorded in France (+EUR 12 bn), Germany (+EUR 6 bn) and the Netherlands (+EUR 6 bn). For the latter, the rebound followed a EUR 15 bn collapse in the previous month. In contrast, bank loans to NFC remained subdued in Spain, while in Italy bank loans to NFC fell by EUR 5 bn, following a drop of EUR 7 bn the previous month. This might be a reflection of structural weaknesses in the Italian banking sector that have started to be addressed by the Renzi’s government.

ECB: Case for additional easing remains very strong

Although today's M3 and credit data will certainly reassure the ECB in terms of the positive credit dynamics, the case for additional easing remains very strong. The pace of credit expansion remains subdued and the rebound in January bank credit flows came before the most severe episode of financial market stress, which could have an impact on banks' balance sheets with a few months' delay. Faced with growing external risks, the euro area needs a solid banking sector more than ever. This would argue for pre-emptive easing at the 10 March meeting including measures aimed at supporting credit transmission – the second contingency in Draghi's Amsterdam speech. We expect a 10 bp rate cut along with a tiered deposit system that would mitigate the cost of negative rates for banks, or at the very least a hint at such a mechanism. We also expect some form of TLTRO easing (cost, maturity and/or new operations). Note that net credit flows to the private sector (excluding loans for house purchases) are used to set TLTRO allowances relative to benchmarks, with non-negligible risks that some banks need to repay the ECB if they fail to meet their lending benchmarks. This could be the case for some banks in the Netherlands and in Ireland, in particular.

Lastly, we continue to expect the ECB to increase the pace of QE purchases by EUR 20 bn, to EUR 80 bn per month, and to make a number of technical yet important changes to QE modalities, including a broadening of the eligible universe, an increase in the issue limits and possibly the removal of the yield floor for asset purchases – all of which we will discuss in our upcoming ECB preview.