The effects of the UK referendum continue to reverberate throughout the euro area. But the ECB stands ready to steady nerves, and we believe Brexit could bring some benefit to the euro area. As a result of the Brexit vote, our in-house model points to a net drag on euro area GDP of around 0.50% over the next three years through direct trade and financial linkages. This is similar to the ECB’s own forecast. In addition, we have lowered our euro area GDP forecast to 1.5% in 2016 (from 1.8%) and 1.3% in 2017 (from 1.7%).The European Central Bank is naturally monitoring macroeconomic and financial developments closely. Stabilisation in economic and financial conditions will hinge on the so-called ‘ECB put’, i.e. the expectation that the ECB will intervene strongly to prevent any signs of prolonged market turbulence. With a strong focus on the monetary transmission channels, the ECB is likely to respond to any renewed pressure on the banking sector in general, and on peripheral banks in particular. In addition, a downgrade to the outlook for price stability will likely force some policy adjustments by September, in our view, including a 6-month quantitative easing (QE) extension and some targeted changes in QE parameters.

Topics:

Frederik Ducrozet considers the following as important: euro area post-Brexit, euro area referendums, European integration, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The effects of the UK referendum continue to reverberate throughout the euro area. But the ECB stands ready to steady nerves, and we believe Brexit could bring some benefit to the euro area.

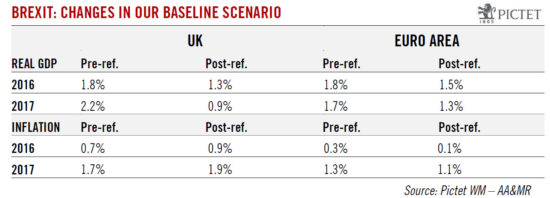

As a result of the Brexit vote, our in-house model points to a net drag on euro area GDP of around 0.50% over the next three years through direct trade and financial linkages. This is similar to the ECB’s own forecast. In addition, we have lowered our euro area GDP forecast to 1.5% in 2016 (from 1.8%) and 1.3% in 2017 (from 1.7%).

The European Central Bank is naturally monitoring macroeconomic and financial developments closely. Stabilisation in economic and financial conditions will hinge on the so-called ‘ECB put’, i.e. the expectation that the ECB will intervene strongly to prevent any signs of prolonged market turbulence. With a strong focus on the monetary transmission channels, the ECB is likely to respond to any renewed pressure on the banking sector in general, and on peripheral banks in particular. In addition, a downgrade to the outlook for price stability will likely force some policy adjustments by September, in our view, including a 6-month quantitative easing (QE) extension and some targeted changes in QE parameters.

While downside risks are likely to dominate the euro area’s fate in the months ahead, including political contagion from Brexit, we believe that the risk of a referendum on EU membership in another country remains low for this year and next. In most countries, an outright parliamentary majority would be required for a referendum initiative to be launched.

The truth is that no one knows how long and how painful the political, economic and financial adjustments to Brexit will be. The downside risks are likely to dominate until we get a better idea of the post-Brexit framework, including the risk of possible political contagion to other EU states. Although the transmission channels are complex and our forecasts are fraught with huge uncertainty.

Eventually, however, Brexit could be positive for EU cohesion: the more painful the experience for the UK, the higher the chances that we see stronger commitment to Europe in other countries. After a period of instability, there is a chance that eurosceptic sentiment will decline rather than increase following the Brexit vote.