In line with our expectations, the Fed announced 'normalisation' of its balance sheet at its September meeting. Our scenario for a December Fed rate hike remains unchanged.As widely expected, the Federal Reserve announced at its 20 September meeting the start of the ‘normalisation’ of its balance sheet; some of its bond holdings will not be reinvested from October on. The Fed’s balance sheet should therefore start to shrink gradually. Fed chair Janet Yellen justified this decision by saying that “stimulus is no longer needed” and that QE had been “successful”. The Fed now wants to focus on interest-rate rather than balance-sheet tools.In a veiled hint that rate hikes would resume soon, Yellen dismissed recent weak inflation prints as temporary, while she highlighted the strength of the

Topics:

Thomas Costerg considers the following as important: Fed dot chart, Macroview, US Fed hikes, US rate projections, US September meeting

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In line with our expectations, the Fed announced 'normalisation' of its balance sheet at its September meeting. Our scenario for a December Fed rate hike remains unchanged.

As widely expected, the Federal Reserve announced at its 20 September meeting the start of the ‘normalisation’ of its balance sheet; some of its bond holdings will not be reinvested from October on. The Fed’s balance sheet should therefore start to shrink gradually. Fed chair Janet Yellen justified this decision by saying that “stimulus is no longer needed” and that QE had been “successful”. The Fed now wants to focus on interest-rate rather than balance-sheet tools.

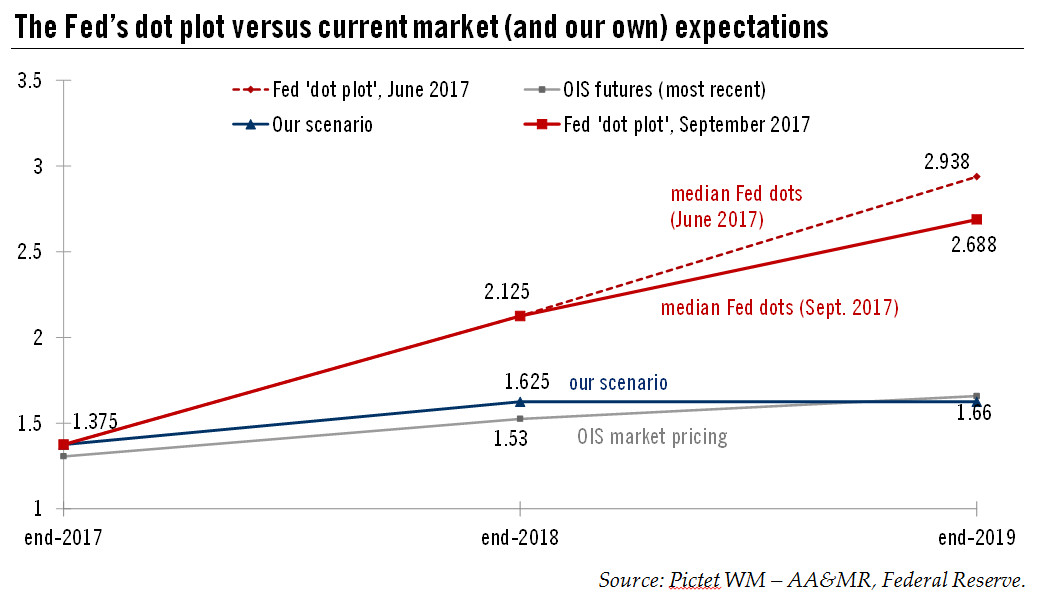

In a veiled hint that rate hikes would resume soon, Yellen dismissed recent weak inflation prints as temporary, while she highlighted the strength of the labour market and the “low” unemployment rate. The Fed’s median dot for 2017 still showed one rate hike is expected before year’s end. But the Fed cut its long-term projections, including the ‘terminal’ rate (2.75% vs. 3.0% previously).

We are keeping our Fed scenario unchanged, as Yellen’s stance echoes our base scenario that the Fed will hike rates at its 13 December policy meeting. It would take a sizeable slowdown in employment or in inflation, and/or a material drop in financial markets, for the Fed not to hike then, in our view. Loose financial conditions – and the fear of nurturing financial instability – have been receiving more attention from the Fed of late. This reasoning may also lead to a further quarter-point hike in March 2018.

Further out, the outlook is muddier as we suspect inflation could undershoot the Fed’s 2% target in 2018. The Fed could pause rate hikes after March, in our view. Our core view is that changing of the guard at the Fed (many nominations to its Board remain in flux) will not result in an abrupt shift in its stance, but some uncertainty remains.