3Q GDP growth in the euro area met expectations. The play off between strong business indicators and weak-ish credit dynamics means we maintain our full-year growth forecast of 1.5% in 2016.Euro area real GDP expanded at a quarter-on-quarter (q-o-q) rate of 0.3% in Q2 (1.4% q-o-q annualised, 1.6% year on year), in line with expectations and our own forecast. This comes after GDP growth of 0.3% q-o-q in Q2 and 0.5% q-o-q in Q1.Looking ahead, risks to our scenario for the euro area economy...

Read More »Strong U.S. GDP report conceals softness of some components

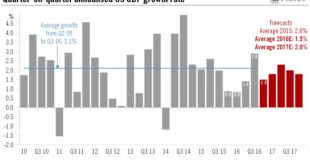

3Q GDP growth was flattered by a temporary surge in soybean exports, while consumer spending was disappointing. However, our 2016 and 2017 growth forecasts remain unchanged.On the back of a temporary surge in exports, real US GDP grew by a strong 2.9% in Q3, above consensus expectations. Our yearly average forecasts that US GDP will grow by 1.5% in 2016 and 2.0% in 2017 remain unchanged. The robust rate of expansion in Q3 needs to put in proper context. First, it is partly linked to a...

Read More »Taking stock of the latest European GDP numbers

While growth in the UK and Spain is proving resilient, it is expected to slow in both places next year, while growth in France will remain moderate.This week saw the release of preliminary third-quarter GDP numbers in the UK, France and Spain. Following stronger-than-expected GDP growth (+0.5% q-on-q in the third quarter), we have revised our growth forecast for the UK higher, to 2.0% in 2016, (up from an earlier estimate of 1.8%). However, we still expect the fallout from the Brexit...

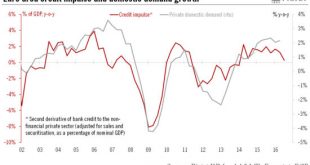

Read More »Disappointing credit flow figures in the eurozone

Data pose a downside risk for GDP forecast and strengthens case for additional ECB intervention.Euro area bank credit flows to non-financial corporations (NFC) were pretty disappointing in September (coming in flat after a decline of EUR 1bn in August). On a country by country basis, NFC flows were positive for the four biggest economies, but not enough to bring the 3-month average back into positive territory in Italy and Spain. On a brighter note, credit flows to euro area households rose...

Read More »Pictet – In Conversation with Sally Osberg

Sally Osberg, who has lead the Skoll Foundation since its creation in year 2000, spoke to an audiance of 80 entrepreneurs and investors at The Pictet Entrepreneur Summit Seminar held in Geneva in September 2016. Sally said that to be successful, a social entrepreneur has to really understand the system that creates the problem – the actors and the forces – in order to intervene at a high leverage point. In this conversation, she explains the approach taken by the Skoll Foundation and how...

Read More »Euro area business surveys point to strong start to Q4

Markit Flash PMI surveys for October were above consensus and there was a considerable improvement in sentiment in Germany, possibly pointing to stronger Q4 GDP figures. Euro area business surveys just released show a solid start to the fourth quarter. More importantly still, these forward-looking indicators suggested that growth is likely to gain momentum in the months ahead, in particular in Germany. The good performance of the German manufacturing sector suggests that external demand...

Read More »Spain: an end to 10 months of political deadlock

Macroview There is a risk that government will not be able to serve full term, but markets are now becoming more focused on the Italian referendum in December. After 10 months of political impasse, Spain is set to have a new government at the end of this week. The decision by the Socialist party (PSOE) to abstain in the second parliament investiture vote clears the way for a minority government to be formed under prime minister Mariano Rajoy and thus avoids the need for a third general...

Read More »ECB: rendezvous in December!

Macroview ECB keeps holding pattern, but we expect an extension of bond purchases in December Nothing in today’s ECB press conference challenged our view that quantitative easing (QE) will be extended at the bank’s next policy meeting on 8 December. We continue to expect the bank to use this meeting to announce a six-month extension of its QE programme beyond March 2017, with monthly asset purchases maintained at their current pace of EUR80 bn monthly, resulting in EUR480 bn in extra asset...

Read More »Chinese GDP forecast revised up for 2016

Third-quarter data leads us to revise up our growth forecast for this year to 6.7%, but forecast for 2017 remains unchanged at 6.2%. The latest data releases confirm our view that the Chinese economy is stabilising for the moment and that growth is on track to meet the government’s target of 6.5%-7% in 2016. The strong Q3 GDP reading leads us to revise our full-year GDP forecast for China to 6.7% from our previous forecast of 6.5%.Recent Chinese data releases prompt several...

Read More »Weekly View, 18 October 2016

Weekly View Pictet Wealth Management’s near-term view on the economy and financial markets18 October 2016.Last week saw profit-taking on equity markets. Chinese export data unsettled Asian markets (the MSCI Asia ex-Japan fell 2.4% in local currency), but had no notable effect on developed markets (the S&P500 lost 1% in local currency while the Stoxx 600 edged up 0.1%). Cyclicals did better than defensives.A turnaround in earnings growth forecasts following several disappointing years...

Read More » Perspectives Pictet

Perspectives Pictet