Today’s inflation report raises the likelihood of an even bigger easing package to be delivered at the 10 March meeting. Not only were today’s preliminary inflation figures for the euro area very weak, but the breakdown raised new concerns over the underlying trend in consumer prices – a potential headache for the ECB, independently of recent developments in the real economy and financial markets. According to Eurostat’s estimates, euro area HICP inflation fell to -0.19% y-o-y in February, down from +0.33% in January. The last time headline inflation turned negative was in September 2015 (for one month); before that negative inflation has been recorded during 4 months in early 2015 and during 5 months in 2009. This time again, base effects on commodity prices are playing a large role, with energy HICP down to -8.0% y-o-y in February, back to Q4 2015 levels. The real bad news came from non-energy prices as core HICP inflation (excluding energy, food, alcohol and tobacco) unexpectedly dropped by 30bp, to 0.74% y-o-y in February, its lowest level since April 2015. Part of this decline could reflect the lagged impact of currency appreciation and, possibly, second-round effects of oil prices, which President Mario Draghi identified as a contingency the ECB would have to respond to. Today’s inflation report is likely to deliver the final blow to the ECB.

Topics:

Frederik Ducrozet considers the following as important: ECB, HICP, inflation, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Yen Jumps on Rate Hike Speculation

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Today’s inflation report raises the likelihood of an even bigger easing package to be delivered at the 10 March meeting.

Not only were today’s preliminary inflation figures for the euro area very weak, but the breakdown raised new concerns over the underlying trend in consumer prices – a potential headache for the ECB, independently of recent developments in the real economy and financial markets.

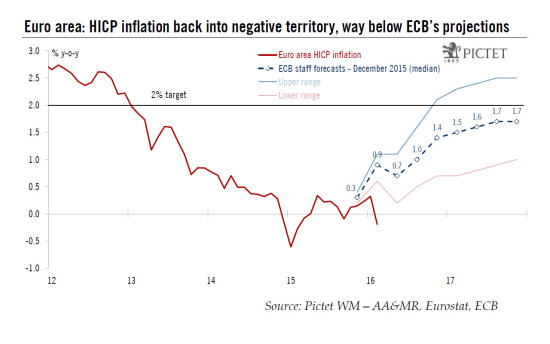

According to Eurostat’s estimates, euro area HICP inflation fell to -0.19% y-o-y in February, down from +0.33% in January. The last time headline inflation turned negative was in September 2015 (for one month); before that negative inflation has been recorded during 4 months in early 2015 and during 5 months in 2009. This time again, base effects on commodity prices are playing a large role, with energy HICP down to -8.0% y-o-y in February, back to Q4 2015 levels.

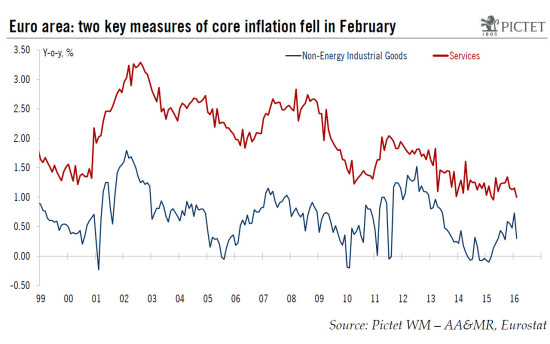

The real bad news came from non-energy prices as core HICP inflation (excluding energy, food, alcohol and tobacco) unexpectedly dropped by 30bp, to 0.74% y-o-y in February, its lowest level since April 2015. Part of this decline could reflect the lagged impact of currency appreciation and, possibly, second-round effects of oil prices, which President Mario Draghi identified as a contingency the ECB would have to respond to.

Today’s inflation report is likely to deliver the final blow to the ECB. We continue to expect a comprehensive easing package at the 10 March meeting, including a 10bp deposit rate cut (along with a tiered deposit system), a EUR20bn increase in the pace of asset purchases (along with changes to QE modalities) as well as new TLTROs (with looser terms and conditions).

From a geographical perspective, the disappointment was fairly equally shared across countries. February HICP inflation fell to -0.2% y-o-y in Germany, to -0.1% in France, to -0.2%in Italy and to -0.9% in Spain, all below consensus expectations.

Looking at the available HICP breakdown, the drop was relatively contained in terms of services inflation, which fell from 1.15% to 1.00% partly on the back of volatile components including German package holidays. We expect services inflation to resume its gradual march higher in coming months. However, Non-Energy Industrial Goods inflation fell sharply, from 0.73% to 0.30% in February, possibly reflecting the delayed impact of a stronger EUR in effective terms on imported inflation.

Meanwhile, Energy inflation has been negative for 20 months now, and base effects are expected to further depress headline HICP in the near-future given the very modest recovery in oil prices so far this year.

On balance, we still see little evidence of large second-round effects of lower oil prices on wage growth and consumer prices at this stage, and we continue to forecast a gradual normalisation in both headline and core inflation rates this year and next, although below the ECB’s target and with downside risks. The ECB will likely become more concerned about potential spill-overs to domestic prices unless commodity prices rebound and/or the currency weakens sharply.

From a broader perspective, the slow yet steady rise in core inflation since Q2 2015 had provided the ECB with some reassurance about the cumulative positive impact of their unconventional policy measures – a rare anchor of stability and hope in recent months, also consistent with reasonably positive prospects for domestic demand and bank credit. Today’s figures will cast some doubt on this optimistic view, potentially affecting medium-term staff projections for inflation which will be released at the 10 March meeting. Note that the last time core inflation surprised with such a large drop, the ECB delivered an unexpected rate cut (in November 2013).

We will soon publish a detailed preview of the upcoming ECB meeting, but there should be no doubt that a more significant easing package is becoming increasingly likely after today’s data. Despite aggressive market expectations, a positive surprise cannot be ruled out.