Published: Monday July 03 2017Stocks in businesses that provide security solutions in a wide variety of market sectors are proving to be an attractive investment theme with growth fuelled by innovation, urbanisation and regulation.When Pictet Asset Management launched the Security Fund ten years ago, the security market was not seen as a strong or growing one. But today the security industry is growing very fast, and expanding to cover many different market sectors.Security permeates our lives, from dawn to dusk. When we rise in the morning, we use electricity, gas and water to heat our homes, shower and make breakfast – relying on utilities whose operations are securely protected. We travel to work by car or public transport, using equipment secured for our safety and under the watchful

Topics:

Perspectives Pictet considers the following as important: In Conversation With, Pictet Report, Pictet Report Summer 2017, Pictet-Security Fund, Security Industry, Security Investment

This could be interesting, too:

Perspectives Pictet writes House View, October 2020

Perspectives Pictet writes Weekly View – Reality check

Perspectives Pictet writes Exceptional Swiss hospitality and haute cuisine

Jessica Martin writes On the ground in over 80 countries – neutral, impartial and independent

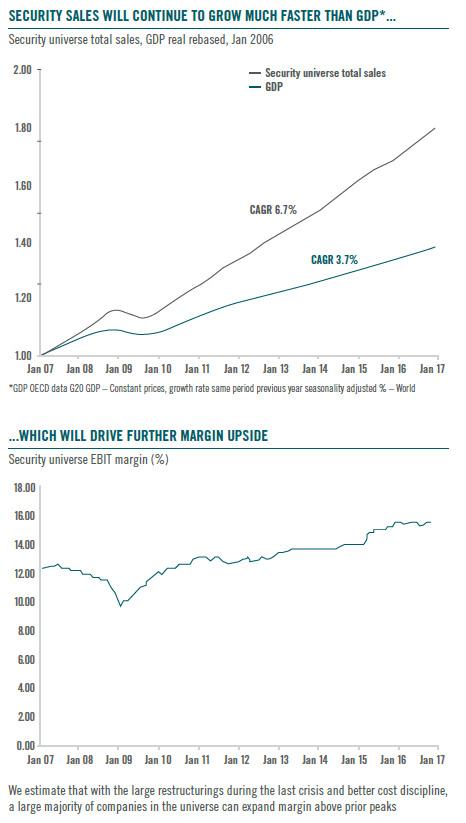

Stocks in businesses that provide security solutions in a wide variety of market sectors are proving to be an attractive investment theme with growth fuelled by innovation, urbanisation and regulation.

When Pictet Asset Management launched the Security Fund ten years ago, the security market was not seen as a strong or growing one. But today the security industry is growing very fast, and expanding to cover many different market sectors.

Security permeates our lives, from dawn to dusk. When we rise in the morning, we use electricity, gas and water to heat our homes, shower and make breakfast – relying on utilities whose operations are securely protected. We travel to work by car or public transport, using equipment secured for our safety and under the watchful eyes of products such as video surveillance.

At work, there are plenty of cyber-security functionalities activated when working online, while the safety of our meals is ensured by testing and traceability. When we shop, we use electronic payment systems that authenticate our transactions and detect fraud. When we travel by train or plane, our safety is ensured during the journey.

The security industry is everywhere, strongly anchored in our daily life, which is why it has been growing so fast over the last few years. And what makes it attractive to investors is that there are three long-term drivers providing secular growth: innovation, urbanisation and regulation.

Innovation can be seen in the new security needs that have arisen from modern technologies. Let’s take the automotive industry as an example. The autonomous car is no longer a dream: it will be reality in the next couple of years. To get there, the security content for each vehicle will increase significantly. It is not only about seatbelts and airbags but features such as cameras, sensors, autonomic braking systems, radar, laser and night visions systems.

There are similar demands for internet security, which was barely required 25 years ago when we mainly used phones and faxes. Now the internet connects billions of people online through many different devices. Security challenges already include data theft and hacking attacks but it is still early days for the emerging cyber-security market. Only 50 per cent of the world’s population is online and connecting the rest will expose the IT infrastructure to new threats at a time when data breaches are already increasing by 60 per cent a year.

The second driver is urbanisation which requires massive investment to secure infrastructure such as power plants, mass transit systems, airports and water utilities. More than half the world’s population now lives in urban areas, and that proportion continues to rise.

Security spending on urban areas in developing and emerging markets is forecast to grow at around 9 per cent a year over the next five years – more than twice the rate in developed markets. Dubai is a good example of what can be achieved when building a new smart city that did not exist two decades ago, integrating brand new security solutions into its infrastructure.

The third driver is regulation, which imposes rules on public bodies, companies and individuals that must be applied. Even in sectors such as financial services where compliance officers apply the rules, testing, inspection and certification has become big business. And new rules are coming all the time – for example, the mandatory side-airbags for every new car in Brazil recently. In France, every home has had to have a smoke alarm since 2015.

In a near future, all new vehicles in Europe must have an eCall terminal which automatically contacts the emergency services if it is involved in a crash – a rule recently introduced in Russia. Meanwhile, the EU’s General Data Protection Regulation which will be enforced in 2018 will require European companies to disclose data breaches, their financial and reputational impact such as the number and kind of data stolen, and the measures taken to avoid repetition. Not complying with this new regulation will also mean the possibility of companies being sued, with fines amounting to 4 per cent of turnover or EUR20 million.

Then there are food regulations which support a large food-testing market around the world. The number of international standards rises every year, and the regulations have to be implemented.

Given this sharp growth in the security industry, Pictet has identified a universe of 330 companies with relevant theme-related activities which have a total market capitalisation of USD3.3 trillion. Applying our SRI criteria excludes any company with more than 5 per cent of sales related to defence or military equipment. Furthermore, our purity test eliminates companies with less than 20 per cent of sales in security. These criteria reduce the universe to around 210 companies with a total market cap of USD1.1 trillion.

Next comes Pictet’s investment process to manage the liquidity and share price volatility of the portfolio for risk management purposes. We visit the companies once or twice a year to evaluate their business franchise – their strategy, competitors, pricing power and similar issues. We also assess the management quality – what kind of management, track record, shareholder-friendliness and how it applies ESG factors.

We score the 210 stocks, and select the 60–75 best companies to make up the portfolio. The portfolio is solely made up of the strongest convictions without any references being made to any benchmarks – geographic exposure, for example, is the result of our conviction ideas. So in December 2016, six of the top ten stocks were US-based companies, two from Japan and one each from Sweden and The Netherlands.