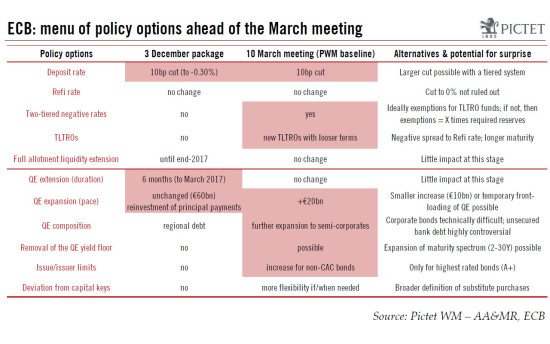

Our baseline scenario remains for the ECB to announce a comprehensive policy package including a 10bp deposit rate cut (along with a tiered deposit system), a EUR20bn increase in the pace of asset purchases to EUR80bn per month (along with changes to QE modalities), as well as more attractive TLTRO operations. This time is different – it’s no longer about oil At first glance it feels as though market participants have gone all the way back to three months ago, when they were expecting a big ECB package at the December meeting. In the end, the ECB’s announcement came as a disappointment to many, including a 10bp deposit rate cut and a 6-month extension to the QE programme. The main challenge facing the ECB today is no longer the collapse in commodity prices, but a more fundamental mix of concerns revolving around the strength of the recovery, the crucial bank credit channel as well as potential second-round effects on wage growth and (core) inflation. We do not expect these downside risks to fully materialise, but the ECB is likely to act pre-emptively as the only risk-manager in town. We expect a comprehensive policy package to be announced at the 10 March meeting (see detailed table below), including a 10bp deposit rate cut to -0.

Topics:

Frederik Ducrozet considers the following as important: ECB, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

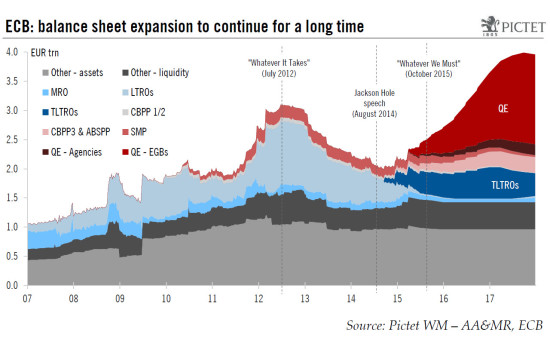

Our baseline scenario remains for the ECB to announce a comprehensive policy package including a 10bp deposit rate cut (along with a tiered deposit system), a EUR20bn increase in the pace of asset purchases to EUR80bn per month (along with changes to QE modalities), as well as more attractive TLTRO operations.

This time is different – it’s no longer about oil

At first glance it feels as though market participants have gone all the way back to three months ago, when they were expecting a big ECB package at the December meeting. In the end, the ECB’s announcement came as a disappointment to many, including a 10bp deposit rate cut and a 6-month extension to the QE programme. The main challenge facing the ECB today is no longer the collapse in commodity prices, but a more fundamental mix of concerns revolving around the strength of the recovery, the crucial bank credit channel as well as potential second-round effects on wage growth and (core) inflation. We do not expect these downside risks to fully materialise, but the ECB is likely to act pre-emptively as the only risk-manager in town.

We expect a comprehensive policy package to be announced at the 10 March meeting (see detailed table below), including a 10bp deposit rate cut to -0.40% along with a tiered deposit system; a EUR20bn increase in the pace of asset purchases to EUR80bn per month along with some technical changes to the programme’s rules; as well as TLTROs with looser terms and conditions.

The ECB is facing a number of political and technical trade-offs. Whether those measures will be well received by the market remains to be seen, depending on how much is priced in (probably a lot, albeit less than in December). Moreover, ECB communication should be dovish enough to make clear that more support is coming if needed, including in terms of flexible QE implementation and old-school forward guidance.

Two ‘hot topics’ and a long list of worries

There is no escaping the fact that economic and financial conditions have worsened since the ECB eased three months ago, which is not exactly the intended effect of new policy measures. The Governing Council (GC) promised to “review and possibly reconsider” its monetary stance at the 10 March meeting. Discussions will likely focus on the following two issues in an attempt to assess the impact of exogenous shocks on domestic demand:

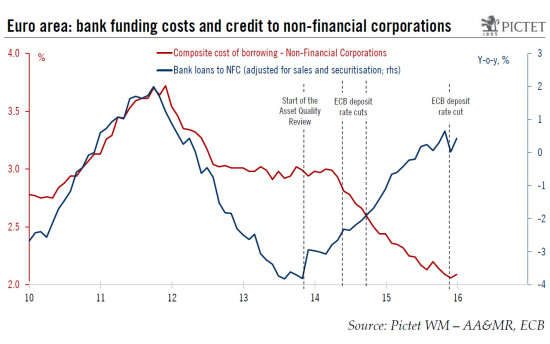

- Hot topic #1: weaker growth momentum and the credit channel

Downside risks to euro area GDP – once an island of relative stability – have increased as weaker global growth and tighter financial conditions have taken their toll on business confidence. Meanwhile concerns over adverse consequences of negative rates have intensified in the aftermath of the BoJ’s decision, with spill-overs to the European banking sector.

