While core inflation was slightly stronger than expected in June, we believe it will rise only slowly for the rest of this year.Euro area ‘flash’ HICP inflation eased to 1.3% y-o-y in June (down from 1.4% in May) while core inflation increased to 1.1% (up from 0.9% in May). Both figures were slightly above consensus expectations, but our overall assessment is unchanged. The bottom line from the June inflation report is that the broad picture remains unchanged – we continue to expect euro area core inflation to rise only very slowly in the months ahead.The main boost to core inflation in June came from services inflation, which rebounded to 1.6%, from 1.3%. This was probably due to exceptional factors such as the timing of the Pentecost holiday in Germany or the sales discount in France,

Topics:

Frederik Ducrozet considers the following as important: ECB inflation projections, euro area core inflation, euro area headline inflation, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While core inflation was slightly stronger than expected in June, we believe it will rise only slowly for the rest of this year.

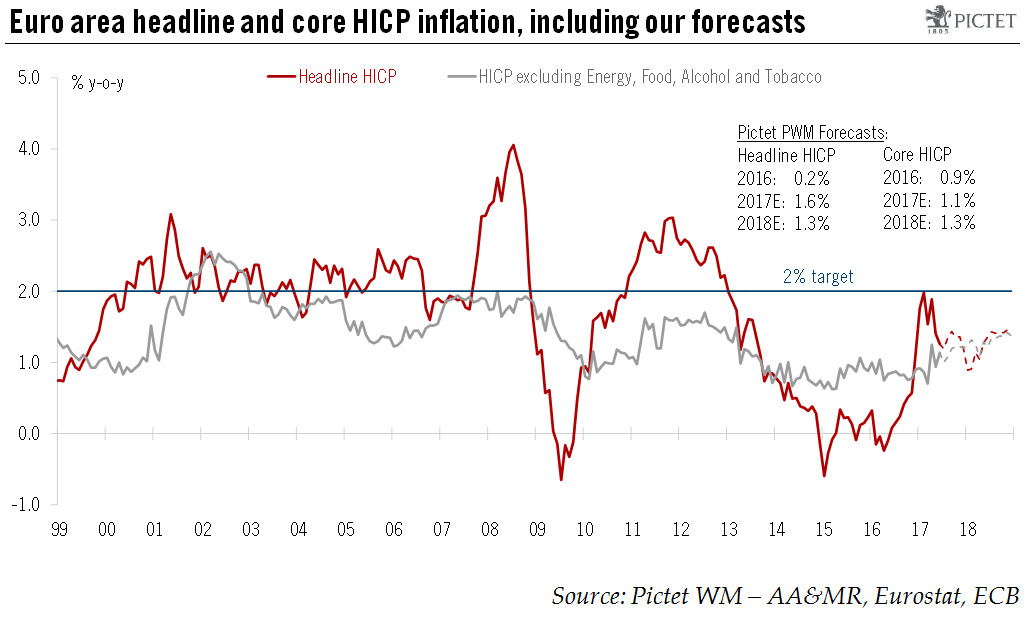

Euro area ‘flash’ HICP inflation eased to 1.3% y-o-y in June (down from 1.4% in May) while core inflation increased to 1.1% (up from 0.9% in May). Both figures were slightly above consensus expectations, but our overall assessment is unchanged. The bottom line from the June inflation report is that the broad picture remains unchanged – we continue to expect euro area core inflation to rise only very slowly in the months ahead.

The main boost to core inflation in June came from services inflation, which rebounded to 1.6%, from 1.3%. This was probably due to exceptional factors such as the timing of the Pentecost holiday in Germany or the sales discount in France, with a modest setback possible next month.

Unless oil prices rebound and/or the currency depreciates significantly from here, headline inflation is at risk of falling more significantly at the beginning of 2018 and the ECB staff forecasts could be lowered in September. This strengthens our view that a QE tapering announcement is likely to be postponed to October or December 2017.