But the potential for fiscal stimulus and ongoing Fed tightening are factors that support USD appreciation in 2017 at least.Our core scenario foresees risk appetite remaining robust as President Trump adopts a more moderate stance on protectionism than his past rhetoric would suggest. The USD should appreciate most against low-yielding currencies. But while we acknowledge that fundamental drivers also justify further USD strength, we believe that the long-term trend of USD appreciation is reaching maturity and that some currencies are likely to be more attractive to sell against the USD than others.Among G10 currencies, the Japanese yen could weaken the most against the greenback as it is heavily penalised by the Bank of Japan’s 0% yield target in a global environment of higher yields. The euro should also weaken against the US dollar—but to a lesser extent, as the ECB’s impact on the long-end of the yield curve (through its asset-buying programme) is smaller than the BoJ’s. The prospect of ECB tapering in early 2018 should give some support to the euro in the second half of next year. This idea finds some support in the 10-year real yield differential, which is not pointing to a sharp decline in EUR/USD.

Topics:

Luc Luyet considers the following as important: currency cycle, dollar appreciation, Macroview, US dollar

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Joseph Y. Calhoun writes Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

But the potential for fiscal stimulus and ongoing Fed tightening are factors that support USD appreciation in 2017 at least.

Our core scenario foresees risk appetite remaining robust as President Trump adopts a more moderate stance on protectionism than his past rhetoric would suggest. The USD should appreciate most against low-yielding currencies. But while we acknowledge that fundamental drivers also justify further USD strength, we believe that the long-term trend of USD appreciation is reaching maturity and that some currencies are likely to be more attractive to sell against the USD than others.

Among G10 currencies, the Japanese yen could weaken the most against the greenback as it is heavily penalised by the Bank of Japan’s 0% yield target in a global environment of higher yields. The euro should also weaken against the US dollar—but to a lesser extent, as the ECB’s impact on the long-end of the yield curve (through its asset-buying programme) is smaller than the BoJ’s. The prospect of ECB tapering in early 2018 should give some support to the euro in the second half of next year. This idea finds some support in the 10-year real yield differential, which is not pointing to a sharp decline in EUR/USD.

Emerging-market currencies with weak external buffers, such as a high current account deficit or a high ratio of short-term external debt to FX reserves, could also suffer in the current environment. Future rises in US yields also make low-yielding emerging market Asian currencies particularly unattractive. By contrast, high-yielding currencies should benefit from a brighter global growth outlook, a risk-positive environment and the abeyance of concerns about trade.

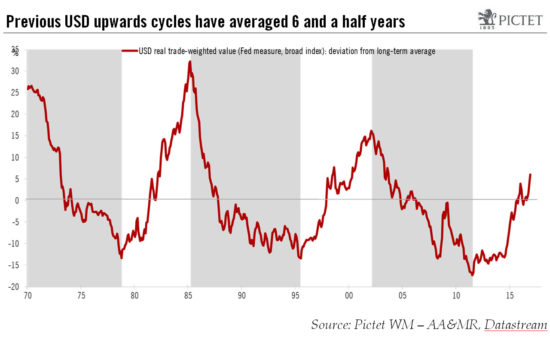

Our in-house core scenario is based on a fiscal stimulus worth roughly 1.0% of GDP (0.2% in H2 2017 and 0.8% in 2018), with Congress likely to water down Trump’s plans for anything more substantial. But providing we do not see a budget stimulus significantly higher than this, long-term analysis suggests that the USD could stop appreciating in 2018. The current dollar appreciation cycle started in July 2011. Previous such cycles have tended to last roughly six and a half years on average, suggesting that the current one could be close to ending. At the same time, we recognise that a sizeable fiscal stimulus, coupled with the Fed’s tightening cycle, could prolong the long-term appreciation of the US dollar for a while yet.