A ‘No’ vote in the 4 December referendum would be seen as a negative by investors in Italy, adding to the challenges the country must face.The 4 December referendum on senate reform is the next big event on the European political calendar, coming just ahead of the next ECB and Fed policy meetings on 8 December and 14 December, respectively.We believe a ‘Yes’ vote would boost government confidence and marginally help Italian securities, but is unlikely to represent a significant game changer for Italy and for the euro zone as a whole. By contrast, a ‘No’ vote would add to the current political uncertainty and could hurt an already fragile and modest recovery.Italian sovereign bonds have come under increasing stress. The spread between 10-year Italian government bonds and their Spanish equivalents is now close to their highest level since 2011. Should the referendum be rejected, spreads are likely to widen even more. However, the ECB could be expected to provide a sufficient backstop to avoid any stress spiralling into a systemic crisis. Moreover, Italy benefits from a relatively stable base of domestic investors.There is also the risk that Italy’s sovereign debt rating will be downgraded (both DBRS and Fitch have their ratings of Italy’s debt on negative outlook).

Topics:

Nadia Gharbi considers the following as important: Italian bonds, Italian politics, Italian referendum, Italy, Macroview

This could be interesting, too:

Marc Chandler writes The Greenback is in Narrow Ranges to Start the Week

Marc Chandler writes Sharp Fall in US Yields ahead of Large Supply

Marc Chandler writes The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Marc Chandler writes Fitch Roils Markets

A ‘No’ vote in the 4 December referendum would be seen as a negative by investors in Italy, adding to the challenges the country must face.

The 4 December referendum on senate reform is the next big event on the European political calendar, coming just ahead of the next ECB and Fed policy meetings on 8 December and 14 December, respectively.

We believe a ‘Yes’ vote would boost government confidence and marginally help Italian securities, but is unlikely to represent a significant game changer for Italy and for the euro zone as a whole. By contrast, a ‘No’ vote would add to the current political uncertainty and could hurt an already fragile and modest recovery.

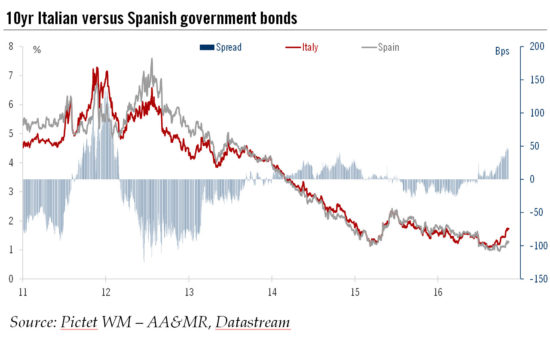

Italian sovereign bonds have come under increasing stress. The spread between 10-year Italian government bonds and their Spanish equivalents is now close to their highest level since 2011. Should the referendum be rejected, spreads are likely to widen even more. However, the ECB could be expected to provide a sufficient backstop to avoid any stress spiralling into a systemic crisis. Moreover, Italy benefits from a relatively stable base of domestic investors.

There is also the risk that Italy’s sovereign debt rating will be downgraded (both DBRS and Fitch have their ratings of Italy’s debt on negative outlook). A downgrade would force Italy’s banks to post more collateral to keep the ECB funding they receive, adding to the concerns that already beset the Italian banking system. A ‘No’ vote could also increase the difficulty of a market-based recapitalisation of the Italian banking sector. Without a market solution, a bail-in and a state bailout may be required for Monte dei Paschi di Siena. The total amount involved is manageable, but would likely be seen as a defeat for the government and could prolong banking industry uncertainty.

Rejection of the referendum could dent consumption and investment prospects, hurting an already fragile and modest recovery. Higher sovereign bond yields (even if the ECB’s QE provides support) could put sovereign sustainability at risk and worsen the banking sector’s problems. In addition, further reforms would likely be put on hold, at least until the next general elections.

By contrast, the government of Matteo Renzi is more likely to remain in place until the next elections that are due in 2018 if the referendum is carried. The focus would then shift back to the separate issue of changes that have been introduced to the voting system, which some believe increase the probability of the anti-establishment party winning majority control of parliament at the next general elections.

Whatever happens, the outlook for Italy will remain challenging in 2017. Additional meaningful structural reforms are unlikely, as the government will want to avoid controversial measures that would cost it support before the 2018 elections. Overall, independently of the referendum outcome, Italian growth is likely to remain modest in 2017. Major weaknesses such as high public debt, low productivity and a fragile banking sector are unlikely to be solved in the current climate.