Our baseline scenario for 2018 sees a moderate rise in benchmark bond yields. But US Treasury yields could be stuck at 2.5% as growth moderates and inflation remains stubbornly low.In our start-of-the-year scenario for 2017, we thought that inflation, monetary and fiscal policy would push yields on core sovereign bonds higher, except on Japanese ones. In the event, political gridlock in Washington forced us to abandon our expectations for a significant fiscal stimulus in the US that would...

Read More »Messing about in boats

A sharp rise in boat buying suggests that US economic expansion has matured.A key question for investors is how to gauge the point we are at in the US business cycle. Some are worried that we have already surpassed the length of the previous expansion. According to data from the National Bureau of Economic Research, we are 99 months into an upward cycle that started in July 2009, while the 2002-07 expansion lasted for 72 months. That said, we are still below the lengthy expansion of the...

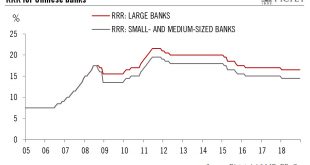

Read More »PBOC aims to stave off potential liquidity shock

The decision to lower reserve requirements for some lending does not represent a policy shift by the PBoC, still intent on reining in excessive financial leverage.The People’s Bank of China (PBoC) announced on 30 September that it would lower the required reserve ratio (RRR) for selected banks by 50-150 basis points (bps) from the beginning of next January.Specifically, banks eligible for a 50 bps cut to their RRR will include those that have at least 1.5% of their existing loans or of their...

Read More »Deceptive calm, ‘Perspectives’, October-November 2017

Published: 4th October 2017Download issue:English /Français /Deutsch /Español /ItalianoThe strong equity gains of early 2017 petered out over the summer, in spite of buoyant earnings, reflecting the market’s belief that remaining upside in equites remains limited, especially in the absence of meaningful tax stimulus in the US. Reflecting relatively modest prospects, Pictet Wealth Management (PWM) recently moved from a positive to a neutral position on a number of sectors in both the US and...

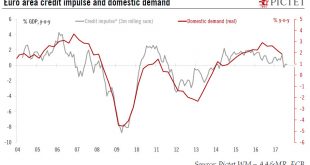

Read More »The declining link between the credit impulse and domestic demand

The latest ECB credit report confirmed that credit flows in the euro area remains strong. But reliance on bank credit is falling in Europe.The ECB’s M3 and credit report for August published this week was pretty strong overall and confirmed the ongoing improvement in lending dynamics in the euro area. Bank credit flows to the private sector (adjusted for seasonal effects and sales and securitisations) amounted to €17bn in August, lower than the July figure of €39bn. In y-o-y terms,...

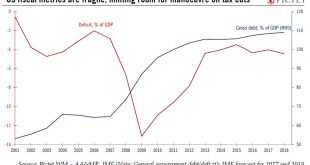

Read More »A long way to the finish line for US tax reform

We are sceptical that Trump’s tax proposals will make much headway and that what tax cuts are enacted will add much to US growth.President Trump’s ambitious tax plan, just unveiled, aims to simplify and lower tax rates for households and corporates, with the statutory tax rate for the latter to be reduced to 20% from 35%.We remain sceptical that this plan will see its way through Congress given opposition from Democrats and even some Republicans wary about sharp increases in the deficit. The...

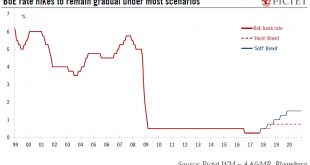

Read More »Shifting prospects for the UK economy and financial assets

Developments in Brexit negotiations, a hawkish Bank of England, and the strong performance of blue chip stocks mean that we have been updating our forecasts for the UK.Although the UK macro outlook has not changed much in recent weeks and considerable uncertainty remains in terms of the Brexit negotiations, the BoE’s hawkish shift has led to a material repricing of UK assets, including the currency and rates. In addition to monetary policy considerations, another driver of improved market...

Read More »Corporate America is cash rich, helped by declining competition

US corporations’ cash accumulation continues unabated, leading to the rise of ‘superstar’ firms that are crushing market competition.We think many keys for understanding the US economy right now – and why it may not be behaving the way textbook economics say it should – are to be found at the microeconomic rather than macroeconomic level. What the microeconomic picture shows is a sharp reduction in the level of market competition due to the rise of a small number of ‘superstar’ firms with...

Read More »Political fragmentation means Jamaica coalition is the only option

The German election proved less predictable than some thought. Coalition talks are likely to be long and difficult, complicating moves to deepen European integration.Angela Merkel looks set to secure a fourth term as Chancellor amid growing fragmentation and a surge in far-right support. The only arithmetically possible options are another Grand Coalition (ruled out by the SPD) and a Jamaica coalition between the CDU-CSU, FDP and the Greens (very difficult due to diverging positions on a...

Read More »Business surveys show strong end to Q3 in euro area

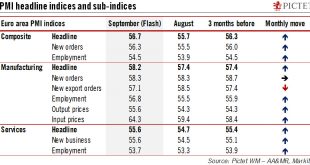

Better-than-expected Flash PMI numbers in September mean that the quarter is ending on a strong note, with some upside risks ahead.Flash PMI surveys for the euro area ended the third quarter on a strong note. The composite flash PMI increased to 56.7 in September from 55.7 in August against consensus expectations for a stable print (55.6).The breakdown by sub-indices showed pretty strong signals in most forward-looking components, with the sole weak spot manufacturing new export orders....

Read More » Perspectives Pictet

Perspectives Pictet