As we tried to distinguish between good and bad reasons to worry about the euro area outlook, we concluded that some of those concerns look overdone, largely based on the view that the improvement in domestic demand should more than compensate for external weakness. We would expect the GC to reach the same conclusion emphasising growing downside risks.

Specifically, the ECB should take the threat of a potential impairment of the credit transmission channel very seriously, having put considerable efforts in crisis years to support the banking sector. In fact, we expect the ECB to be pre-emptive when responding to those risks. At the same time, Mario Draghi can be expected to repeat what his GC colleagues have said before: 1) the euro area banking sector is much more solid and resilient than it was before the crisis; 2) it is not the ECB’s job to make banks profitable; 3) if profitability is at risk then banks should look at other options including cost-cutting measures and restructuring; 4) without ECB support the situation would have got much worse.

As a matter of fact, available data suggest that any adverse impact of negative rates on net interest income and margins has so far remained contained[1]. Executive Board member Benoît Coeuré recently noted that “many banks have been able to more than offset declining interest revenues with higher lending volumes, lower interest expenses, lower risk provisioning and capital gains”. Indeed bank credit flows rebounded sharply in January, and we expect the credit impulse to improve further in the next few months.

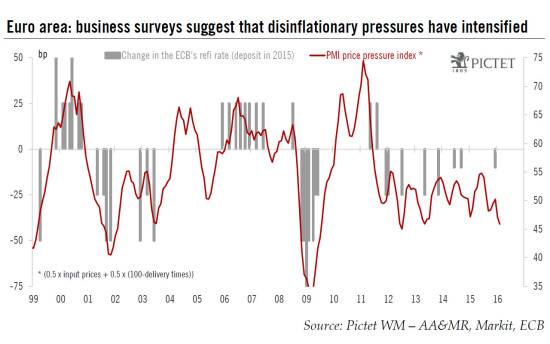

- Hot topic #2: inflation dynamics and second-round effects

Inflation prospects have deteriorated further in the past three months, except this time the collapse in oil prices is not the only factor to blame. Assuming the ECB had become worried about weaker core inflation dynamics at the end of last year, the February HICP report certainly did not help. Not only did headline inflation turn negative again (at -0.2%), but core inflation unexpectedly fell to 0.7% y-o-y, a 10-month low, raising new concerns over the underlying trend in consumer prices.

While we believe that temporary factors have amplified the drop in services inflation, the ECB will likely worry about potential second-round effects of lower oil prices and currency appreciation on the price of some other (non-energy) goods and services, including on Non-Energy Industrial Goods inflation which fell sharply, from 0.7% to 0.3% in February.

Some indicators point to potential effects of a prolonged period of low headline inflation on the dynamics of wages and core prices, possibly reflecting hysteresis effects. The worst news in recent PMI surveys came from price sub-components reflecting renewed disinflationary pressures (see chart above). Recent wage developments have been mixed, with negotiated wages roughly stable but compensation per employee easing to a record low level of 1.1% y-o-y in Q3 2015 (see chart below). Finally, market-based measures of inflation expectations have failed to recover despite slightly higher oil prices.

To be clear, we do not forecast second-round effects to lead to a self-sustained wage-price downward spiral, and the data are certainly not consistent with outright deflation. Our own models suggest that second-round effects will remain contained barring another episode of currency appreciation[2]. Still, this is a risk the ECB cannot ignore in the current context.

