Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationAs central bank support starts to be withdrawn, volatility could well rise.We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.CommoditiesOil prices fell again in June, but now appear close to what we assess as the current equilibrium price (around USD44 per barrel).EquitiesThe slowdown in market momentum has occurred later in Europe than in the US, but margin for further outperformance by Europe may be shrinking.Until markets start pricing in 2018 earnings later this year, there is a good chance that equities will

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationAs central bank support starts to be withdrawn, volatility could well rise.We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.CommoditiesOil prices fell again in June, but now appear close to what we assess as the current equilibrium price (around USD44 per barrel).EquitiesThe slowdown in market momentum has occurred later in Europe than in the US, but margin for further outperformance by Europe may be shrinking.Until markets start pricing in 2018 earnings later this year, there is a good chance that equities will

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

- As central bank support starts to be withdrawn, volatility could well rise.

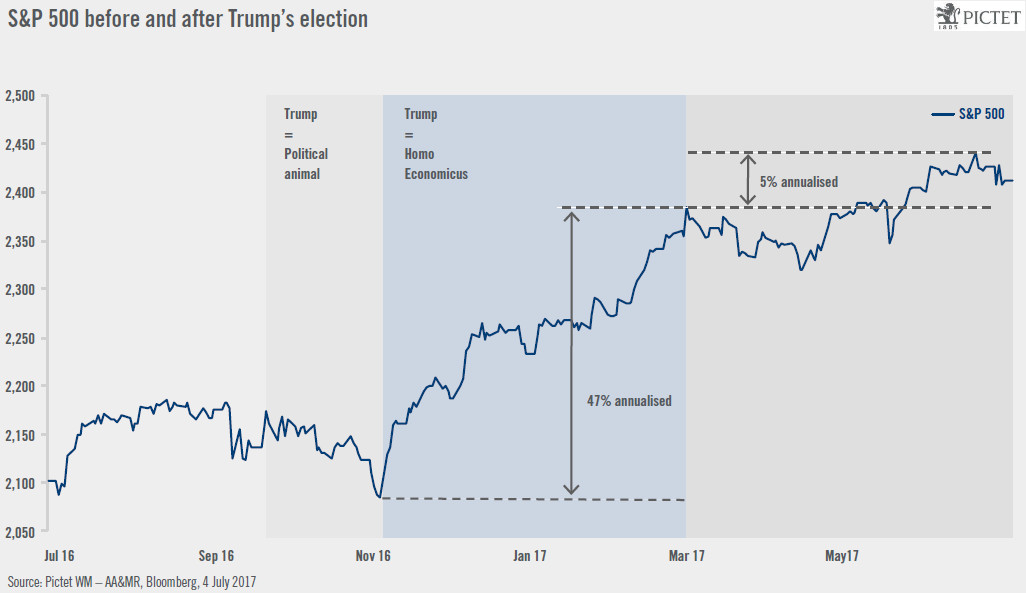

- We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.

Commodities

- Oil prices fell again in June, but now appear close to what we assess as the current equilibrium price (around USD44 per barrel).

Equities

- The slowdown in market momentum has occurred later in Europe than in the US, but margin for further outperformance by Europe may be shrinking.

- Until markets start pricing in 2018 earnings later this year, there is a good chance that equities will mark a pause and that volatility will increase.

- Overall valuations in the US and Europe are high, but there is room for multiples expansion in some areas, notably in US financials and biotech.

Currencies

- We believe that long-term real rate differentials do not back the recent rise of currencies such as the euro against the US dollar, and we expect the USD to firm in the coming months.

- Sovereign yields are likely to rise in recognition of policy normalisation and the potential for higher inflation.

- USD high-yield looks especially exposed to a rise in volatility.

Alternatives

- 2017 has seen a particularly conducive environment for the merger arbitrage strategy.

- Valuations, competition and capital inflows remain high in PE, but there are still good opportunities for attractive returns in regional, industry and mid-market niches.

- The real estate cycle seems to be changing direction: from cap rate compression to cap rate expansion.