We see the ECB making its QE programme progressively more flexible in response to the shortage of eligible bonds Press reports suggest the European Central Bank (ECB) may be weighing up the idea of loosening its QE rules via a deviation from the capital keys which the central bank uses as a basis for balancing its sovereign bonds purchases across euro area member states.The ECB faces a problem, because a Brexit-led flight-to-safety has reduced the universe of core bonds eligible for purchases as part of its QE programme (to be eligible, bonds have to have a yield above the current deposit rate of -0.40%). This programme is meant to run until March 2017, with the possibility of running further.We ourselves believe that an explicit deviation from capital keys would be an optimal solution, but there are institutional constraints to be taken into account that would favour a more gradual and flexible approach, barring severe financial stress.

Topics:

Frederik Ducrozet considers the following as important: ECB asset purchases, ECB bond scarsity, ECB capital keys, ECB QE, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We see the ECB making its QE programme progressively more flexible in response to the shortage of eligible bonds

Press reports suggest the European Central Bank (ECB) may be weighing up the idea of loosening its QE rules via a deviation from the capital keys which the central bank uses as a basis for balancing its sovereign bonds purchases across euro area member states.

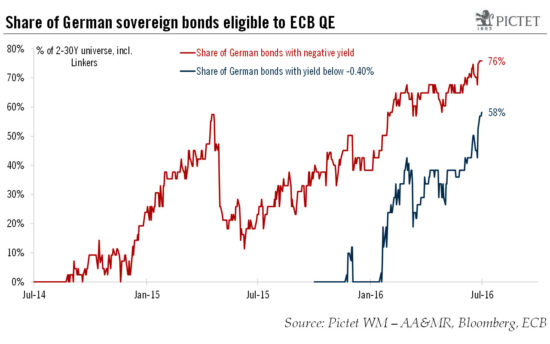

The ECB faces a problem, because a Brexit-led flight-to-safety has reduced the universe of core bonds eligible for purchases as part of its QE programme (to be eligible, bonds have to have a yield above the current deposit rate of -0.40%). This programme is meant to run until March 2017, with the possibility of running further.

We ourselves believe that an explicit deviation from capital keys would be an optimal solution, but there are institutional constraints to be taken into account that would favour a more gradual and flexible approach, barring severe financial stress.

Specifically, our best guess is that the ECB announces the following changes by September: 1) a 6-month extension of its QE programme until September 2017; 2) an increase in issuer limits from 33% to 50% for high-rate bonds without collective action clauses (CAC), including German bonds; 3) the possibility that if issue limits are hit in one country, additional bond purchases are re-allocated to other countries based on current capital keys (but recalculated excluding the country where eligible bonds are ‘scarce ’) possibly without risk-sharing. Indeed, a deviation from capital keys that only applies to a limited share of additional bond purchases and that does not include risk-sharing could be an acceptable compromise. If an agreement were reached, we believe the ECB’s current QE programme could be extended into 2018 if needed, with fewer concerns about the scarcity of eligible bonds.

In the end, we believe even small, targeted deviations from the ECB’s capital keys have the potential to boost risk sentiment and to improve monetary policy transmission to the euro area periphery.