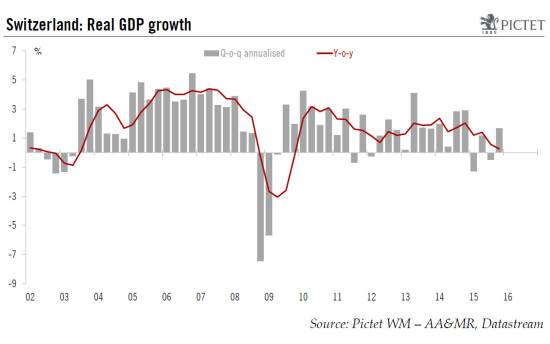

According to SECO’s estimate, Swiss real GDP expanded by 0.4% q-o-q (1.7% q-o-q annualised, 0.3% y-o-y) in Q4, much better than consensus expectations (0.1%). Swiss GDP surprised on the upside in Q4, driven by robust consumption. Looking ahead, our scenario for the Swiss economy remains unchanged. For 2016, we expect Swiss GDP to expand by 1.1% and headline inflation to average -0.6%. The 0.4% q-o-q rise in the Q4 figure came after a downwardly revised Q3 figure of -0.1% q-o-q. For 2015 as a whole, quarterly estimates show a provisional GDP growth rate of 0.9% against 1.9% in 2014. The breakdown by expenditure components should be taken with a pinch of salt as GDP components are particularly volatile in Switzerland. Nevertheless, several observations can be drawn from Q4’s expenditure breakdown. GDP growth was primarily supported by private (+0.1% q-o-q) and public consumption (+0.6% q-o-q). Developments in investment were mixed. Investment in construction (+0.1% q-o-q) rose after two quarters of decrease, while those in equipment (-0.9% q-o-q) declined due to the negative trend in vehicles and R&D investment, according to SECO’s press release. Turning to foreign trade, exports of goods (excluding non-monetary gold, valuables and merchanting) grew markedly by 2.9% in Q4.

Topics:

Nadia Gharbi considers the following as important: GDP, growth, Macroview, Switzerland

This could be interesting, too:

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

According to SECO’s estimate, Swiss real GDP expanded by 0.4% q-o-q (1.7% q-o-q annualised, 0.3% y-o-y) in Q4, much better than consensus expectations (0.1%).

Swiss GDP surprised on the upside in Q4, driven by robust consumption. Looking ahead, our scenario for the Swiss economy remains unchanged. For 2016, we expect Swiss GDP to expand by 1.1% and headline inflation to average -0.6%.

The 0.4% q-o-q rise in the Q4 figure came after a downwardly revised Q3 figure of -0.1% q-o-q. For 2015 as a whole, quarterly estimates show a provisional GDP growth rate of 0.9% against 1.9% in 2014.

The breakdown by expenditure components should be taken with a pinch of salt as GDP components are particularly volatile in Switzerland. Nevertheless, several observations can be drawn from Q4’s expenditure breakdown. GDP growth was primarily supported by private (+0.1% q-o-q) and public consumption (+0.6% q-o-q). Developments in investment were mixed. Investment in construction (+0.1% q-o-q) rose after two quarters of decrease, while those in equipment (-0.9% q-o-q) declined due to the negative trend in vehicles and R&D investment, according to SECO’s press release.

Turning to foreign trade, exports of goods (excluding non-monetary gold, valuables and merchanting) grew markedly by 2.9% in Q4. As in Q3, growth was primarily boosted by chemical and pharmaceutical exports which account for 41% of total exports of goods. In contrast, other categories such as watches or jewellery stagnated or declined. Imports (+4.2% q-o-q) excluding non-monetary gold, valuables and merchanting also posted solid growth in Q4.

