Relatively strong credit data for October were not enough to prevent the credit impulse from continuing to soften.Euro area bank credit flows to non-financial corporations rebounded strongly in October, by EUR11 bn in adjusted terms. Bank loans to households continued to expand at a healthy pace (+EUR10 bn). The slowdown in annual growth of the broad monetary aggregate M3, from 5.1% to 4.4% year on year in October, was largely due to base effects.The rebound in credit flows to the private sector was particularly strong in France and to a lesser extent in Germany. Credit flows were weaker in Italy and Spain, with the three-month average in negative territory in both countries.The European Central Bank will welcome the rebound in credit flows in October, but we see little reason to celebrate as the credit impulse remains subdued, pointing to a slowdown in aggregate private demand in the quarters ahead. A strong rebound in credit flows to enterprises will be needed for the impulse to rise significantly from here and remain consistent with a rate of GDP growth that remains stable.Our cautious assessment of the credit cycle is also underpinned by the latest Bank Lending Survey pointing to modest gains in credit flows in the next few months in what remains a very challenging environment for commercial banks.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: credit impulse, euro area credit demand, euro area credit flows, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

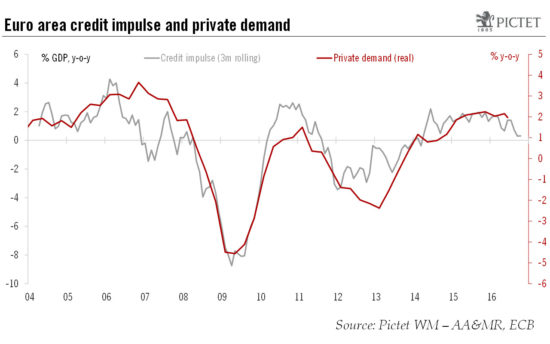

Relatively strong credit data for October were not enough to prevent the credit impulse from continuing to soften.

Euro area bank credit flows to non-financial corporations rebounded strongly in October, by EUR11 bn in adjusted terms. Bank loans to households continued to expand at a healthy pace (+EUR10 bn). The slowdown in annual growth of the broad monetary aggregate M3, from 5.1% to 4.4% year on year in October, was largely due to base effects.

The rebound in credit flows to the private sector was particularly strong in France and to a lesser extent in Germany. Credit flows were weaker in Italy and Spain, with the three-month average in negative territory in both countries.

The European Central Bank will welcome the rebound in credit flows in October, but we see little reason to celebrate as the credit impulse remains subdued, pointing to a slowdown in aggregate private demand in the quarters ahead. A strong rebound in credit flows to enterprises will be needed for the impulse to rise significantly from here and remain consistent with a rate of GDP growth that remains stable.

Our cautious assessment of the credit cycle is also underpinned by the latest Bank Lending Survey pointing to modest gains in credit flows in the next few months in what remains a very challenging environment for commercial banks.

These factors lead us to expect that the ECB will continue to look for ways to stimulate activity. We expect it to extend its quantitative easing programme by six months beyond its March deadline at its 8 December policy meeting, continuing to buy bonds at the current EUR80 bn per month pace.