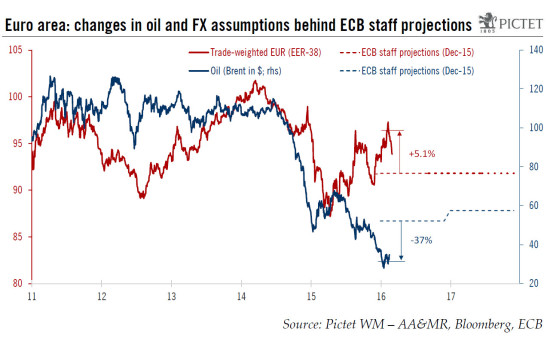

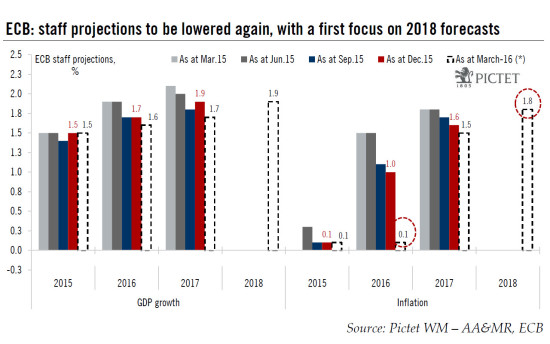

Ever lower staff projections and a first focus on 2018

In the end, the extent to which those concerns will be reflected in the ECB staff projections will drive the policy response. Inflation forecasts will be revised down, if anything automatically, as the result of lower oil prices (-37% between the mid-November and mid-February cut-off dates) and a stronger trade-weighted currency (+5.1% for the EUR EER-38, although the index has eased by 3.5% from its peak). We estimate the resulting drag on inflation at around 0.8% within the next 18 months, all else equal, although Draghi should emphasise that financial conditions have eased again more recently, with the trade-weighted EUR depreciating by over 3% from its February highs (which coincided almost exactly with the cut-off date).

All in all, taking account of the latest data releases, we expect the staff projections for HICP inflation to be revised down to around 0.1% for 2016 (from 1.0%) and to 1.5% for 2017 (from 1.6%).

Meanwhile, growth forecasts should be fine-tuned lower, albeit not by a very large margin. Tighter financial conditions will be factored in, knocking off 10-20bp from GDP growth projections, but the staff should keep a scenario of improving domestic demand underpinning activity beyond 2016.

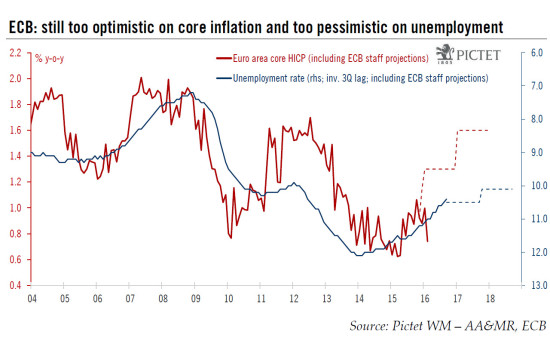

The interesting part will come with the first release of 2018 projections. In terms of the ECB’s broader communication, the long-term projections will help send a signal about their assessment of supply-side developments and potential growth as well as the expected closing of the output gap. By way of a reminder, the ECB has remained (too) optimistic about core inflation, largely partly on the view that a decline in potential growth to around 1% and an increase in the equilibrium rate of unemployment would push wage growth and core prices gradually higher by 2017. This assessment might be challenged by recent data as the unemployment rate kept on falling but wage growth has stabilised at best, if not slightly decelerated.

ECB’s March package: the easy, the likely and the tricky

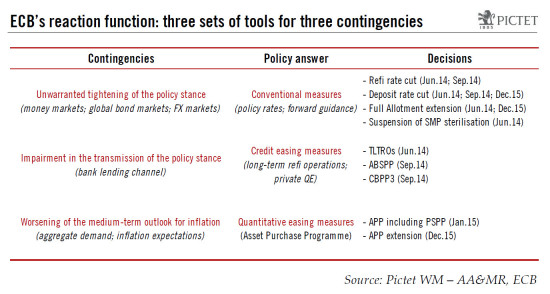

We have long argued that the framework set by Draghi in Amsterdam in April 2014 remains valid, meaning that specific policy tools should be used for specific purposes (see table below).

Speaking at the EU parliament last month, Draghi described more specifically which contingencies the ECB would be looking at in order to calibrate its next policy response: “First, we will examine the strength of the pass-through of low imported inflation to domestic wage and price formation and to inflation expectations. Second, in the light of the recent financial turmoil, we will analyse the state of transmission of our monetary impulses by the financial system and in particular by banks.” As previously mentioned, we do not expect either of those second-round effects to fully materialise but the case remains for the ECB to act pre-emptively.

We continue to expect a comprehensive policy package to be announced at the 10 March meeting, including some measures specifically designed to support the banking sector:

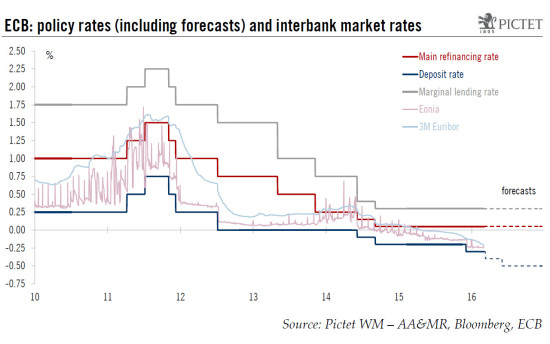

- A 10bp deposit rate cut, to -0.40%, and a tiered deposit system[3].

