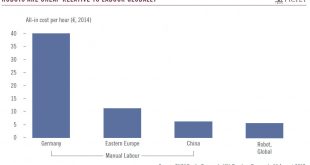

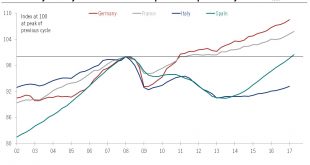

Digitalisation offers huge new opportunities and improved growth, margins and valuations for some industrial firms, but will also create losers as traditional machinery sales decline.Amid a growing challenge from the emerging world, US and European industrial companies must be at the forefront of technological innovation to stay competitive. With the fourth industrial revolution, a new industrial era is opening up: digitisation. The fields of application of digitisation are vast, covering...

Read More »The importance of independent validation

Published: Monday August 14 2017Geneva-based SGS provides teams of experts to help businesses become faster, simpler and more efficient, ensuring compliance with fast-evolving global standards and local regulations that protect customers and consumers.In the early days of SGS, the company specialised in inspecting shipments of grain arriving in large French ports from elsewhere in Europe, North America and further afield. Its network of inspectors would verify the quantity and quality of...

Read More »The ECB and the euro, from Amsterdam to Sintra

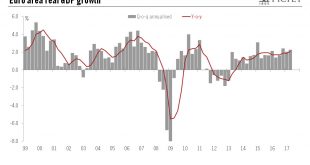

The threat to the ECB’s inflation targets posed by the appreciation of the euro is being offset by strengthening growth in the euro area. The ECB should pursue its cautious exit strategy.The trade-weighted EUR has appreciated by 4.8% since the ECB’s June meeting. ECB models and Mario Draghi’s rule of thumb suggest that a stronger currency could lower euro area inflation by about 30-40bp in 2018-2019, all else being equal.But all else is not equal, and the euro area economy is in a very...

Read More »Monthly Investment Strategy Highlights, August 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.Low correlations and a pick-up in disruptive M&A are already creating an improved...

Read More »Ensuring the protection of confidential data until the end

Published: Monday August 07 2017Two entrepreneurs who created a service which shreds paper documents on-site for clients have developed techniques for destroying redundant hard drives, putting the information they hold beyond the reach of competitors and criminals.There is much talk in business of “the paperless office”, but as technology advances, more and more paper is used in the workplace – increasing the amount that needs to be destroyed to preserve confidentiality. That insight was...

Read More »In spite of broadening growth, ECB will remain prudent

A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our...

Read More »How world war two code-breaking laid the foundations for today’s cyber warfare

Published: Monday July 31 2017British code-breakers gave the UK and US a vital advantage in the second world war by deciphering the enemy’s secret communications with techniques that were the precursors of modern computer technologies.Bletchley, an unremarkable town north of London, was known until the 1970s mainly as a railway junction. But a book published in 1974 revealed that it had played an essential role in the second world war by intercepting and decoding secret communications...

Read More »France & Spain : Strong Q2 GDP growth performance

The latest Q2 GDP figures published by France and Spain point to solid growth for the euro area. We maintain our euro area GDP growth forecast at 1.9% for 2017 as a whole.France and Spain today were the first big countries in the euro area to publish GDP growth figures for Q2 2017. French real GDP rose by 0.5% q-o-q in Q2 2017, the same pace as the two previous quarters. The details showed that domestic demand remained solid, while the sharp improvement in net exports offset the fall in...

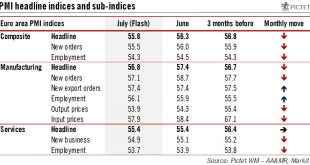

Read More »Euro area : Momentum slows at the start of Q3

PMI surveys for the euro area eased somewhat in July, suggesting that momentum slowed at the start of Q3. We maintain our GDP growth forecast of 1.9% for 2017.The composite flash PMI fell to 55.8 in July from 56.4 in May, below consensus expectations (56.2). The headline dip was entirely driven by the manufacturing index, which fell to 56.8 in July from 57.4 in June. By contrast, the services index remained stable at 55.4. The PMI’s forward-looking components remained pretty strong, despite...

Read More »Why people divulge confidential information

Published: Monday July 24 2017Most people say they want to keep their personal information private, according to Professor Leslie John of Harvard Business School, but in practice they will reveal it for often trivial reasons or to win the approval of others.Privacy is an issue of great sensitivity in a digital age. Many people go to considerable lengths to protect their personal information from online access by strangers, commercial enterprises and public bodies. And users of most social...

Read More » Perspectives Pictet

Perspectives Pictet