As widely expected, core PCE inflation picked up further in January, but the increase was surprisingly pronounced. However, we do not expect much more upside over the rest of the year. In Friday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. Following higher-than-expected CPI numbers the week before, a relatively marked monthly increase was also expected last Friday. However, the move was even more pronounced than expected and data for the previous few months were revised up. At the core level (i.e. excluding food and energy), the PCE price index increased by a steep 0.3% m-o-m in January (0.26% before rounding), above consensus expectations (+0.2%). Moreover, December’s monthly increase was revised up from +0.0% to +0.1%. As a result, on a y-o-y basis, core PCE inflation picked up from 1.5% in December (revised up from 1.4%) to 1.7% in January (1.67% before rounding), its highest level since February 2013. As such, January’s figure is already higher than the median Fed forecast for Q4 2016 (1.6%). The marked pick-up in y-o-y core PCE inflation over the past few months (from a ‘local’ low of 1.26% in July 2015 to 1.67% last month) was relatively widespread.

Topics:

Bernard Lambert considers the following as important: inflation, Macroview, United States

This could be interesting, too:

Marc Chandler writes Yen Jumps on Rate Hike Speculation

Claudio Grass writes Gold climbing from record high to record high: why buy now?

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

As widely expected, core PCE inflation picked up further in January, but the increase was surprisingly pronounced. However, we do not expect much more upside over the rest of the year.

In Friday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. Following higher-than-expected CPI numbers the week before, a relatively marked monthly increase was also expected last Friday. However, the move was even more pronounced than expected and data for the previous few months were revised up.

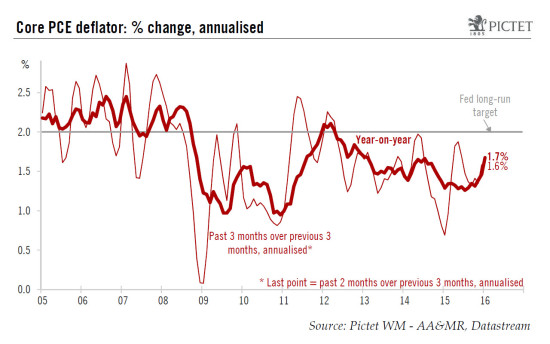

At the core level (i.e. excluding food and energy), the PCE price index increased by a steep 0.3% m-o-m in January (0.26% before rounding), above consensus expectations (+0.2%). Moreover, December’s monthly increase was revised up from +0.0% to +0.1%. As a result, on a y-o-y basis, core PCE inflation picked up from 1.5% in December (revised up from 1.4%) to 1.7% in January (1.67% before rounding), its highest level since February 2013. As such, January’s figure is already higher than the median Fed forecast for Q4 2016 (1.6%).

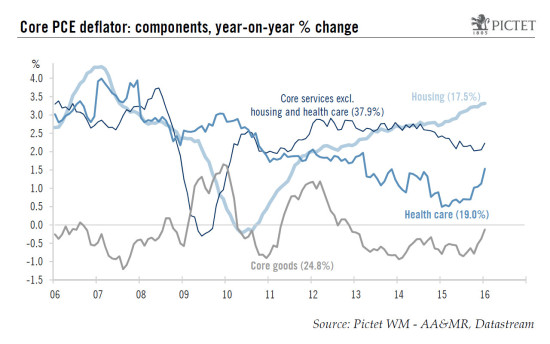

The marked pick-up in y-o-y core PCE inflation over the past few months (from a ‘local’ low of 1.26% in July 2015 to 1.67% last month) was relatively widespread. It was notably linked to an acceleration in housing inflation and health care inflation, together with less deflation for core goods (see chart below). Inflation in health care had fallen markedly between June 2014 and January 2015 – a likely consequence of Obamacare. This base effect has progressively phased out over the past few months, and the move continued in January this year. Both effects (housing and health care) were expected, although to a lesser extent. However, the main surprise came from core goods, where the fall in prices narrowed from -0.9% y-o-y in July 2015 to -0.1% in January this year, a pick-up possibly linked to the lagged effect of the temporary downward correction in the trade-weighted dollar in Q2 2015.

