But in the medium to long term, Swiss growth will depend on the terms of the UK’s exit from the EU While it is outside the EU, Switzerland is not immune to external shocks such as Brexit. The transmission channels are multiple (direct trade exposure, financial markets, confidence effect, political agenda…). That said, while the Swiss economy is mainly an export economy, its exposure to the UK is limited. Exports of goods to the UK represent 6% of total Swiss exports, for example, and half of the exports to the UK are pharmaceutical and chemical products, which, according to our estimates, could be relatively insensitive to sterling decline. Instead, the main risks for the Swiss economy come from a potential slowdown in the euro area and/or a sharp appreciation of the Swiss franc against the euro.Following the Brexit vote, we revised downward our GDP growth forecast for the euro area this year from 1.8% to 1.5%. But while additional downside risks from Brexit cannot be ruled out, we are leaving our already cautious scenario for the Swiss economy unchanged. Our 2016 GDP growth forecast for Switzerland is maintained at 0.9%, although with additional downside risks depending on the outcome of negotiations between the Confederation and the EU (over the free movement of labour) and between the EU and the UK.

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss Brexit, Swiss growth, Swiss National Bank

This could be interesting, too:

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

But in the medium to long term, Swiss growth will depend on the terms of the UK’s exit from the EU

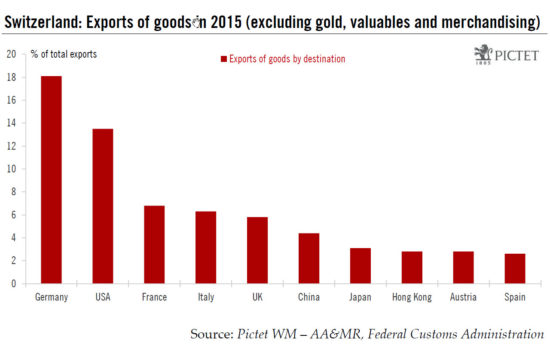

While it is outside the EU, Switzerland is not immune to external shocks such as Brexit. The transmission channels are multiple (direct trade exposure, financial markets, confidence effect, political agenda…). That said, while the Swiss economy is mainly an export economy, its exposure to the UK is limited. Exports of goods to the UK represent 6% of total Swiss exports, for example, and half of the exports to the UK are pharmaceutical and chemical products, which, according to our estimates, could be relatively insensitive to sterling decline. Instead, the main risks for the Swiss economy come from a potential slowdown in the euro area and/or a sharp appreciation of the Swiss franc against the euro.

Following the Brexit vote, we revised downward our GDP growth forecast for the euro area this year from 1.8% to 1.5%. But while additional downside risks from Brexit cannot be ruled out, we are leaving our already cautious scenario for the Swiss economy unchanged. Our 2016 GDP growth forecast for Switzerland is maintained at 0.9%, although with additional downside risks depending on the outcome of negotiations between the Confederation and the EU (over the free movement of labour) and between the EU and the UK.

Already overvalued, further franc appreciation would put even more pressure on the Swiss export sector. As a result, the Swiss National Bank (SNB) is likely to remain active. But the SNB will also want to see what other central banks do, in particular the Bank of England (which holds a policy meeting on 14 July) and the European Central Bank (21 July). If the Swiss franc comes under renewed upward pressure, the SNB is likely first to use forex market intervention as its main policy tool, but we believe the option of cutting the policy rate (CHF Libor 3-month) further will only be used in the case of significant currency appreciation. The SNB will be very cautious about using this option given the impact on the banking system. Other options such as removing or changing the exemption threshold (beyond which the SNB charges negative interest on sight deposits it holds from banks) seem unlikely at this stage.