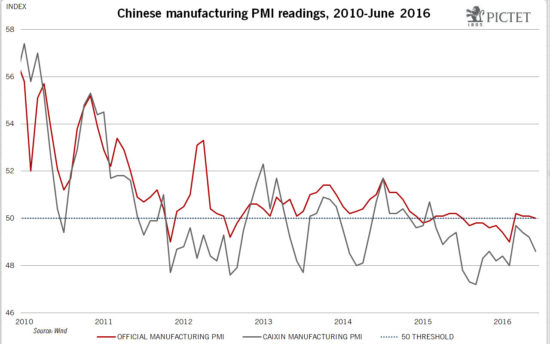

Macroview Nonmanufacturing helped by construction, but growth may slow given stimulus pull-back China’s official and Caixan purchasing manufacturing indices (PMI) declined in June. The official figure stood at 50 (down from 50.1 in May), right at the mid-point between expansion and contraction, while the Caixin PMI fell to 48.6. At the same time, the official PMI figures show that activity at large companies, many of them state owned, was much stronger than at small and medium-sized companies. The underperformance of smaller companies is seen as an indication of the challenges facing the private sector. The decline in growth in fixed asset investment is a further sign of the pressures facing the private sector in China.Meanwhile, the Chinese non-manufacturing PMI rose in June thanks to strong construction activity. However, we believe construction activity may well drop in the coming months as government stimulus eases. Indeed, there have been noticeable declines in recent growth figures for bank loans and total social financing (TSF) and the property market has cooled in the last few months.Overall, however, the June PMI readings are consistent with our forecasts. We expect China to “muddle through” to 6.5% GDP growth this year thanks to continued government support.

Topics:

Dong Chen considers the following as important: China economic activity, Chinese growth, Chinese manufacturing, Chinese PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Nonmanufacturing helped by construction, but growth may slow given stimulus pull-back

China’s official and Caixan purchasing manufacturing indices (PMI) declined in June. The official figure stood at 50 (down from 50.1 in May), right at the mid-point between expansion and contraction, while the Caixin PMI fell to 48.6. At the same time, the official PMI figures show that activity at large companies, many of them state owned, was much stronger than at small and medium-sized companies. The underperformance of smaller companies is seen as an indication of the challenges facing the private sector. The decline in growth in fixed asset investment is a further sign of the pressures facing the private sector in China.

Meanwhile, the Chinese non-manufacturing PMI rose in June thanks to strong construction activity. However, we believe construction activity may well drop in the coming months as government stimulus eases. Indeed, there have been noticeable declines in recent growth figures for bank loans and total social financing (TSF) and the property market has cooled in the last few months.

Overall, however, the June PMI readings are consistent with our forecasts. We expect China to “muddle through” to 6.5% GDP growth this year thanks to continued government support.