Is this uptick in core PCE inflation good or bad news? Well, this is probably good news for the economy, as it means that the threat of deflation is waning and it implies lower real short-term rates. However, at the same time, this is probably bad news for financial markets in the short run, as it raises the likelihood that the Fed will hike a second time over the coming months.

We don’t expect core PCE inflation to pick up much further

What should we expect for the future? With high demand for rental units and a low level of rental vacancies, housing inflation is likely to remain relatively high. However, we do not expect any further acceleration over the coming months, mainly due to the lagged moderating impact of the slowdown in house price inflation witnessed over the past two years or so. Meanwhile, despite the very recent downward correction, the dollar’s surge in the past few months will have a dampening impact on import prices. And we forecast that, on a trade-weighted basis, the greenback will climb further over the coming months. Moreover, the indirect lagged impact of much lower oil and commodity prices is probably not completely behind us. These two factors should continue to weigh on core inflation, at least over the coming few months.

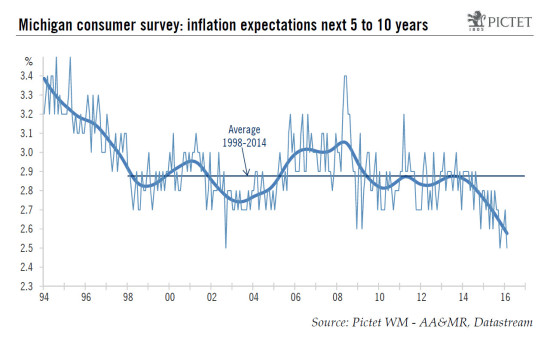

In addition, it is important to keep in mind that the global economic backdrop is not conducive to more inflation – quite the opposite in fact. Inflation remains pretty low worldwide, and deflationary forces are still present. This context is limiting pricing power in the US as well. Moreover, as Janet Yellen has repeated on many occasions, domestic inflation expectations play an important role in the inflation process. And on that front, recent developments appear quite disturbing. Market-based inflation expectations have come down markedly over the past few months and survey-based inflation expectations have also declined noticeably over the past couple of years. More specifically, the long-term (5 to 10 years) inflation expectations out of the Michigan consumer sentiment survey fell to a record low 2.5% (see two charts above). All this suggests that higher inflation is not around the corner.

As for potential domestic wage pressure, the analysis remains quite difficult. Although wages seem to have picked up somewhat over the past few months, most measures of wages continue to show a very modest pace of growth. At the same time, though, the unemployment rate is falling rapidly, and most indicators of the situation in the labour market have improved quite markedly of late. Although there is much discussion about the extent of the slack in the labour market, there is no denying this slack is diminishing rapidly. At some stage or another, the fall in unemployment is expected to feed through and push wage inflation further upwards. We continue to expect wage increases to pick up gradually over the coming months. However, we think the influence of wage increases on overall core inflation should remain pretty muted, at least this year.

More technically speaking, it is also important to note that over the past six months or so the base effect was favourable to a pick-up in y-o-y core PCE inflation (between July 2014 and January 2015, the core PCE deflator had increased at an annualised pace of just 0.8%). However, between January 2015 and September 2015, it had increased at annualised pace of 1.7%. This is going to be much harder to beat.

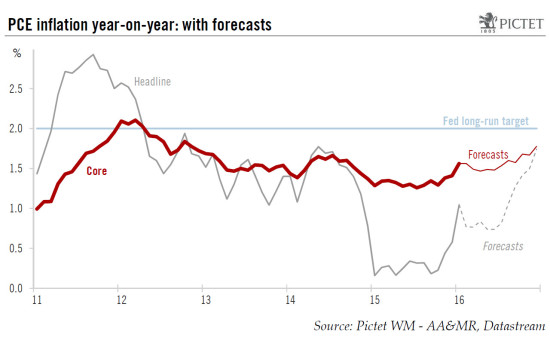

Overall, we now believe that y-o-y PCE core inflation will end this year at a rate around 1.9%, i.e. a rate not much higher than the one registered last month (see chart above).