Risks to our baseline: we have outlined in our latest note on the ECB’s lower bound what we view as an ideal ‘win-win’ solution, increasing the share of bank reserves not subject to negative rates while creating incentives for banks to borrow from ECB’s TLTROs and to lend to the real economy. A similar approach could be applied to a share of QE flows. If such a BoJ-inspired, TLTRO-based tiered deposit system proves too complicated, an alternative option would be to introduce an extra buffer of bank reserves, up to a certain amount equivalent to 2, 3 or even 5 times required reserves, that would be remunerated at the ECB’s main refinancing rate (currently +0.05%).

The larger the exemptions, the lower the cost for banks and the lower the (effective) lower bound. Finally, there is a risk that the ECB hints at such a system and does not implement it immediately, but either way the door should remain open to more cuts in the future (we forecast another deposit rate cut to -0.50% by June). We do not expect a refi rate cut, but even this option cannot be completely ruled out in the future.

- A EUR20bn increase in the pace of asset purchases, to EUR80bn per month, along with changes to QE technical rules including a further increase of issuer limits (for non-CAC bonds) and a broadening of the universe of asset purchases to new semi-corporate names.

Risks to our baseline: we deem a further extension of the duration of the QE programme beyond March 2017 as useless, if not counterproductive. The main risk to our baseline is that ECB hawks continue to oppose QE expansion[4]. As a compromise, the ECB could opt for either a smaller (EUR10bn-15bn) increase of a temporary frontloading in the pace of asset purchases for some months, leaving for flexibility for a later decision.

Meanwhile, any QE expansion would make the issue of core bond scarcity worse – we estimate that 45-50% of the PSPP universe of German Bunds currently trade below the ECB’s deposit rate, thus non eligible for QE, and contributing to a flattening of the German yield curve. We expect the ECB to hint at more flexibility in the future, with several (more or less radical) tools at its disposal. In particular, the removal of the yield floor for asset purchases, currently set at the deposit rate, would make QE implementation much easier and the curve steeper, especially if the ECB cuts rates more aggressively, but the Bundesbank seems reluctant to tolerate what could be viewed as indirect monetary financing. An explicit deviation from ECB capital keys would be much more powerful, in our view, yet even more politically-sensitive, unless the ECB manages to force the decision step-by-step, once it has tried everything thing else.

Lastly, the GC may not be fully convinced of the interest of adding corporate bonds to the pool of eligible purchases given the lack of homogeneous and liquid markets across countries, although one idea that has been floated would be to use ETFs. Outright purchases of unsecured bank debt remain highly unlikely at this stage given the conflict of interest the ECB is facing, although other targeted options could be envisaged, including a reduction in collateral haircuts, eligibility of more risky ABS tranches, or even some targeted purchases of bank loans if things get worse.

- New TLTRO operations with looser terms and conditions, including a negative 5bp spread to the ECB’s refi rate and possibly longer maturities.

Risks to our baseline: banks do not need more central bank liquidity at the moment and even if they did, the ECB’s refinancing operations continue to be conducted through fixed rate, full allotment procedures until at least end-2017. This includes the last two Targeted Long-Term Refinancing Operations (TLTRO) to be allotted on 24 March and 23 June 2016. Still, the ECB could make those two operations more attractive by lowering their cost (currently set 0.05%), adding a negative spread to the refi rate. Recall that TLTRO rules matter a lot for the credit cycle, if anything because some banks would be forced to repay TLTRO funds should they fail to meet their lending benchmarks. The ECB is unlikely to take that risk, in our view.

Conclusion: the ECB is facing a number of political and technical trade-offs making its decision process more difficult. We expect next week’s package to be specifically designed to support the economy through the bank credit channel in particular; whether it will be well received by the market remains to be seen, depending on how much is priced in (probably a lot, albeit less than in December). Either way, ECB communication should be dovish enough to make clear that more support is coming if needed, including in terms of flexible QE implementation and old-school forward guidance.

[1] See ECB’s lower bound and the impact of negative rates (19 February 2016).

[2] See Second-round effects on core inflation (22 January 2016).

[3] Vitor Constancio and Benoît Coeuré have recently made clear references to the possibility of tiered deposit system aimed at mitigating the cost of negative rates for banks.

[4] Even though Jens Weidmann is not formally voting at the March meeting due to rotating votes, he is unlikely to be bypassed for this reason.