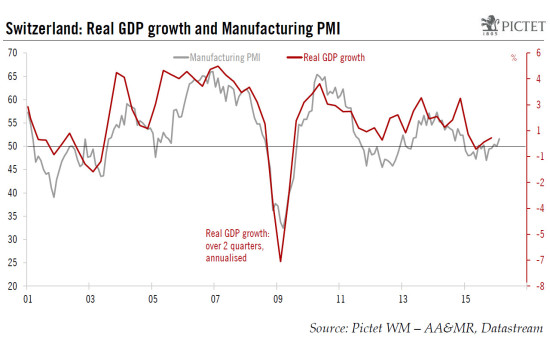

Looking ahead, the latest key Swiss sentiment indicators such as the KOF surveys and the manufacturing PMI (see the chart below) are consistent with an expansion of GDP in Q1.

A bit less consumer-driven in 2016

For 2016 as a whole, domestic demand is likely to remain an important economic driver. Private consumption is expected to continue to grow on the back of continued population growth and rising real disposable income. However, given the fading effect from lower energy prices and the slight deterioration in the labour market due to restrained economic activity, GDP growth is likely to be a bit less consumer-driven. As for investment, the prospects are mixed. Given the subdued economic outlook, there is little hope for an acceleration in the pace of expansion in investment. The strength of the Swiss franc will continue to weigh on exports, although its effect is likely to ease somewhat. The slight acceleration expected in the euro area, which accounts for 37% of total Swiss exports, and decent growth in the US (10% of total Swiss exports) could partly compensate for the impact of the Swiss franc.

Today’s GDP figure was above our forecast and therefore mechanically pushes up our forecast for 2016 as a whole. Nevertheless, given the challenging external environment for the Swiss economy, we are maintaining our scenario unchanged for Swiss GDP to expand by 1.1% for 2016.

Regarding price dynamics, as we mentioned in a previous post, Swiss headline inflation is likely to remain in negative territory in 2016 as well, averaging -0.6%.

Swiss National Bank under mounting pressure

Despite negative inflation, the Swiss National Bank (SNB) has become somewhat less sensitive to persistent undershoots of its inflation target of “less than 2% per year”. In a recent speech, SNB president, Thomas Jordan, said that “in the context of major international spillovers, small open economies must sometimes live with temporary suboptimal inflation”.

Nevertheless, the SNB remains highly sensitive to any new significant appreciation of the Swiss franc, as this would have a serious negative impact on inflation and the growth outlook. Given the increasing chance of an aggressive package by the ECB (see also the ECB preview coming soon) on 10 March, the pressure on the SNB is mounting. In an attempt to curb the recent Swiss franc appreciation (+2.3% since early February against the euro) and to signal to markets that the SNB is not out of ammunition, Thomas Jordan stated for the first time in a speech at the G20 that the SNB could reduce the size of the exemption threshold.

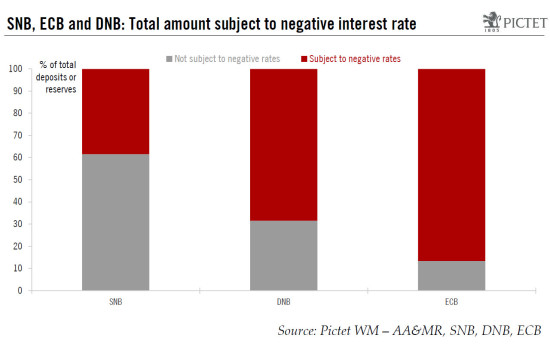

Currently, the exemption threshold is fixed at 20 times the minimum reserve requirement. At present, some 40% of SNB sight deposits are subject to the negative interest rate, which is less than in other central banks (see the chart below). A hypothetical scenario where the SNB reduces the exemption threshold to 10 times and leaves the target rate at -0.75% would increase the total cost for banks to approximately CHF 2.4 bn.

As a result, in the event of Swiss franc appreciation, the first step is likely to be increased FX intervention, which creates less distortion for the banking system. However, if intervention fails to weaken the Swiss franc, a new decrease of the target rate (CHF 3-month Libor) further into negative territory or a reduction of the exemption threshold cannot be ruled out at the next meeting on 17 March.