Rising core prices, along with wage growth, should help the ECB along the road to policy normalisation.Euro area cyclical inflation has been slowly rising over the past few months, from low levels. Several measures of underlying inflation have broken out of the tight range around which they have fluctuated for the past three years.The ECB’s ‘super core’ inflation rate rose to a three-year high of 1.04% in August, with other indicators showing a stronger upward momentum. Today’s stronger-than-expected euro area PMI indices confirmed that pipeline price pressures were rising.Next week’s release of euro area ‘flash’ HICP for September will be more important than usual ahead of the 26 October ECB meeting. Any core inflation print at, or above the August level of 1.2%, would be strong enough

Topics:

Frederik Ducrozet considers the following as important: core euro area inflation, ECB october meeting, ECB policy normalisation, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Rising core prices, along with wage growth, should help the ECB along the road to policy normalisation.

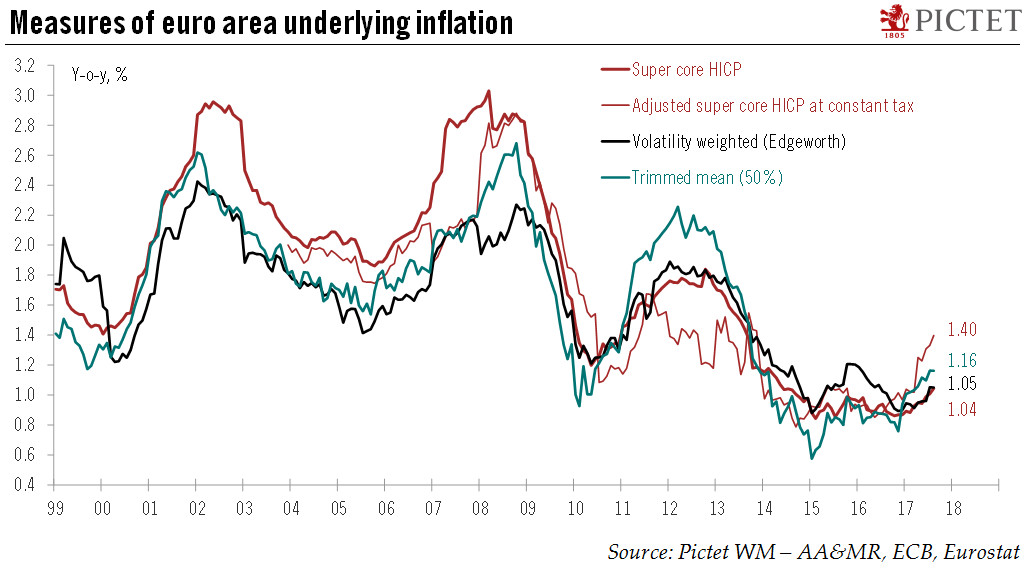

Euro area cyclical inflation has been slowly rising over the past few months, from low levels. Several measures of underlying inflation have broken out of the tight range around which they have fluctuated for the past three years.

The ECB’s ‘super core’ inflation rate rose to a three-year high of 1.04% in August, with other indicators showing a stronger upward momentum. Today’s stronger-than-expected euro area PMI indices confirmed that pipeline price pressures were rising.

Next week’s release of euro area ‘flash’ HICP for September will be more important than usual ahead of the 26 October ECB meeting. Any core inflation print at, or above the August level of 1.2%, would be strong enough for the ECB to move ahead with policy normalisation, in our view.