June PMI surveys suggest that economic activity moderated only slightly in the last quarter, but we maintain our view the deceleration in Chinese growth will be more notable in the second half.China’s official manufacturing PMI rose to 51.7 in June, the second highest reading in 2017. The Markit manufacturing PMI also rebounded to 50.4 in June after having dropped below the 50 threshold in the previous month. The rise in both indices in June suggests that China’s growth momentum in the second quarter was likely still fairly solid, only moderating mildly from Q1.Looking further ahead, however, we continue to expect the Chinese economy to decelerate more notably in the second half of 2017. On the monetary policy front, we believe that the People’s Bank of China will likely maintain a

Topics:

Dong Chen considers the following as important: China growth forecast, China growth momentum, China PMI, Chinese exports, Chinese manufacturing, Chinese policy tightening, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

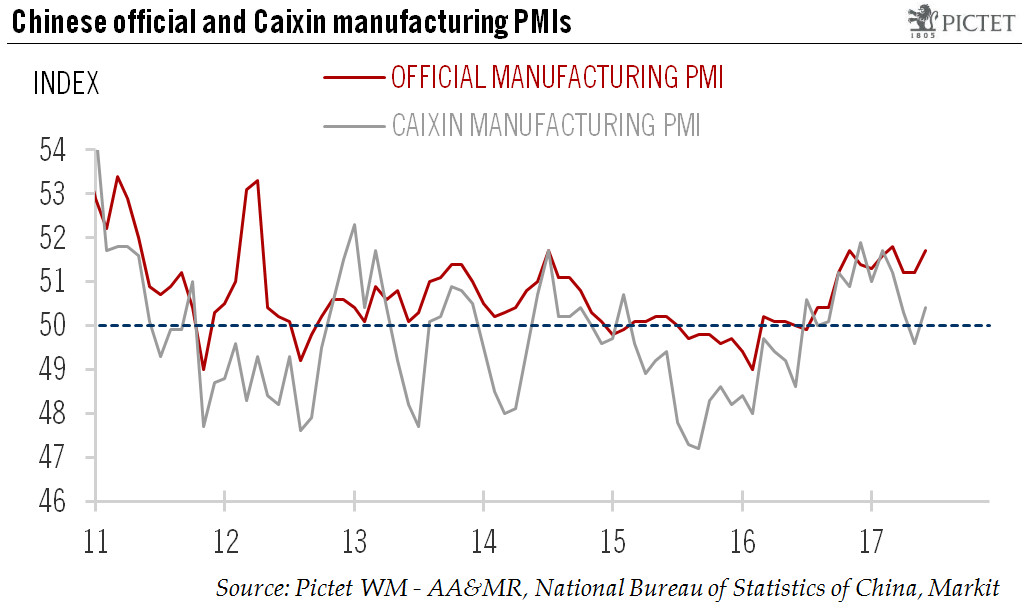

June PMI surveys suggest that economic activity moderated only slightly in the last quarter, but we maintain our view the deceleration in Chinese growth will be more notable in the second half.

China’s official manufacturing PMI rose to 51.7 in June, the second highest reading in 2017. The Markit manufacturing PMI also rebounded to 50.4 in June after having dropped below the 50 threshold in the previous month. The rise in both indices in June suggests that China’s growth momentum in the second quarter was likely still fairly solid, only moderating mildly from Q1.

Looking further ahead, however, we continue to expect the Chinese economy to decelerate more notably in the second half of 2017. On the monetary policy front, we believe that the People’s Bank of China will likely maintain a neutral policy stance with a tightening bias for the rest of the year. But while policy tightening has been targeting closely at curbing rising risks in the financial sector, its effects are starting to spill into the real economy as well.

In addition, China’s property sector remains a major source of uncertainty. This likely slowdown in property construction and tightening financial conditions may pose more downward pressure on the economy in H2 2017. With these considerations in mind, we have decided to keep our GDP forecast for China unchanged at 6.5% in 2017.

The production, new orders and imports sub-indices of the official PMI all pointed upwards in June, suggesting domestic demand is still on a solid footing. The new export orders sub-index also continued to rise, reaching 52 in June, its highest reading in more than five years. China’s export sector may well extend its solid growth in the near term as global demand remains buoyant.